NYSE Blockchain Unleashed: 24/7 Onchain Markets for Tokenized Stocks Are Here

Wall Street's sleeping giant just woke up—and it's running on code. The New York Stock Exchange is throwing open the doors to round-the-clock, on-chain trading for tokenized equities, bypassing the traditional market's 9-to-5 constraints and custodial gatekeepers.

The 24/7 Trading Engine

Forget waiting for the opening bell. The new infrastructure allows investors to buy and sell tokenized representations of stocks anytime—nights, weekends, holidays. It cuts settlement times from days to minutes by leveraging blockchain's immutable ledger, stripping out layers of intermediaries in the process.

A New Market Architecture

This isn't just a new product; it's a new market structure. By placing stock tokens on a public blockchain, the NYSE is effectively creating a parallel, globally accessible exchange. It democratizes access while introducing the liquidity and volatility of crypto markets to traditional assets—hold onto your hats.

The move pressures every major exchange to innovate or obsolesce. It validates the entire tokenization thesis for real-world assets, signaling that the future of finance is programmable, permissionless, and never closes. Of course, it also gives financiers a new, complex product to bundle, slice, and sell—some things never change.

What the NYSE Blockchain Platform Really Means?

The NYSE Blockchain platform will allow U.S. stocks and ETFs to be traded 24 hours a day, seven days a week.

Source: X (formerly Twitter)

Investors will be able to buy fractional shares, fund trades with stablecoins, and get instant settlement.

Investors will still own real shares.

They will still receive dividends.

They will still have voting rights.

Only the system that moves money and confirms trades is changing.

Instead of waiting one or two days for settlement, trades will be completed almost instantly.

This reduces risk, saves time, and opens markets to people across all time zones.

Why Tokenized Stocks Are a Big Deal?

Tokenized stocks are regular shares represented as digital tokens on a blockchain. Under this model, these tokens are fully regulated and connected to real securities.

Faster trading

No settlement delays

Access outside banking hours

Easier global participation

Lower operational friction

This is not crypto trying to fit into Wall Street. This is Wall Street choosing blockchain.

Banks and Stablecoins Powering the System

NYSE’s parent company ICE is working with major banks like BNY and Citi to move money and collateral on-chain. This allows institutions to manage funds even when banks are closed.

Stablecoins will be used to fund trades. This gives the NYSE Block-chain true 24/7 functionality. Money can move at any time, across borders, without waiting for traditional banking hours.

This is exactly how crypto markets already work. Now stock markets are adopting the same structure.

Always-On Markets Need Always-On Prices

When markets never close, price updates must never stop. It depends on high-quality, real-time pricing coming directly from institutions.

This is where systems like PYTH become important. Pyth is built for always-on markets and provides accurate prices from real market sources. With support from partners like Blue Ocean, which supplies U.S. equities data beyond normal hours, Pyth helps make 24/7 trading possible.

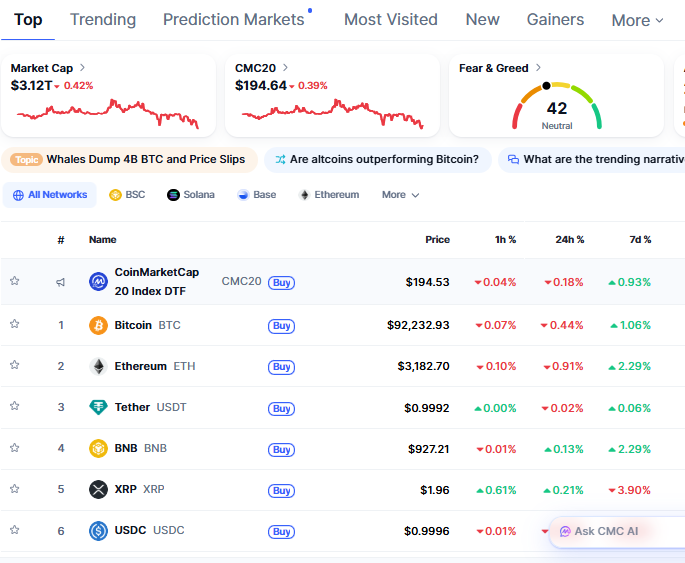

Crypto Market Today Shows the Right Moment

The current crypto market shows calm but steady confidence. The total market cap is around $3.12 trillion, slightly down by 0.42%. The Fear & Greed Index is at 42, showing a neutral mood.

Source: CoinMarketCap Data

Bitcoin is trading near $92,200, while ethereum is around $3,180. Prices are stable, and there is no panic in the market. This kind of environment is perfect for big institutions to build long-term systems like the NYSE Blockchain.

Permissioned Today, Open Tomorrow

Right now, the NYSE Blockchain runs on permissioned blockchains. This means access is controlled for safety and regulation. It makes sense at this stage because financial laws must be followed strictly.

But history shows that systems evolve. Just like bitcoin ETFs came after years of indirect exposure, public blockchains may become part of NYSE’s system in the future once rules allow it.