Fed’s $55 Billion Liquidity Injection: The Rocket Fuel XRP Needs to Hit $3?

Central banks open the taps, and crypto traders start doing the math. The latest $55 billion liquidity move from the Fed isn't just a number on a spreadsheet—it's potential jet fuel for digital asset markets. The question on every speculator's mind: Will XRP be the prime beneficiary?

The Liquidity Logic

Fresh capital sloshing through the system has a notorious habit of finding its way into risk assets. It's a classic playbook: lower the cost of money, watch investors chase yield. Crypto, with its volatility and 24/7 markets, often acts as a high-beta satellite to these macro tides. This injection could be the tide that lifts all boats, especially those positioned for a breakout.

XRP's Unique Positioning

Unlike purely speculative tokens, XRP's value narrative is tethered to institutional adoption and cross-border settlement utility. A liquidity surge doesn't just mean more speculative cash; it can mean renewed confidence in the corridors of traditional finance where Ripple has been steadily building bridges. When traditional markets get a sugar rush, the assets bridging the old and new worlds often get a second look.

The $3 Target: Speculation or Sound Thesis?

Hitting $3 would require a monumental market cap leap. It's a big ask, but not an impossible one in a crypto bull run supercharged by loose monetary policy. The target represents more than a price—it's a symbol of XRP finally shrugging off its regulatory overhang and being valued purely on its network potential and adoption trajectory. The liquidity wave could provide the perfect cover for such a re-rating.

Of course, in the grand casino of modern finance, central bank liquidity is the house pumping free chips onto the table—everyone feels richer until the music stops. For now, the beat goes on, and XRP holders are watching the Fed's balance sheet like a hawk. The path to $3 might just be paved with freshly printed dollars.

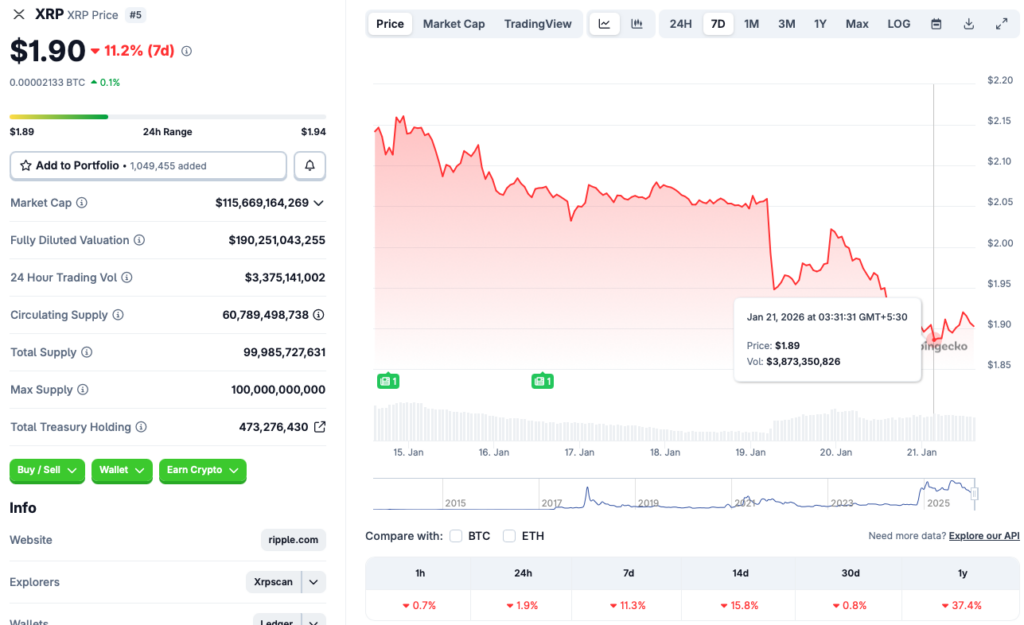

Source: CoinGecko

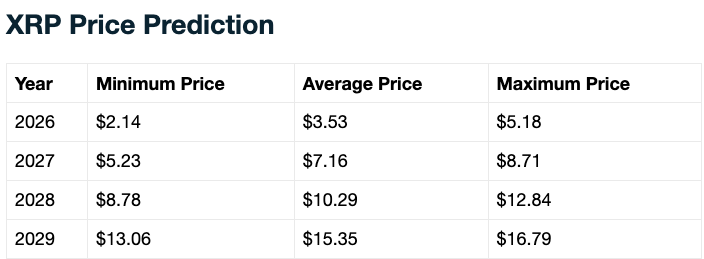

Source: CoinGecko

Can The Federal Reserve’s $55 Billion Liquidity Save XRP From Its Price Dip?

The Federal Reserve has announced that it will inject $55 billion in liquidity over the coming weeks. The first liquidity $8.3 billion package was injected on Jan. 20, 2026. The move could lead to a surge in the crypto market. bitcoin (BTC) has historically rallied after a Federal Reserve intervention. XRP could follow BTC’s trajectory if the original crypto breaks out.

Moreover, earlier this month, CNBC called XRP the “hottest crypto deal of 2026.” Many experts anticipate the asset to rally over the coming months. XRP also saw the launch of several spot ETFs late last year. ETF inflows could pick up, driving the asset’s price further north.

According to Telegaon analysts, XRP will have a bullish year in 2026. The platform anticipates the asset to hit a potential maximum price of $5.18. Hitting $5.18 WOULD be a new all-time high for the asset, and reaching this level will entail a rally of about 172.6%.

However, we are still in a bear market, and cryptocurrencies are struggling to gain momentum. XRP’s price could face substantial challenges from the ongoing geopolitical tensions and macroeconomic uncertainties. President Trump’s additional tariffs on countries supporting Greenland could lead to further market corrections.