Binance’s $100 Million Bitcoin Dip Buy: Should You Follow the Whale?

Binance just dropped $100 million on Bitcoin—right as prices dipped. The exchange's massive buy-in signals confidence, but retail investors face a different calculus.

Reading the Whale Moves

When a major player like Binance makes a nine-figure purchase during a downturn, it's not a casual trade. It's a strategic accumulation. The move suggests institutional-grade conviction that current prices represent long-term value, not just a temporary discount.

The Retail Dilemma

For the average investor, mimicking whale behavior is risky. Binance operates with different capital, risk tolerance, and market influence. Their buy can stabilize or even propel the market—a luxury the retail trader doesn't have. It's the classic finance tale: the house buys the dip, while the players wonder if the table is rigged.

Strategy Over Hype

Instead of blind imitation, use the signal to inform your own strategy. Assess your portfolio's exposure, risk appetite, and investment horizon. Dollar-cost averaging often beats timing the market, even when the timing looks inspired by a whale.

Binance's bet is a powerful data point, not a direct command. In crypto, following the smart money requires knowing your own position first—otherwise, you're just another minnow in the whale's wake.

Should You Follow Binance And Buy The Bitcoin Dip?

Bitcoin (BTC) had a historic run from early 2024, when the SEC approved several spot ETFs, till October 2025, when it hit its most recent all-time high of $126,080. Since October of last year, the original crypto has faced significant hurdles. In fact, October registered the largest single-day liquidation event in crypto history. BTC’s price has fallen by nearly 40% since its October 2025 all-time high.

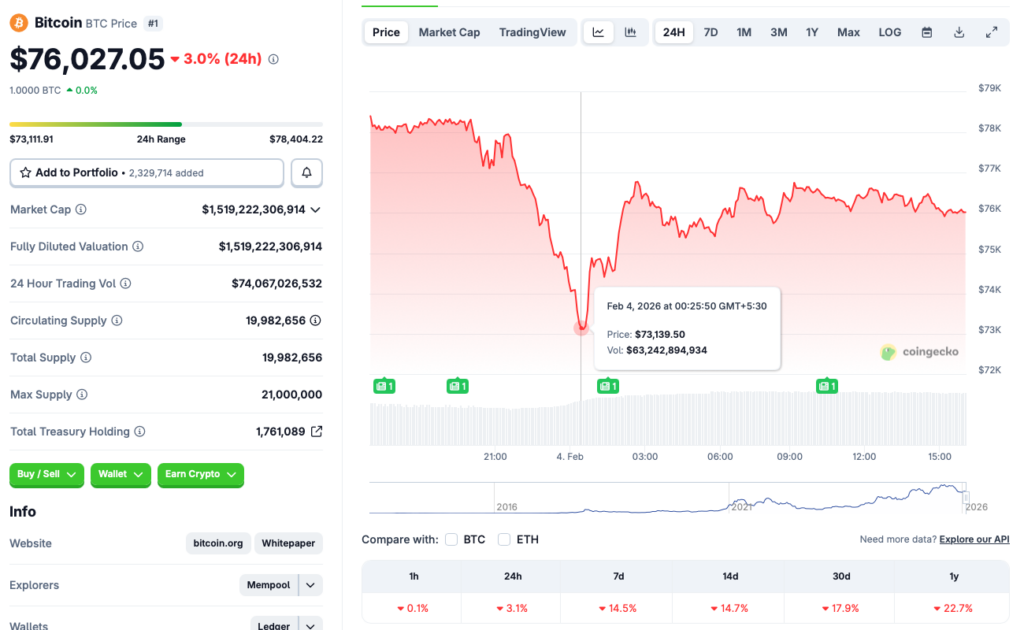

Bitcoin fell to the $73,000 price level earlier today, Feb. 4, 2026, but has since reclaimed the $76,000 mark. According to CoinGecko’s Bitcoin data, BTC’s price is down 3.1% in the last 24 hours, 14.5% in the last week, 14.7% in the 14-day charts, and nearly 18% over the previous month.

Many experts anticipate Bitcoin (BTC) to hit another all-time high this year. Bernstein and Grayscale claim that the original crypto is following a 5-year path, and not the typical 4-year trajectory. This means that the asset could hit a new peak this year, five years after its 2021 all-time high.

While there are some bullish forecasts around Bitcoin (BTC), others present quite a bearish outlook for the asset. Michael Burry, the the hedge fund manager who predicted the 2008 housing crisis, and depicted by Christian Bale in “The Big Short” movie, warns that Bitcoin (BTC) could enter a “death spiral.” He further added that BTC has failed to prove itself as a SAFE haven, like gold.

However, one should remember that the crypto market tends to move in cycles. Bitcoin’s (BTC) price fell below $16,000 in 2022, but has since hit multiple all-time highs. A similar pattern could emerge in the future. Hence, the low prices could prove to be a good entry point for investors.