Fed’s $8.3 Billion Liquidity Injection Hits Today: Is This Bitcoin’s Next Rocket Fuel?

Fresh money hits the system. Markets twitch. Crypto traders lean forward.

### The Liquidity Spigot Opens

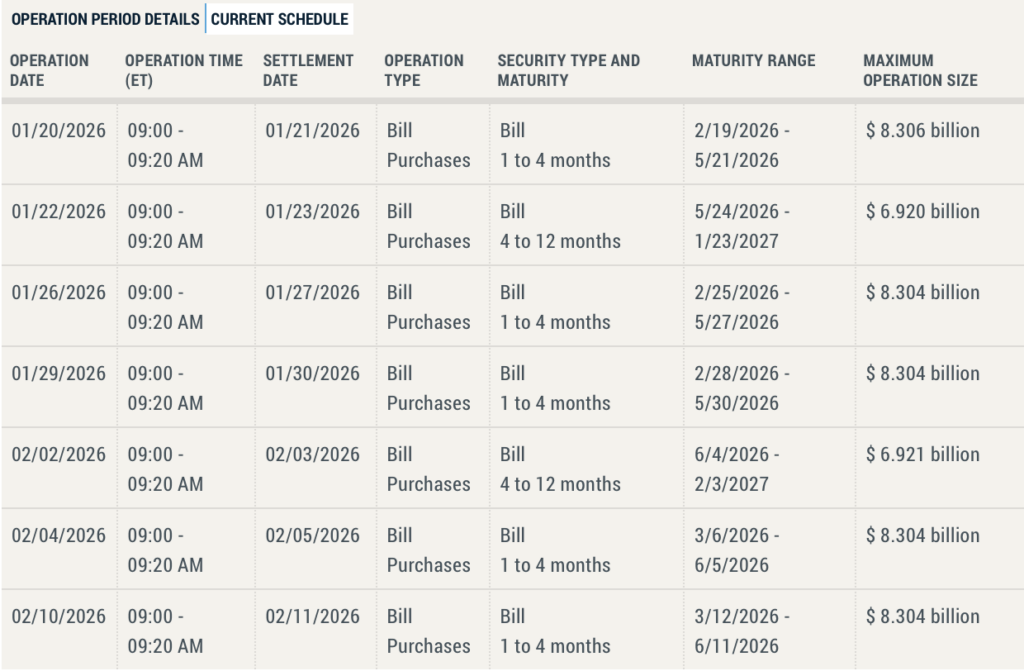

The Federal Reserve just activated another $8.3 billion in liquidity operations. It's not a direct stimulus check to Main Street—think of it as high-octane fuel pumped into the banking system's engine. Wall Street gets the first sip, as usual.

### Digital Gold's Reflex

History shows a pattern: when central banks flood the zone with cheap cash, a portion inevitably seeks the exit ramp out of traditional finance. Bitcoin, with its fixed supply and decentralized ledger, often becomes a parking garage for that fleeing capital. It's the ultimate hedge against monetary dilution—a cynical but proven trade.

### The Rally Question

Will it pump? Past injections have lit short-term fuses under crypto markets. The logic is simple: more dollars chasing the same 21 million Bitcoin. It's basic supply and demand, dressed in cryptographic clothing. Traders are watching order books and leverage ratios, gauging whether this inflow meets a market ready to spring.

### The Bigger Picture

This isn't just about one day's price action. It's another data point in the long-term narrative of fiat debasement versus digital scarcity. Every liquidity injection quietly argues Bitcoin's case. The Fed plays its old tune, and a growing chorus of investors starts humming a different one—one with a hard cap.

So watch the charts today. But remember, the real story isn't the temporary spike; it's the relentless drip of policy that makes a decentralized alternative look less like a gamble and more like a plan. After all, trusting central bankers with money printing is the biggest speculative bet in town.

Source: New York Fed

Source: New York Fed

Can Bitcoin Rally To $120,000 After The Fed’s Liquidity Injection?

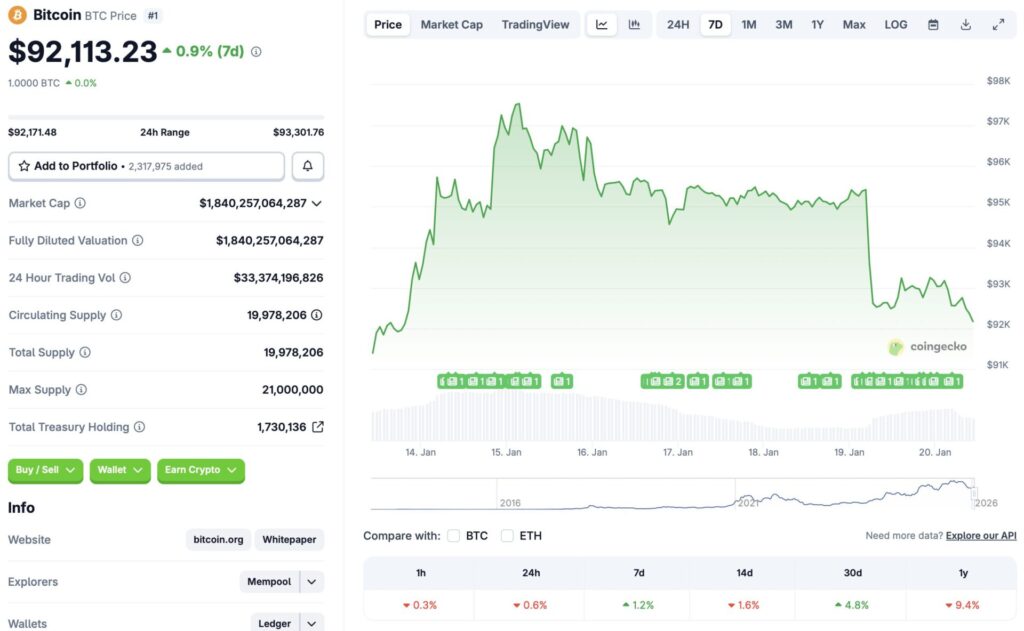

BTC has experienced a significant correction over the past few days. The original crypto reclaimed the $97,000 mark on Jan. 15, but has since dipped to the $92,000 price level. According to CoinGecko’s Bitcoin data, the price of BTC is down 0.6% in the last 24 hours, 1.6% in the 14-day chart, and 9.4% since January 2025. However, the asset’s price has risen 1.2% over the last week and 4.8% over the previous month.

Bitcoin and the larger market correction over the last few days are likely due to geopolitical tensions between the US and Greenland. Many countries have rallied in support of Greenland, with France, Germany, and Norway sending some troops. The US has imposed additional tariffs on countries supporting Greenland, leading to a spike in investor worry.

Despite the market bearishness, there is a chance that Bitcoin (BTC) will rally following the Federal Reserve’s liquidity injection. Historically, BTC has rallied under such circumstances. Moreover, many experts are already quite bullish on BTC’s 2026 forecast. Bernstein even anticipates the original crypto to breach the $150,000 mark this year.

Nonetheless, given the macroeconomic uncertainties and the ongoing geopolitical tensions, investors may stay away from risky assets, such as cryptocurrencies. Additionally, investors are taking a risk-off approach, preferring gold and silver investments. Both commodities have new all-time highs. Bitcoin’s (BTC) price could consolidate around current levels or face further corrections if the trend persists.