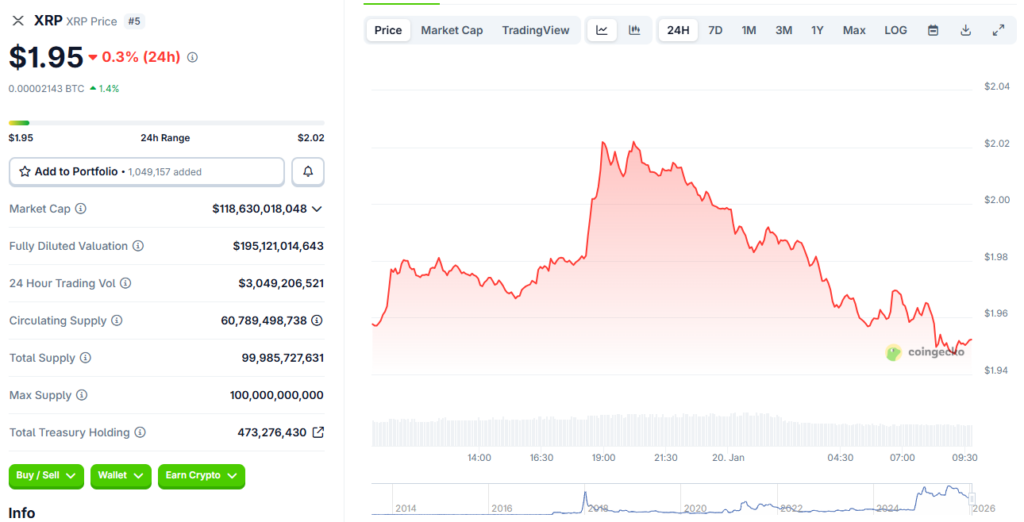

Ripple CEO’s Subtle Signal After XRP Price Crash Sparks Market Speculation

Brad Garlinghouse breaks silence—but not the way traders expected. No panic, no promises, just a cryptic post that sent the XRP army scrambling for clues.

The Non-Response Response

When a token sheds double-digits, CEOs usually hit the crisis comms playbook. Not this time. Garlinghouse bypassed the standard 'fundamentals are strong' script. His move? A single, seemingly mundane social media update—loaded with subtext for those watching close enough. It's the corporate equivalent of a raised eyebrow during a market meltdown.

Reading Between the Tweets

The signal wasn't in what was said, but what was omitted. No mention of the sell-off. No defense of the chart. Instead, a deliberate pivot to long-term infrastructure—a classic chess move when everyone else is playing checkers. It suggests a roadmap unaffected by daily volatility, or a stunning indifference to retail panic. Take your pick.

The Ripple Effect

This isn't just about XRP's price. It's a masterclass in narrative control. While day traders hyperventilate over candles, the CEO reframes the conversation entirely. He directs attention to adoption pipelines and regulatory trenches—the boring stuff that actually builds value, but rarely makes for good memes.

Market Psychology in Action

The reaction tells you everything. Had Garlinghouse issued a fiery defense, it would've smelled of desperation. Silence would've bred conspiracy theories. This? A calibrated middle ground that fuels speculation while maintaining plausible deniability. A neat trick if you can pull it off—and cheaper than a buyback program.

Sometimes the loudest message is the one never spoken. Garlinghouse just gave a clinic in letting the 'community' connect its own dots—all while Wall Street analysts charge $500 an hour to overcomplicate the same game. The signal was subtle, but the intent was crystal: in crypto, the narrative often cuts deeper than the code.

Navigating XRP Price Crash With Ripple CEO Insights On Market Volatility

What Garlinghouse’s Social Media Move Means

Captain Mallard posted on X asking the community about the xrp price crash. The question was simple – are you worried about this dip? Brad Garlinghouse liked the post, which doesn’t sound like much but actually sent a message during the cryptocurrency volatility.

No way![]() Brad, Ripple’s CEO, just liked another post of mine that’s 2 in the last 24 hours. Lock in, XRP Army.

Brad, Ripple’s CEO, just liked another post of mine that’s 2 in the last 24 hours. Lock in, XRP Army.![]() https://t.co/WFm810aYil pic.twitter.com/WJZhkFUrG2

https://t.co/WFm810aYil pic.twitter.com/WJZhkFUrG2

![]()

![]()

![]()

Ripple’s CEO reaction got noticed fast, and Captain Mallard shared his thoughts:

XRP dropped below $2.00 during this crypto market dip. The XRP price crash happened alongside drops in other tokens too, though his response suggests the cryptocurrency volatility isn’t concerning him much.

Seeing Past the Present Recession

Ripple’s CEO reaction goes beyond social media though. At Binance Blockchain Week, Garlinghouse talked about where things are headed even with the cryptocurrency volatility happening right now.

Brad Garlinghouse said:

These numbers tell a different story about investor sentiment during the XRP price crash. The crypto market dip looks bad on charts, but institutional money is coming in. His comments about 2026 give context for understanding the current cryptocurrency volatility too. The XRP price crash tested holders, and Ripple’s CEO reaction through both X and public appearances shows leadership sees this as temporary. Investor sentiment is recovering because the crypto market dip doesn’t look like it worried Ripple’s CEO at all.