Hedge Fund Goes All-In on XRP—Is This the Tipping Point for Crypto Bulls?

A major hedge fund just bet 100% of its portfolio on XRP—a move that’s either genius or reckless, depending on which crypto bro you ask.

Why this matters: Institutional money flooding into altcoins signals growing confidence—or desperation—as regulators circle like vultures.

The big question: Will this trigger the long-awaited altseason, or just add fuel to the ’greater fool theory’ bonfire?

Bonus jab: Nothing says ’sound investment strategy’ like YOLO-ing into an asset that’s still fighting a SEC lawsuit.

Why XRP Price Prediction & Sentiment Are Bullish in 2025

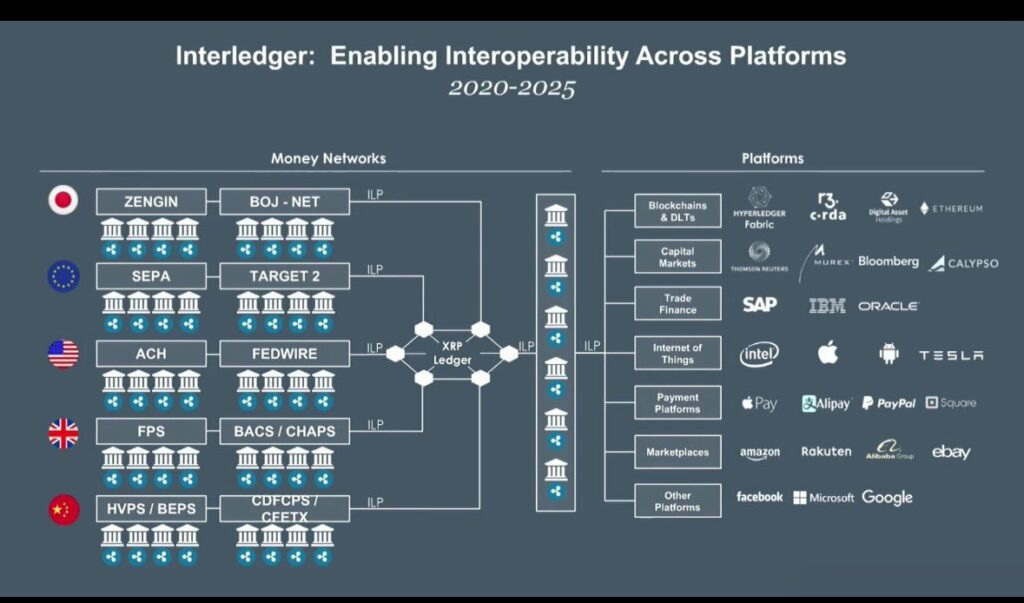

The market sentiment for XRP has shifted dramatically following Claver‘s announcement on X. At the time of writing, he shared an interesting infographic titled “Interledger: Enabling Interoperability Across Platforms 2020-2025,” which essentially positions XRP as a central bridge between traditional financial systems and modern platforms.

The infographic presents XRP as the key intermediary connecting traditional networks such as Japan’s Zengin and also the EU’s SEPA with major tech platforms including Apple, Amazon, and various others.

Institutional Investment Signals

XRP’s bullish forecast as predicted by Claver runs contrary to the diversified investment strategy guidelines which standard financial advisors endorse for 2025.

Concerns Raised

The Interledger Protocol exists beyond XRP since critics label its functionality as blockchain-agnostic. The 2025 investment outlook for XRP faces uncertainties since major financial networks have not revealed their adoption plans for the protocol.

According to the source material Michael Graziano explained that Claver’s personal investment decision should be treated separately from investor opinion about XRP’s future performance.

To which Claver reportedly agreed, though no direct quote of his agreement was provided in the source.

Regulatory Impact

Ripple’s ongoing SEC lawsuit, which began back in 2020, continues to influence price predictions for XRP. The resolution of this case could significantly impact investment prospects for 2025, and might validate Claver’s strategy if the outcome is favorable for Ripple.

Market Response

The sentiment surrounding XRP remains quite mixed right now, with many analysts divided on its potential. This highlights the complexity and uncertainty of cryptocurrency forecasts for 2025 and the absolute need for careful evaluation before any investment decisions are made.

Claver’s approach to XRP investment represents an interesting and somewhat unusual case study of institutional belief in cryptocurrency utility beyond mere speculation. Whether this signals what bulls have been waiting for will become clearer as 2025 progresses and more data becomes available.