Ethereum Teeters on $3000 Precipice as Liquidation Wave Intensifies

Liquidation cascades threaten to shatter Ethereum's critical support level, sending shockwaves through the DeFi ecosystem.

The Domino Effect in Action

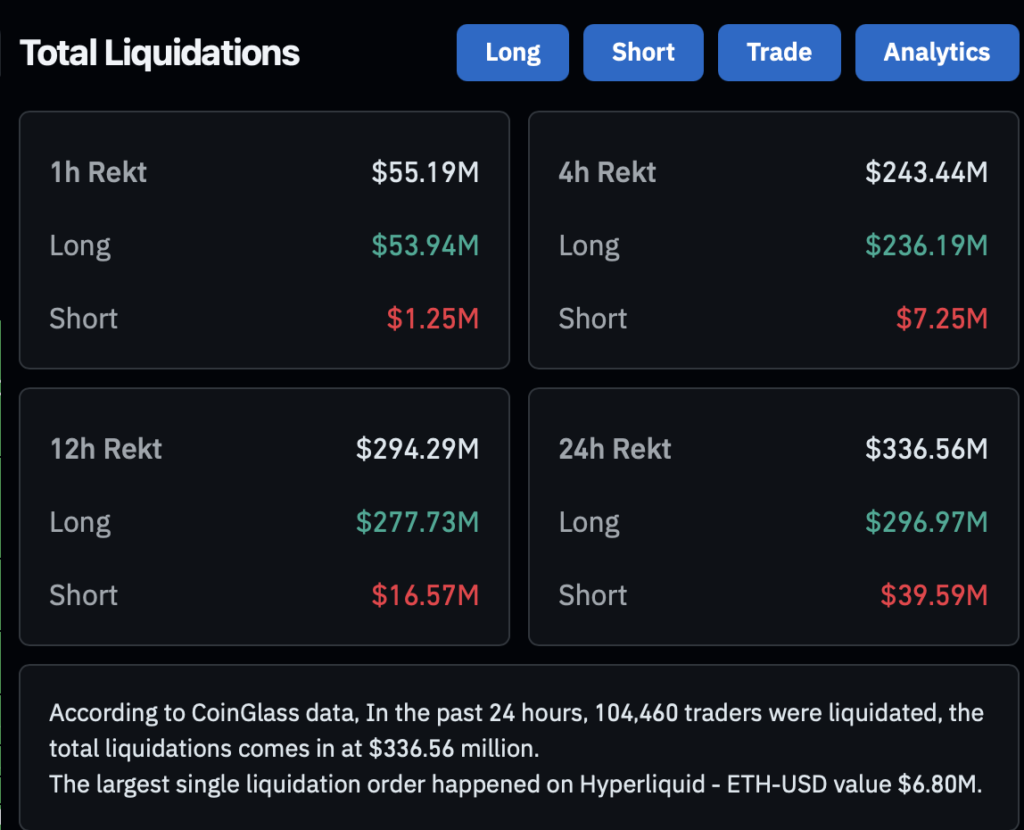

Massive leveraged positions are getting flushed out. Each forced sale triggers the next, creating a self-reinforcing downward spiral. The $3000 mark isn't just psychological—it's a technical linchpin holding up a mountain of collateral.

Why This Liquidation Spike is Different

This isn't isolated profit-taking. It's a systemic unwinding. The sheer volume of liquidations points to overextended leverage across major lending protocols. When the tide goes out, you see who's been swimming naked—and right now, the water's receding fast.

The $3000 Line in the Sand

A breach below this level would invalidate months of consolidation. It opens the path to significantly lower valuations as stop-losses cluster just beneath. The market's memory is short, but its algorithms are ruthless.

Watch the order books, not the headlines. The real story unfolds in the bid-ask spread, where liquidity either holds firm or evaporates. Remember, in crypto, 'long-term investment' is often just a polite term for a bagholder waiting for the next sucker. The next 48 hours will separate the strategic from the stranded.

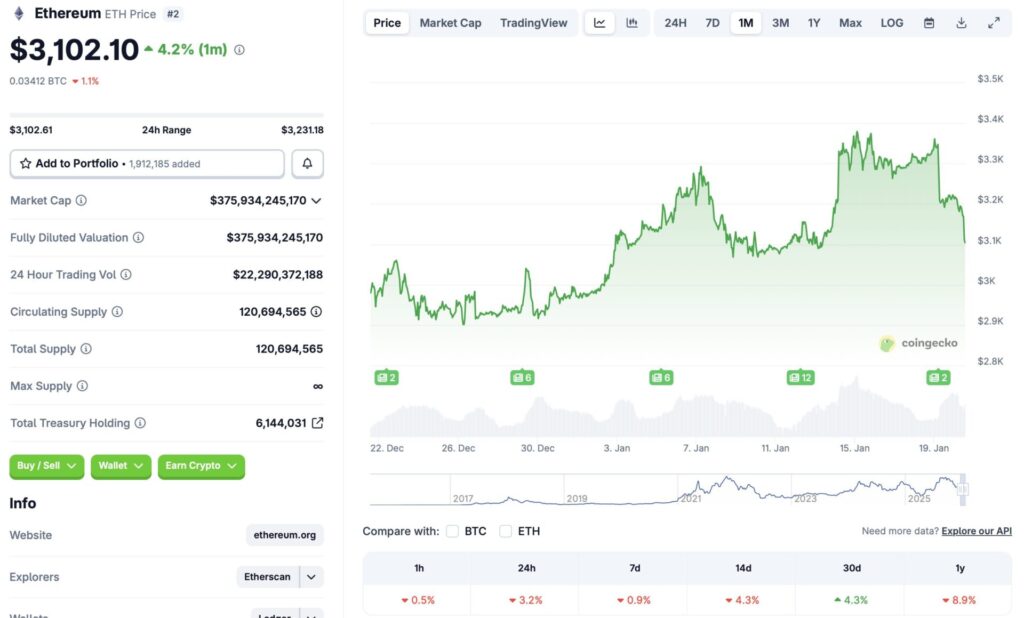

Source: CoinGecko

Source: CoinGecko

Can Ethereum Rebound From Its Price Crash?

Ethereum (ETH) had quite a bullish year in 2025. The asset hit an all-time high of $4,946.05 in August, thanks to increased ETF inflows. However, the rally was short-lived as the crypto market faced a massive crash in October. ETH’s price has struggled to gain momentum over the last few months, albeit it did see some sporadic rallies.

Ethereum’s (ETH) current downward trajectory follows the general market trend. Geopolitical tensions and macroeconomic uncertainties are pulling investors away from the crypto market. According to CoinGlass data, $336.56 million was liquidated from the crypto market in the last 24 hours. Moreover, the single largest liquidation took place on Hyperliquid for Ethereum-USD, valued at $6.8 million.

Market participants seem to be moving towards SAFE havens, such as gold and silver. Both precious metals have hit multiple new all-time highs over the last few months. Ethereum’s (ETH) trajectory is unlikely to change unless the larger economy shows signs of improvement.

Despite the bearish market environment, CoinCodex analysts anticipate Ethereum (ETH) to break out over the coming months. The platform predicts ETH will climb to a new all-time high of $5683.73 on April 20, 2026.