Silver Price Prediction: Will the Metal Outshine Traditional Assets Over the Next 6 Months?

Silver's price is poised for a volatile six-month sprint. Can it finally break free from its industrial chains and shine as a monetary asset?

The Macro Tug-of-War

Forget gold's safe-haven narrative. Silver trades with a split personality—half precious metal, half industrial commodity. That duality creates a perfect storm. On one side, rate cuts and a wobbly dollar could send investors scrambling for hard assets. On the other, a global manufacturing slump drags on industrial demand. Which force wins dictates the next move.

The Technical Crucible

Charts show silver consolidating in a tightening range. It's a classic spring-coiling pattern. A decisive break above key resistance could trigger a swift rally, while a failure risks a slide back to support. Volume trends and moving averages will confirm the direction—technical traders are watching for the breakout signal.

The Crypto Contender

Here's the twist: digital gold is eating traditional gold's lunch. Why hedge with a bulky, centuries-old store of value when a decentralized, programmable asset exists? Silver's appeal must now compete with the 24/7 crypto markets—a sector that never sleeps and loves a narrative more than fundamentals. It's a tough crowd.

Silver's fate hinges on a fragile equilibrium. It needs just enough economic fear to boost its monetary premium, but not so much that it crushes its industrial use. Get that balance wrong, and it's back to being just another commodity. Get it right, and it could have its moment in the sun—proving that even in a digital age, some old metals still have some fight left. After all, in finance, sometimes the best new trade is a very, very old one.

Silver Price Narratives: What to Expect

Silver price has now become a leading topic of debate. The metal’s usage and rising industrial demand have brought silver back into the limelight. Silver’s crucial usage in broad-spectrum industries such as solar panels, semiconductors, EVs, AI data centers, and advanced electronics industries has played a crucial role in spiking its price up a notch.

Silver Will Remind Us: We Are Deeply Dependent On The Earth (Zero Hedge)

Unlike dollars, you can’t print more silver. Unlike gold, silver is consumed at an industrial scale because it is required for the defining industries of our time:

• Solar panels

• Electric vehicles

•… pic.twitter.com/ocfDhnY9cS

However, at present the metal is encountering a reversal of sorts, falling 15% in the last 24 hours.

JUST IN: Silver crashes under $75, falling over 15% in a single day. pic.twitter.com/0on8ZFRYBM

— Watcher.Guru (@WatcherGuru) February 5, 2026Per Rashad Hajiyev, a leading financial expert, silver and gold were expected to show some consolidation, with both the metals challenging their new price highs for some time.

The best part about recent smash down in precious metals that it had already happened. The worst is over. Unprepared did not make it. Metals are going to provide an opportunity of the century so violent shakeouts are going to accompany this journey from time to time. It would…

— Rashad Hajiyev (@hajiyev_rashad) February 3, 2026Silver Price Forecast: Six Months Ahead

According to Rashad Hajiyev, the silver price is still on track to hit $200 post minor consolidation and challenging periods.

Gold to silver ratio (GTS) after retesting 2014 – 2021 broken support, which acted as a resistance is now headed to 2011 low around 32. Not going to be a straight line, but with gold at $6k plus, silver is going to trade around $200 probably by March 2026…

Posts are not an… pic.twitter.com/nAOMmFBVLi

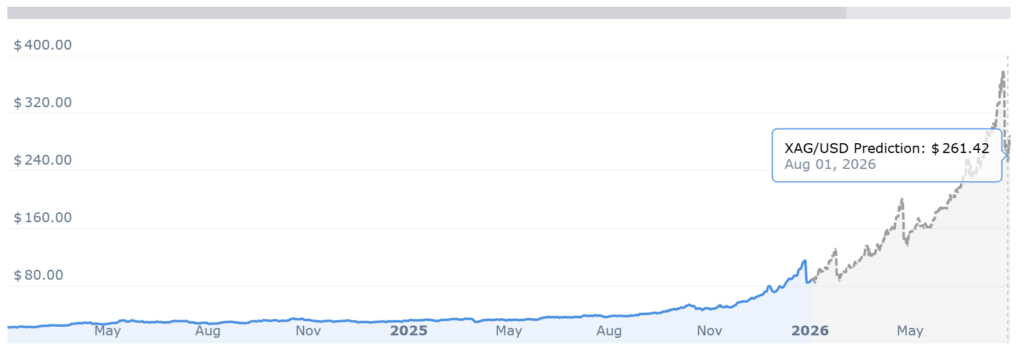

Per CoinCodex silver stats, silver may hit a new high of $261 by August 2026.