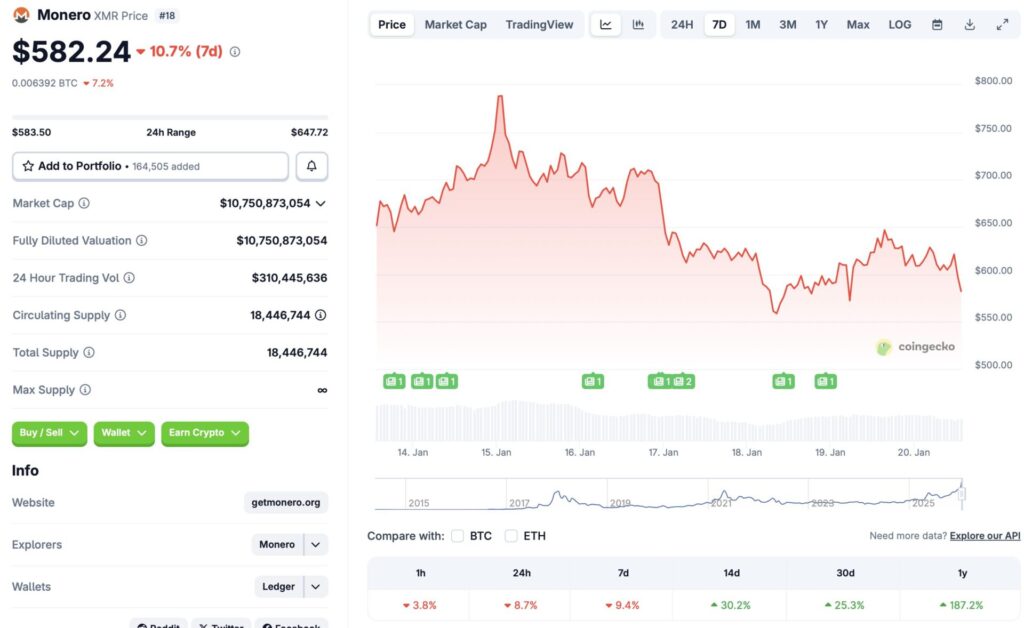

Monero’s Bullish Run Crashes 10%: What’s Next for the Privacy Coin?

Monero's rally just hit a wall—a 10% plunge in 24 hours. The privacy-focused cryptocurrency, riding high on recent momentum, saw its gains evaporate overnight. So, what triggers a drop this sharp?

Reading the Charts

Technical indicators flipped from green to red in a hurry. That 10% cut didn't just erase a day's progress—it breached key support levels traders were watching. The move signals a classic profit-taking event after an extended climb, where early buyers cash out and new money hesitates to step in.

The Privacy Premium Under Pressure

Monero trades on a unique value proposition: untraceable transactions. But that same feature draws regulatory scrutiny, creating a persistent overhang. Every time a major exchange delists privacy coins or a government agency raises concerns, the 'regulatory discount' gets priced in—sometimes violently. It's the finance sector's favorite game: champion innovation until it threatens the gatekeepers' control.

Where Does It Go From Here?

The immediate path hinges on whether bulls defend the new lower range. If buying volume returns, this could be a healthy correction. If not, traders might brace for another leg down. For long-term believers, nothing about the core technology changed—just the mood of the market, which shifts faster than a trader can say 'risk-off.' Sometimes the most private thing in crypto isn't your wallet address, but a fund manager's real motive for selling.

Source: CoinGecko

Source: CoinGecko

Is Monero’s Price Crash The End Of Its Bullish Trajectory?

Monero’s (XMR) bullish breakout started in late 2025, while other assets were facing steep price corrections. The rally was quite anomalous, given that the larger market was facing heavy liquidations. The period marked a sharp increase in the demand for privacy-focused coins, with Zcash (ZEC) also registering big gains.

However, ZEC’s momentum was disrupted by internal struggles. The project’s development team quit en masse, leading to an exodus of investors. Investors most likely parked their funds in Monero (XMR), leading to a massive price surge for the asset.

Monero (XMR) seems to have faced the same fate as the larger crypto market. The cryptocurrency sector has taken a big hit over the last few months. Macroeconomic uncertainties and global geopolitical tensions have led to investors taking a risk-averse approach, evident by the rising prices of gold and silver.

Given the larger bearish market environment, it is unlikely that Monero (XMR) will make a rebound anytime soon. Bitcoin (BTC) is leading the market trajectory, and its price movement will most probably dictate the larger market direction. XMR will likely rebound when the general crypto market sees positive price action.