Dogecoin Plunges 5% in 24 Hours: Is a Drop to 10 Cents Imminent?

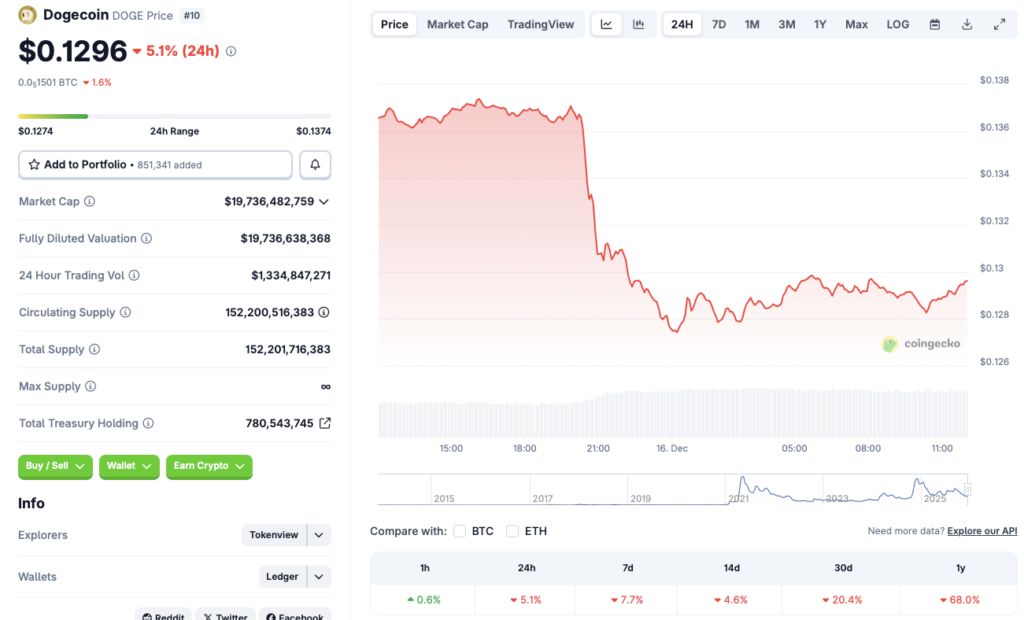

Dogecoin's latest price action has traders bracing for impact. A sharp 5% decline in a single day has the market whispering about a potential slide toward the 10-cent mark.

The Technical Breakdown

The sell-off wasn't subtle. It sliced through short-term support levels, leaving a chart that looks more like a warning signal than a buying opportunity. Momentum indicators flipped bearish, and trading volume spiked on the way down—a classic sign of distribution.

Sentiment Takes a Hit

Remember the memes and the moon-shot predictions? They've gone quiet. Social sentiment metrics are cooling faster than a crypto bro's NFT portfolio after a market correction. The fear of missing out has been neatly replaced by the fear of losing more.

The Macro Squeeze

It's not happening in a vacuum. Broader risk assets are feeling the heat, and Dogecoin, for all its community spirit, remains a high-beta play on market sentiment. When liquidity gets tight, the speculative froth is always the first to evaporate—a lesson the finance sector relearns with every cycle, yet somehow never budgets for in their glossy projections.

What's Next for DOGE?

The path to 10 cents is now a legitimate chart conversation. It would require another significant leg down, but the current trajectory suggests it's on the table. Bulls need to step in quickly to defend key levels; otherwise, gravity might just do its thing. In crypto, sometimes the most powerful force isn't adoption—it's simple, old-fashioned price discovery.

Source: CoinGecko

Source: CoinGecko

Will Dogecoin Crash Below 10 Cents?

The cryptocurrency market has seen some of its worst months in 2025 since October, a historically bullish month. Bitcoin (BTC) climbed to an all-time high of $126,000 in early October, but has been on a downward trajectory since. Dogecoin (DOGE) is following BTC’s trajectory, registering heavy losses over the last few months. The current market crash is concerning, especially considering the fact that the Federal Reserve rolled out a 25 basis point interest rate cut earlier this month.

Dogecoin’s (DOGE) latest crash is likely due to continued macroeconomic uncertainty. The uncertainties around the economy seem to have outweighed the interest rate cuts over the last few months. Jobs data has also not ignited investor confidence. Market participants are likely moving away from risky assets, such as cryptocurrencies. Dogecoin (DOGE), being a memecoin, carries even more risk than traditional crypto assets, such as Bitcoin (BTC), ethereum (ETH), XRP, etc.

Additionally, Barclays recently said that the crypto market could face increased challenges in 2026, arising from low volume and the lack of demand. Such a circumstance could lead to Dogecoin (DOGE) facing additional price corrections and dipping to the 10-cent mark.

We could also be heading for another crypto winter. In such a case, Dogecoin (DOGE) could even dip to $0.09. The crypto market will likely not improve unless the global economy finds a stronger footing.