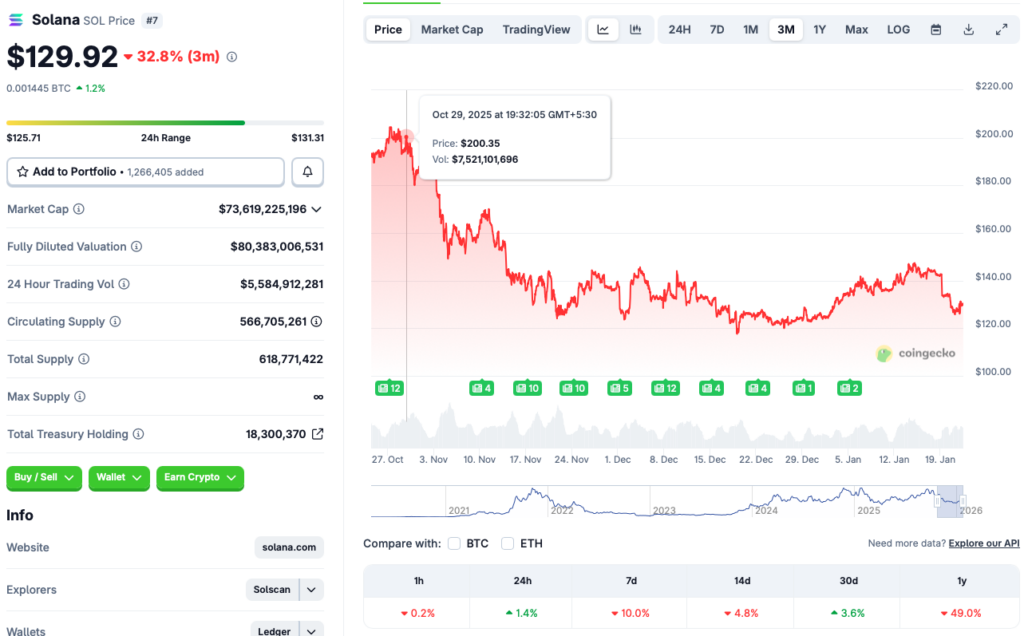

Solana’s Brutal Plunge: From $200 to $130 – Is a Reversal Brewing?

Solana just got rocked. A staggering 35% nosedive from its recent highs has traders scrambling and the crypto-twittersphere in meltdown mode. The question on everyone's lips: Is this the bottom, or just a pit stop on the way down?

The Anatomy of the Drop

Let's be clear—this wasn't a gentle correction. It was a cascade. The move from $200 to $130 represents a massive liquidation event, wiping out leveraged positions and testing the conviction of even the most ardent 'Solana Marines.' The usual suspects are being rounded up: broader market jitters, profit-taking after a parabolic run, and that ever-present specter of network congestion gossip. You know, the classic 'sell the news' routine, even when the news is just vibes.

Key Levels to Watch Now

All eyes are glued to that $130 zone. It's not just a psychological round number; it's a critical technical battleground that acted as both launchpad and landing pad in previous cycles. A sustained hold here could signal the sellers are exhausted. A decisive break below, however, opens the trapdoor to levels not seen since the last time your crypto portfolio made you physically ill. On the flip side, reclaiming $150 is the first step for the bulls to prove this isn't just a dead-cat bounce.

The Bull Case for a Rebound

Ignore the panic. The fundamental engine hasn't stalled. Developer activity remains fierce, and the ecosystem is still churning out real, used-by-people applications at a pace that makes other chains look sleepy. This dip might just be the market's brutal, inefficient way of shaking out weak hands before the next leg up. History shows Solana has a habit of vomiting violently before ripping faces off. Volatility isn't a bug; it's a feature—a very stressful, wallet-draining feature.

The Verdict: Contrarian Opportunity or Value Trap?

So, can it reverse the trend? In crypto, the only certainty is that narratives flip faster than a degenerate trader's position. This plunge feels dramatic because it is, but in the grand, schizophrenic scheme of digital asset markets, it's a Tuesday. The setup is classic: fear is palpable, the crowd is leaning one way, and the underlying tech stack hasn't magically gotten worse overnight. Just remember, in this game, 'buying the dip' often feels indistinguishable from 'catching a falling knife' until about six months later when you're either a genius or broke. As the old Wall Street adage goes, the market can stay irrational longer than you can stay solvent—and crypto is that maxim on digital steroids.

Source: CoinGecko

Source: CoinGecko

Can Solana Reverse Its Trend?

Solana (SOL) has faced its fair share of ups and downs over the last few years. The asset’s price crashed to below $9 after the collapse of FTX in 2022. Since its 2022 lows, SOL has hit multiple all-time highs. The asset’s incredible comeback has solidified its status as one of the most resilient cryptocurrencies in the market. Given its historical performance, there is a high chance that Solana (SOL) will eventually reverse its trend. However, the question is when it does so.

Solana (SOL) tends to follow Bitcoin’s (BTC) trajectory. The asset’s rebound in the last 24 hours follows BTC’s reversal. BTC fell to the $87,000 mark, but has since reclaimed the $89,000 price level. Moreover, the dip in gold and silver prices could be a signal that investors are ready to take on more risks.

However, geopolitical tensions and macroeconomic uncertainties could present challenges to Solana’s (SOL) price. Despite the asset’s incredible comeback story, it could take some time for SOL to completely recover from the late 2025 crash. How things unfold is yet to be seen.