Silver’s $5.3 Trillion Market Cap Stuns Markets, Topples Nvidia to Claim #2 Spot

Move over, tech—the old guard just flexed its muscles.

The Quiet Giant Awakens

While everyone was watching AI stocks and crypto charts, a classic asset just pulled off a staggering coup. Silver, the perennial runner-up to gold, has silently amassed a market valuation that now eclipses one of the world's most valuable tech companies. That's not a typo—it's a $5.3 trillion statement.

More Than Just a Safe Haven

This isn't just about inflation fears or economic uncertainty. The surge points to a massive, structural reallocation. Institutional money is hunting for tangible value outside the digital realm, and it's finding a motherlode in this industrial and monetary metal. The scale of the move suggests this is more than a fleeting hedge; it's a fundamental bet on real assets in a virtual world.

The New Hierarchy of Value

Let's talk brass tacks—or rather, silver ones. By vaulting past Nvidia, silver has redrawn the leaderboard of global assets. It's a stark reminder that for all the talk of digital disruption, physical scarcity and millennia of trust still command a premium that can outpace silicon and algorithms. The message to markets? Don't write off the 'boring' stuff.

The Cynic's Corner

Of course, Wall Street will spin this as a prudent diversification strategy—never mind that most of them were dismissing commodities as a relic six months ago. Nothing gets the old money flowing like the fear of missing out on the next big, shiny thing, even if it's been sitting in the ground for eons.

The takeaway is blunt. In the race for store-of-value supremacy, a metal that conducts electricity and confidence just bypassed a chipmaker that powers AI. Sometimes, the future looks a lot like the past—just with a few more zeros attached.

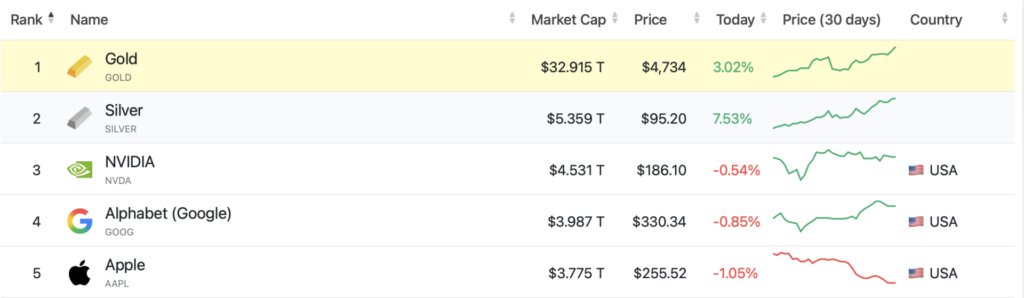

Silver Market Cap Overtakes Nvidia, Hits $5.3 Trillion

According to CompaniesMarketCap, silver’s global market cap has breached the $5.3 trillion mark, overtaking Nvidia to become the 2nd largest asset by valuation globally. Nvidia is currently the 3rd-largest asset, with a market cap of $4.53 trillion.

Silver has hit multiple peaks over the last few months. Market participants are likely concerned about global tensions, opting for safe havens instead of tech stocks or cryptocurrencies. The US-Greenland debacle may have furthered investor worry, as NATO countries experience internal struggles. Meanwhile, Canada seems to be cozying up to China, with Canadian Prime Minister Mark Carney calling it the “new world order.”

Silver prices are expected to continue surging over the coming months, given that geopolitical tensions and macroeconomic worries show no end. Investors may continue their risk-averse approach until there is some relief in the global economy or the geopolitical tensions cool down.

The crypto market has also been severely hit over the last few months, with Bitcoin (BTC) falling to the $90,000 mark today. Cryptocurrencies carry some of the highest risks in the market, and investors are likely taking a step back from crypto assets. Silver and gold seem to be the investment of choice in the current market climate.

Silver prices could slow down over the coming weeks, given that the US Federal Reserve aims to inject $55 billion in liquidity starting from Jan. 20, 2026. bitcoin (BTC) has historically rallied after Federal Reserve interventions, and we could see a trend reversal in the coming weeks.