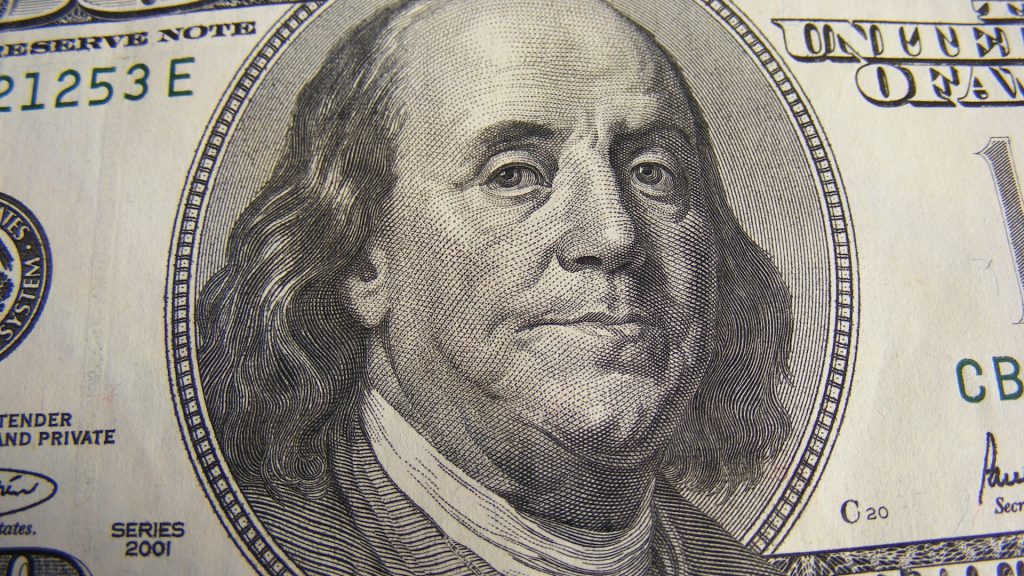

The Unshakeable US Dollar: Why This Currency Refuses to Fall

The US Dollar's dominance faces relentless pressure—yet it stands firm. What's propping up the world's reserve currency while digital alternatives surge?

The Inertia of Global Trust

Decades of entrenched trade agreements, debt instruments, and central bank reserves create a gravitational pull that's nearly impossible to escape. The dollar isn't just a currency; it's the operating system for global finance. Every attempt to dethrone it faces a wall of legacy systems and institutional inertia.

Digital Challengers Knock, But Doors Remain Bolted

Cryptocurrencies cut through traditional payment rails and offer borderless transactions—yet they've barely scratched the dollar's hegemony in sovereign and corporate treasuries. Even as Bitcoin hits new ATHs, it functions more as digital gold than a replacement for daily dollar transactions. The infrastructure shift required for a true takeover would make Y2K look like a minor software update.

The Fed's Invisible Hand (and Fist)

Monetary policy maneuvers and strategic alliances keep the dollar anchored. When volatility spikes, capital still flees to dollar-denominated assets—a reflex that's survived multiple crises. The real magic trick? Convincing the world that the dollar's stability outweighs its inflation erosion, a psychological feat worthy of its own Nobel prize.

The Bottom Line: Bet Against the Dollar at Your Peril

For all the talk of decentralization, the financial world remains remarkably centralized around a single currency. The dollar's greatest strength might be the collective delusion that there's no alternative—because building one requires coordination that even crypto can't algorithmically solve. Sometimes, the most bullish traditional play is recognizing an unmovable object in a world full of unstoppable forces.

The US Dollar-Denominated Financial Market is Unmatched

The whole world, including the foes of America, has US dollar-denominated assets in their central bank reserves. The US Treasury market remains unmatched with heavy yet unending demand for sovereign bonds. It is simply because they are the safest and quickest to liquidate assets with high circulation. Any central bank, at any given point in time, is either buying or selling US dollar-denominated assets.

There’s no other currency that’s capable of absorbing global capital the way the US dollar does. Its debt is easy to buy and sell, and the same cannot be said for other leading local currencies. Trust in the USD is high and intact, despite emerging economies accelerating the de-dollarization initiative.

In fact, history has shown that the US dollar thrives and returns much stronger during periods of crisis. From financial downturns to recessions and wars, the USD has emerged much stronger during chaos. Even the de-dollarization agenda could strengthen the greenback as there’s no single alternative currency to match its current value.