Jamie Dimon Offloads $31.5 Million Worth of JPMorgan Chase Shares—Potential Recession Signal?

JPMorgan Chase CEO Jamie Dimon has sold approximately $31.5 million worth of his shares in the company, sparking speculation among investors about a possible economic downturn. This move, one of his largest divestments in recent years, raises questions about the timing and underlying motivations. Market analysts are closely monitoring whether this indicates Dimon’s bearish outlook on the financial sector or broader macroeconomic risks. The sale comes amid mixed signals from inflation data and Fed policy, adding to the debate about a potential recession in 2025.

How Jamie Dimon’s Insider Trading Signals Recession Risks in 2025

Major Stock Sale Raises Questions

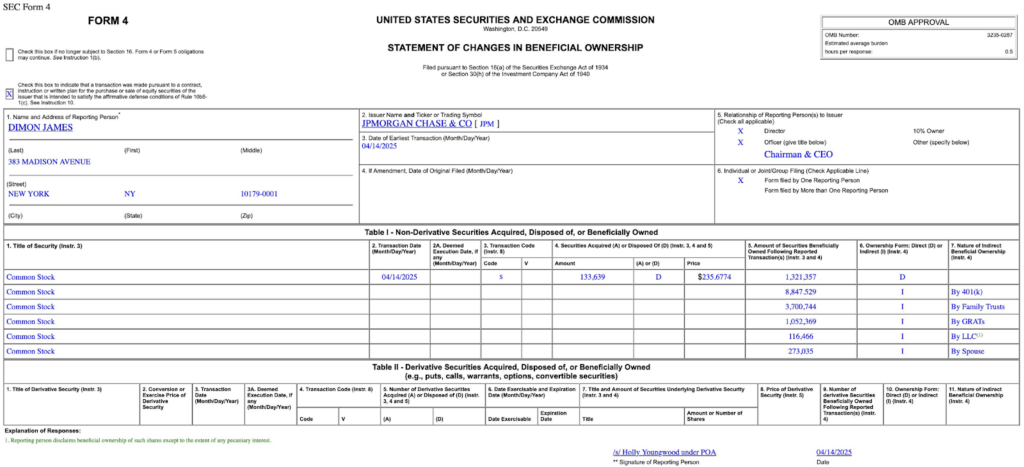

J.P. Morgan’s CEO Jamie Dimon made a substantial insider trading transaction on April 14, selling approximately 133,639 shares at around $231.34 per share. This massive $31.5 million sale, officially recorded in an SEC filing, comes just days after Dimon warned about potential economic trouble possibly looming on the horizon.

On April 11, Dimon was clear about the fact that:

The J.P. Morgan recession 2025 predictions coming directly from its own CEO certainly make this particular stock sale especially noteworthy for market watchers at this time. The timing of such a large divestment following recession warnings has drawn considerable attention from financial analysts.

Part of Planned Selling Strategy

Jamie Dimon’s stock sale follows a pattern established back in February when regulatory filings revealed his Rule 10b5-1 trading plan to sell one million JPM shares by August 1.

What stands out as unusual is Dimon’s historical reluctance to reduce his J.P. Morgan stake since becoming CEO in 2005. A similar sale occurred just last year in April 2024, when he also sold shares worth approximately $33 million. Before this latest transaction, Dimon held roughly about 7.5 million shares in the bank.

Strong Performance Despite Warnings

Somewhat paradoxically, the J.P. Morgan insider trading activity comes at a time when the bank is actually reporting exceptional results. J.P. Morgan recently posted first-quarter earnings of about $5.07 per share on revenue of around $46.01 billion, which actually handily beat analyst expectations of approximately $4.61 per share and also $44.11 billion in revenue or so. At the time of writing, these figures represent quite a significant outperformance compared to what market experts were predicting.

Net income increased by approximately 9% year-over-year to reach $14.64 billion, highlighting the strength of the firm’s trading division. This strong performance has helped JPM stock rally about 5% over the past week, despite closing down 0.6% at $234 on the day of Dimon’s sale.

Recession Signals Amid Trade Tensions

J.P. Morgan’s recession concerns for 2025 appear to center around the escalating US-China trade tensions under President Trump’s administration. Dimon has joined several other Wall Street executives who are currently sounding alarms about the economy’s trajectory amid these growing trade frictions.

For investors monitoring the recession risks for 2025, the J.P. Morgan insider trading activity provides some valuable context. Dimon’s decision, which is actually relatively rare, to sell shares while also explicitly warning about economic contraction deserves serious consideration. Right now, at the time of writing, many analysts are still continuing to debate the significance of these seemingly contradictory signals and such factors.