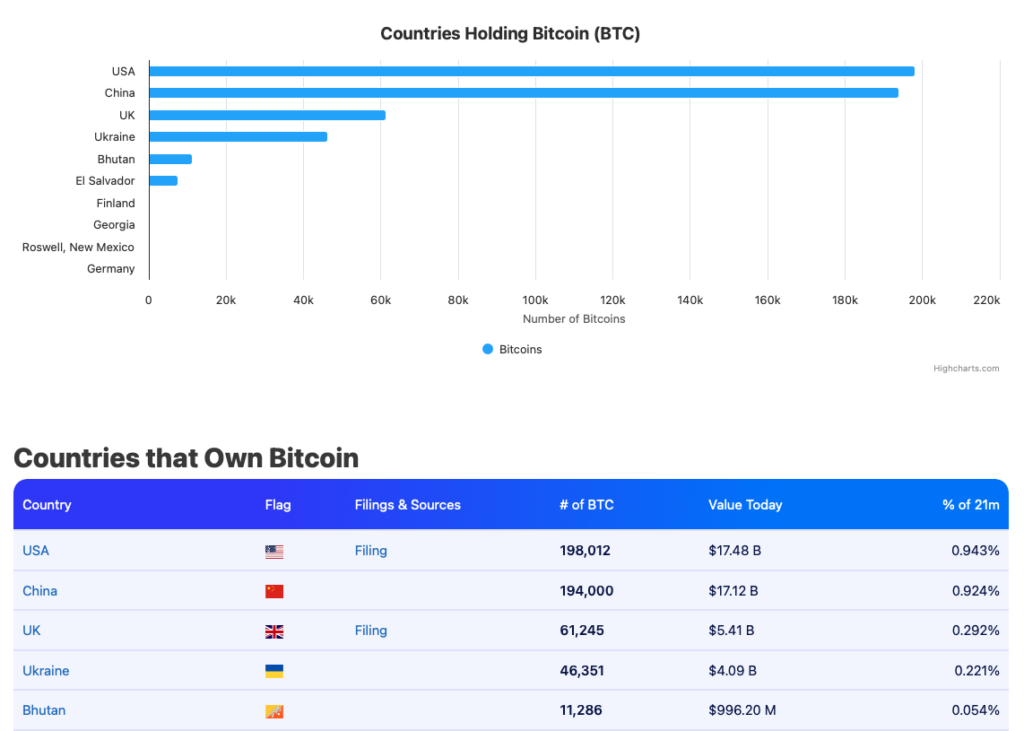

China Nears Bitcoin Supremacy: What This Geopolitical Power Shift Means for Global Finance

Forget trade deficits and currency wars—the real battle for financial dominance is happening on the blockchain. China's state-backed accumulation of Bitcoin is accelerating, positioning the nation to potentially dethrone the United States as the world's largest sovereign holder of the digital asset. This isn't just portfolio diversification; it's a strategic chess move in the new era of decentralized finance.

The Silent Accumulation

While Western regulators debate frameworks and compliance, Eastern state actors have been quietly executing a long-term acquisition strategy. The approach bypasses public markets and traditional financial gatekeepers, leveraging sovereign wealth channels and strategic partnerships with mining operations relocated from mainland China. They're playing the ultimate long game—accumulating during volatility, securing network influence through hash rate, and building a war chest that operates outside dollar-denominated systems.

Geopolitical Implications

This shift redefines what 'reserve currency' means in the 21st century. A nation holding significant Bitcoin reserves gains leverage in global settlements, can circumvent traditional sanctions architecture, and establishes itself as a foundational player in the emerging digital asset ecosystem. It's the financial equivalent of securing oil fields a century ago—control the scarce resource that powers the future economy. Wall Street analysts scrambling to price this in are about ten quarterly reports behind the curve, as usual.

Market Dynamics & Next Moves

When nation-states become whales, market dynamics transform overnight. Sovereign holdings create price floors during corrections and introduce non-economic actors into volatility equations. The next phase likely involves integrating these holdings into broader economic strategy—collateral for digital yuan initiatives, settlement layers for Belt and Road partnerships, or strategic releases to manage global liquidity events. Traditional finance still views crypto as a speculative asset class; geopolitical players treat it as infrastructure.

The real question isn't if China overtakes U.S. holdings, but what happens when the world's largest manufacturing economy also controls a dominant position in the hardest form of digital money. The answer might just rewrite the next century of global finance—while traditional bankers are still arguing about whether to allow Bitcoin ETFs in retirement accounts.

Source: Bitbo

Source: Bitbo

What May Happen If China’s Bitcoin Holdings Overtake The US?

China has become a major player in the last two decades. The country has also asserted substantial dominance in global trade and finance. If China overtakes the US in its Bitcoin agenda, there could be substantial concern among experts. BlackRock CEO Larry Fink had stated in a letter to shareholders that the US dollar may not remain the global standard forever. Fink said that digital currencies like Bitcoin (BTC) could take the dollar’s place in the future. If true, and if China overtakes the US in terms of its Bitcoin holdings, there could be serious consequences for the West. Despite placing a ban on cryptocurrencies, the Chinese government seems to be holding on dearly to its BTC holdings.

Moreover, given the pro-crypto stance of the TRUMP administration, China overtaking the US in the Bitcoin (BTC) race could come as a major blow. However, the US has made cryptocurrency a top priority, especially after Trump took office. We could see a change in US Bitcoin adoption, and buying could pick up momentum over the coming years.