Bitwise XRP ETF: Profit Machine or Sinking Ship? The 2026 Verdict

XRP's ETF experiment hits a crossroads. Investors are demanding answers—has this fund delivered alpha or just amplified the pain?

The Performance Puzzle

Forget the hype. The cold, hard metrics tell the real story. Tracking XRP's notoriously volatile price action, this ETF doesn't create trends—it mirrors them, for better or worse. When the underlying asset rallies, the fund surges. When regulatory headwinds blow, it tanks. It's pure, unfiltered exposure.

Fee Structure Under the Microscope

Every basis point counts. The management fee quietly nibbles away at returns, a constant drag in sideways markets. It's the financial equivalent of a hotel minibar—convenient, but you're definitely paying for the privilege.

The Liquidity Litmus Test

Can you get in and out without moving the market? Daily volume dictates the answer. Thin trading spells wider spreads, turning quick trades into costly affairs. It's the eternal ETF dilemma—accessibility versus efficiency.

The Regulatory Wildcard

This isn't just another crypto fund. XRP's unique legal landscape injects a dose of uncertainty no prospectus can fully quantify. A single court ruling doesn't just move the needle—it can shatter the dial.

The Final Tally

So, profits or losses? The fund's ledger reflects the asset's journey—no more, no less. It offers a clean, regulated on-ramp, bypassing the hassles of direct custody. But it also packages XRP's famed volatility into a tidy NYSE ticker, complete with a management fee for the service. In the end, it delivers exactly what it promises: a piece of the XRP action. Whether that's a gift or a curse depends entirely on your timing, conviction, and tolerance for the rollercoaster ride that is crypto investing—where today's genius trade is tomorrow's cautionary tale told over expensive whiskey.

Has Bitwise XRP ETF Generated Profits or Given Losses?

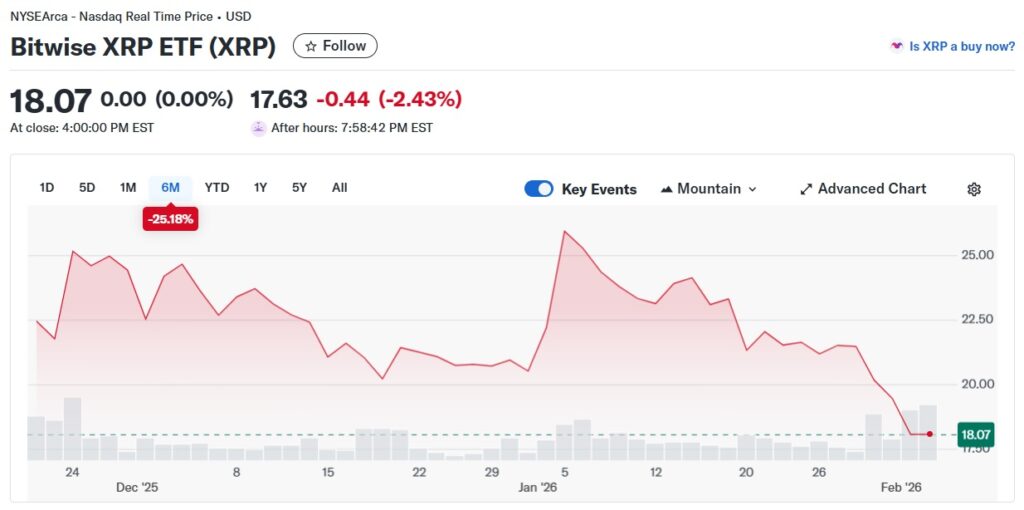

The Bitwise XRP ETF was launched for a price of $24.15 and reached a high of $26.88. However, things went down for the ETF from 2026 as the altcoin went bearish. The uncertainty in the market led to the downfall, with trade being affected due to growing tariffs. The broader markets remain on a slippery slope with a slump around the corner.

Bitwise XRP ETF is now trading at the $18.07 level on Wednesday and had fallen to a low of $17.63. Therefore, the ETF has delivered losses to clients in 2026 with barely any profits. The index is already under pressure as BlackRock briefly encountered losses in its bitcoin ETF funds. The price decline in BTC rocked the sector as BTC fell below the $75,000 range.

Analysts have also projected the Bitwise XRP ETF as a high-risk asset suitable for those with financial tolerance. An investment in this ETF is not the same as holding the actual XRP token. There is heightened volatility as large funds are moved in and out of the asset. Investors must be careful before deciding to go all-in on the asset.