Solana Staking Shatters Records: Is a Price Surge Inevitable?

Solana's validator network just hit a major milestone—staking activity has rocketed to an unprecedented all-time high. The blockchain, famed for its blistering speed, now sees more tokens locked in than ever before. That's serious skin in the game.

The Staking Signal

When staking numbers climb, it usually screams one thing: long-term conviction. Investors aren't just parking funds; they're actively securing the network and betting on its future. This isn't casual interest—it's a capital commitment that often tightens supply on exchanges.

The Million-Dollar Question

History shows a strong correlation between staking peaks and price rallies. Reduced liquid supply meets sustained demand, and basic economics takes over. But let's be real—crypto markets have a knack for ignoring textbook logic just to keep traders guessing. Past performance is no guarantee of future results, a disclaimer Wall Street loves but rarely heeds.

Network Health vs. Market Hype

The surge in staking is a powerful testament to network security and participant confidence. A more decentralized and robust chain emerges from this. Yet, the market often dances to its own erratic tune, where sentiment and macro winds can blow harder than any on-chain metric.

So, will prices follow? The on-chain data builds a compelling bullish case, setting the stage perfectly. But in this theater, the market crowd holds the final ticket. One cynical jab for the road: In traditional finance, this much locked value would trigger a dozen analyst upgrades and a special dividend. Here, it just means we check the charts again in an hour.

The solana network secured $60 BILLION worth of staked $SOL. Staking ratio reached a record high of 70%. pic.twitter.com/abiid8ccJd — Coin Bureau (@coinbureau) January 22, 2026

Will Solana’s Price Climb After Staking Hits New All-Time High?

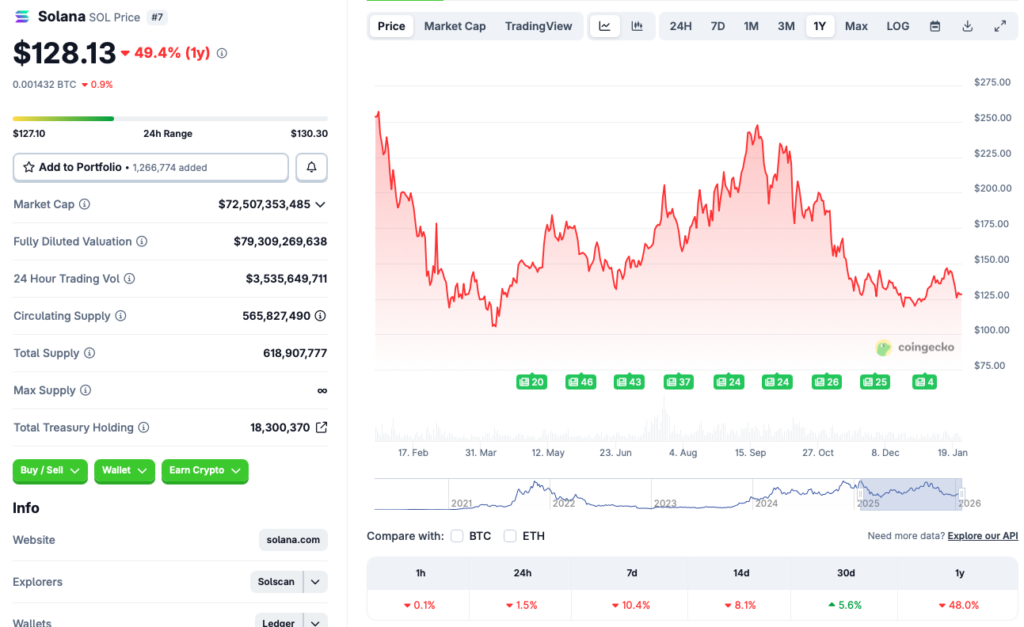

Solana (SOL) has faced a substantial price correction over the last few months. The asset’s price has fallen from $200 in October 2025 to below $130 in January 2026. While the asset is up by 5.6% in the monthly charts, it is trading in the red zone in the other time frames. According to CoinGekco data, SOL’s price has dipped 1.5% in the last 24 hours, 10.4% in the last week, 8.1% in the 14-day charts, and 48% since January 2025. January 2025 was quite a bullish month for Solana (SOL), as the asset climbed to a new peak of $293.31. The asset’s price has fallen by 56.3% since its January 2025 high.

Solana (SOL) is currently following Bitcoin’s (BTC) trajectory. Given BTC’s bearish performance, SOL is unlikely to rebound anytime soon. However, SOL has proven to be one of the most resilient crypto projects in the market. Solana (SOL) fell to below $9 after the collapse of FTX in 2022. The asset’s incredible comeback over the last few years is a testament to its robustness.

Although Solana (SOL) has fallen prey to the current market bearish environment, there is a very high chance that the asset’s price will rebound over the coming months. Many anticipate BTC to climb to a new all-time high sometime this year. BTC hitting a new peak may trigger a rally for Solana (SOL) as well.