Gold Surges Past $3,245: Analysts Eye $4,500 as Next Key Target

Gold prices have broken through the $3,245 resistance level, triggering bullish sentiment among traders and analysts. This significant breakout has set the stage for a potential rally toward the $4,500 mark, with market participants closely monitoring macroeconomic indicators and geopolitical developments. The precious metal’s upward trajectory is supported by a combination of inflationary pressures, currency fluctuations, and safe-haven demand. Technical analysts highlight the importance of sustained momentum above the $3,300 level to confirm the long-term bullish outlook. Investors are advised to watch for potential retracements and key support zones as the market progresses toward higher price targets.

Record Gold Price Surge Spurs Safe Haven Shift Amid Tariff Chaos

The current gold price forecast remains quite bullish at the time of writing as multiple factors are driving record gold price levels ever higher. Traders and investors are closely monitoring market responses to the recent trade policies while SAFE haven assets also continue to attract significant investment flows from various sources.

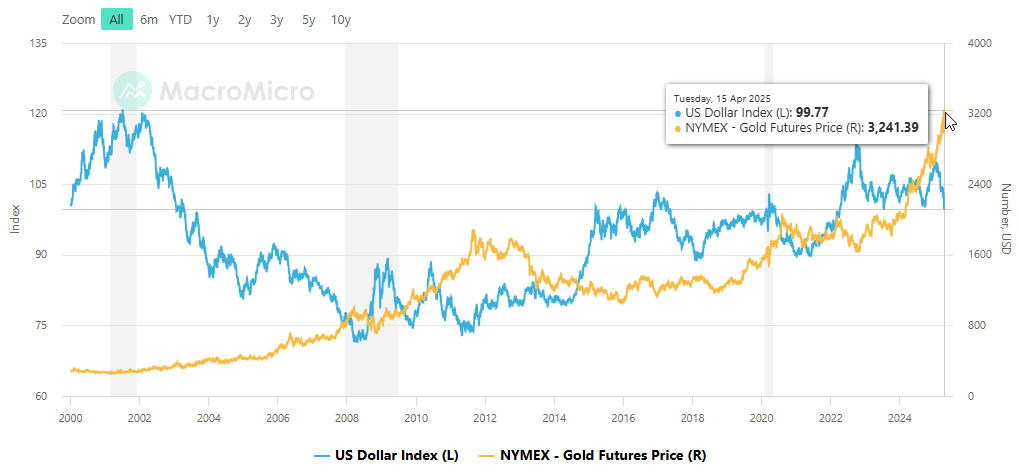

Gold-Dollar Correlation Returns

A comprehensive market report today stated:

This relationship actually suggests further upside in the gold price forecast if dollar weakness persists during this rather challenging period of global economic uncertainty.

Trump’s Trade Policies Boost Gold

Recent market analysis indicates:

These US tariffs impact trading sentiment in a significant way, and are basically providing support for the current gold price forecast models that seem to predict continued strength in the coming weeks.

Technical Analysis Supports Higher Targets

Technical analysts reported in their latest assessment:

RSI readings NEAR 70 suggest some potential short-term corrections, yet the overall gold price forecast remains quite positive with $3,400 as the next target. Safe haven assets typically perform well in such technical setups, especially amid the ongoing global economic uncertainty we’re experiencing.

The combination of persistent US tariffs impact and the growing demand for record gold price exposure essentially points to continued strength in the market. If the resistance at $3,300 breaks, the path toward that $4,500 level becomes increasingly plausible for patient investors who are seeking protection through various safe haven assets during these uncertain times.