Retail Panic? That’s Bitcoin’s Secret Bull Signal - Here’s Why

When the crowd runs for the exits, smart money starts loading up. It's a counterintuitive dance that's played out across every Bitcoin cycle.

The Fear Gauge Flips

Retail sentiment often acts as a perfect contrarian indicator. Panic selling creates liquidity—a wave of cheap coins that institutional players and long-term holders quietly absorb. The market doesn't reward the emotional herd; it punishes them.

Weak Hands, Strong Foundations

Each sell-off shakes out speculative leverage. It transfers assets from impatient traders to conviction-driven portfolios. This consolidation builds a stronger, more resilient price floor—one less prone to cascading liquidations.

The Liquidity Paradox

Mass exits generate the very market depth needed for the next leg up. It's a brutal recycling mechanism: retail provides the fuel, whales provide the spark. Think of it as Wall Street's favorite free delivery service—just without the tipping option.

So next time your feed screams capitulation, remember: in crypto's cold calculus, panic isn't an end. It's a reset. The real money isn't made following the crowd's fear, but patiently waiting for its aftermath. After all, traditional finance taught us to buy high and sell low—why break tradition now?

Why Retail Panicking Is Good for Markets

According to a recent Santiment report, the markets are currently in a tizzy, portraying a vulnerable, panicked stance. With Bitcoin significantly down from its earlier price levels of $120K, the investors are now wondering whether the asset is prone to a meltdown again. However, Santiment outlines a compelling new insight, stating how markets often move in opposition to the crowd’s expectations, building a bullish price case for Bitcoin.

The Santiment report noted how the general market commentary is bearish, with words like “selling,” “sold,” and “lower” trending across the board.

However, as markets generally move in the opposite direction of what investors are currently thinking, Santiment believes a bullish price wave may already be underway for bitcoin soon.

![]() Commentary is mainly showing fear after Bitcoin bounced to $90.2K yesterday, and then quickly retraced to $84.8K. Bearish commentary like #selling, #sold, #bearish, or #lower are notably higher across X, Reddit, & Telegram.

Commentary is mainly showing fear after Bitcoin bounced to $90.2K yesterday, and then quickly retraced to $84.8K. Bearish commentary like #selling, #sold, #bearish, or #lower are notably higher across X, Reddit, & Telegram.![]() Historically, it's a strong sign when retail is… pic.twitter.com/n299F6v4kn

Historically, it's a strong sign when retail is… pic.twitter.com/n299F6v4kn

Bitcoin’s Next Bullish Move

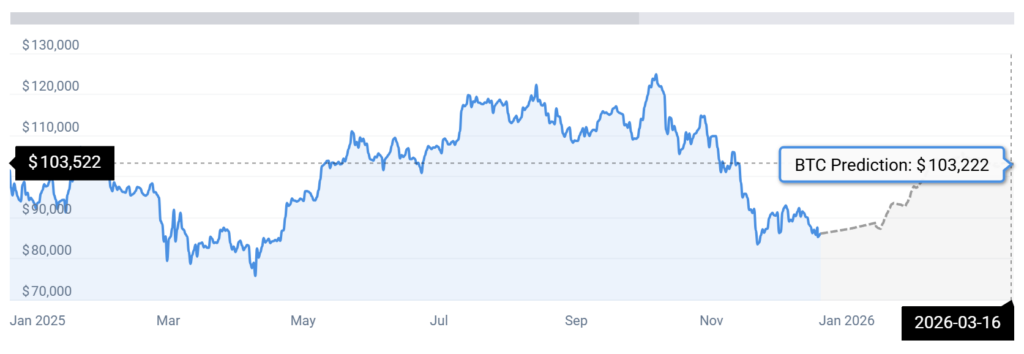

According to CoinCodex BTC stats, Bitcoin’s next bullish MOVE seems to be appearing in March 2026, with BTC claiming $103K.