XRP Price Prediction: Can Ripple Rally Past $2 Before the End of 2025?

Ripple's XRP is making moves—but can it break the $2 barrier by year's end?

Forget the slow-and-steady narrative. The digital asset built for institutional corridors is showing flashes of retail-fueled momentum. A convergence of regulatory clarity and renewed network activity has traders watching the charts with fresh intensity.

The Liquidity Catalyst

It's not just about speculation anymore. Real-world payment flows are ticking up, injecting fundamental utility into the price equation. Major corridors are live, and the on-chain data reflects a network that's being used, not just held.

Technical Breakout or Bull Trap?

The charts tell a story of consolidation and potential. Key resistance levels have been tested and, in some cases, breached. The question now is whether the current structure supports a sustained push higher or if it's another classic setup for the 'buy the rumor, sell the news' crowd—a favorite pastime in crypto markets where hope often outpaces reality.

Market sentiment is a fickle beast, especially for an asset that's spent years in legal limbo. The shadow of past SEC battles still looms, but the path forward appears clearer. Every minor partnership announcement gets magnified, every exchange listing scrutinized for its potential to unlock new capital.

The Final Hurdle

Reaching that elusive $2 mark requires more than just hype. It needs sustained volume, a favorable macro backdrop for risk assets, and no surprise regulatory curveballs. In a sector where 'number go up' is often the only fundamental analysis, XRP's journey to $2 will be a test of its unique value proposition versus pure market mania. After all, in traditional finance, they call it 'valuation'; in crypto, we sometimes just call it a guess with a fancy chart attached.

Watch the order books. The battle for $2 is on.

The XRP price has come under enormous pressure after it experienced a huge sell-off throughout the weekend and closed on a bearish note. Bitcoin price slumped hard in the early trading hours, which dragged the entire market down, including XRP. The whale interest seems to have trembled a bit, which seems to have been absorbed by the bulls. With the technicals and the on-chain data hinting towards a ‘market reset,’ it would be interesting to watch whether the XRP price will reclaim $2 this year or not.

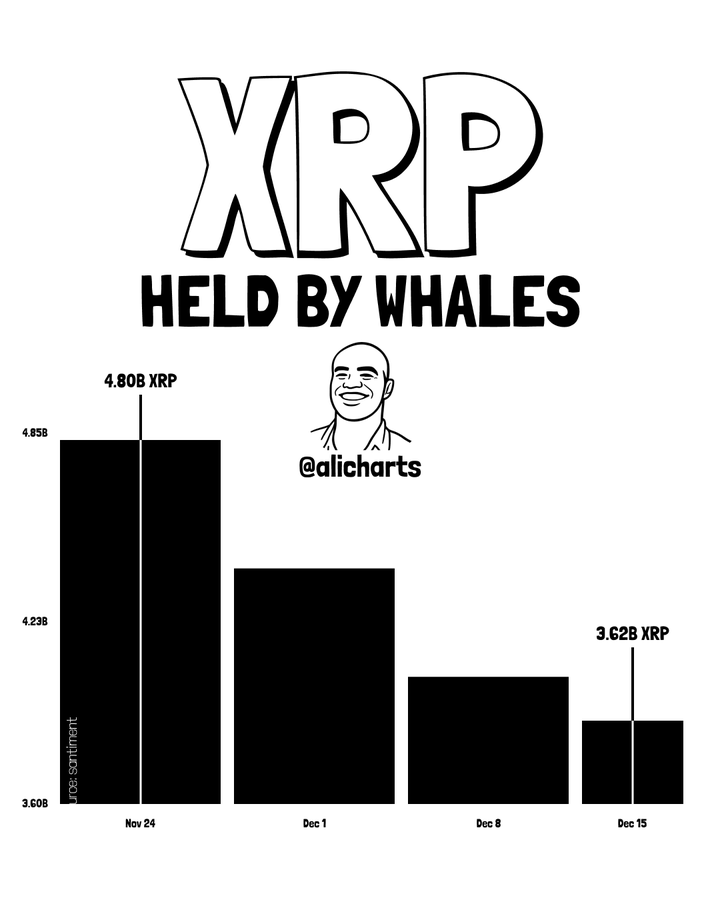

Whale Distribution Triggers Short-Term XRP Weakness

The clearest source of XRP’s current sell-side pressure comes from whales. Large-wallet holdings have fallen from roughly 4.8 billion XRP in late November to 3.6 billion XRP by December 15, according to Sentiment data presented by a popular analyst, Ali. This is a meaningful drop in deep-pocket supply and historically aligns with short-term tops or multi-week corrections.

Whales typically offload during high volatility or uncertainty, and their selling over the past three weeks has coincided with XRP breaking key support levels—including the crucial $0.60 zone—and sliding further in line with the broader market downturn. For now, the short-term trend remains bearish primarily because the largest holders are driving liquidity out of the market.

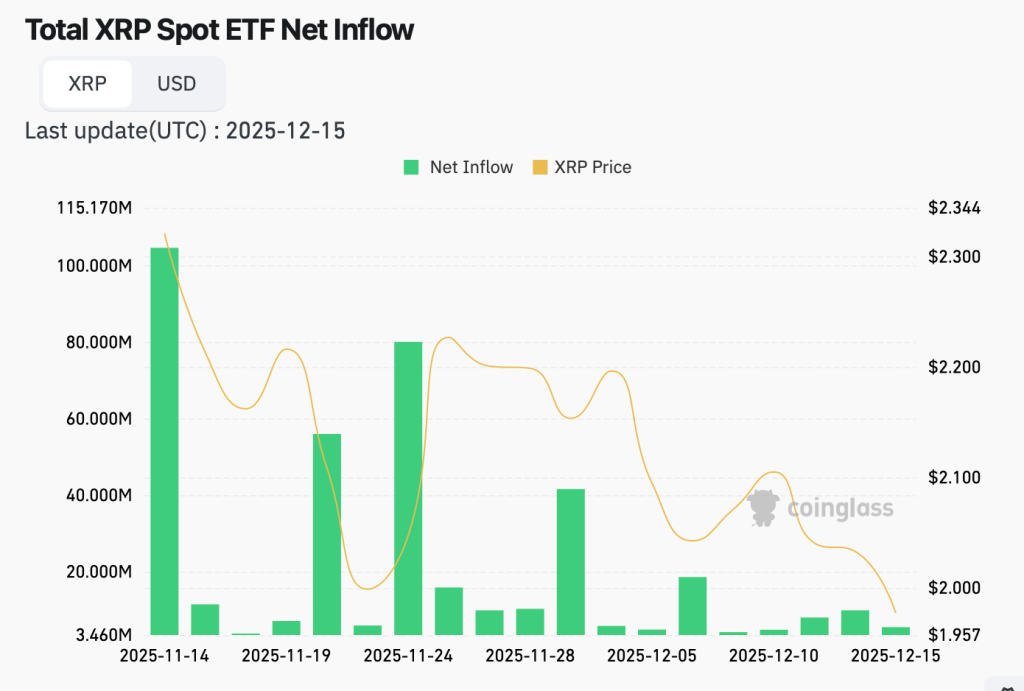

ETF Inflows Show Institutions Accumulating Into Weakness

But the second chart tells a very different story. While whales have been exiting, XRP-focused ETFs and ETPs have recorded consecutive net inflows, outperforming both Bitcoin and ethereum products during the same period.

Bitwise, Franklin, and other issuers posted multi-million-dollar daily inflows, pushing cumulative net assets above $1.18 billion. Bitwise alone attracted nearly $3.9 million in new flows, while Franklin added more than $4.3 million, suggesting institutional allocators are quietly increasing exposure.

This divergence—whales selling, institutions buying—indicates that longer-term players view the current weakness as an opportunity rather than a trend reversal. ETF flows don’t typically chase short-term momentum; they reflect strategic positioning and confidence in future value.

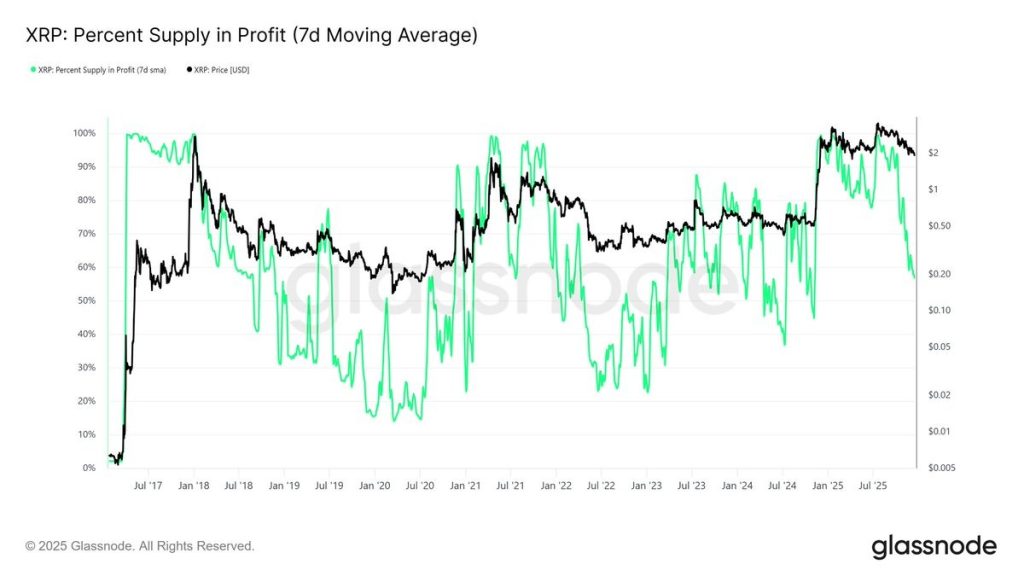

Percent Supply in Profit Confirms a Market Reset, Not a Breakdown

The final piece of the puzzle is XRP’s percent supply in profit, which has collapsed sharply during the recent decline. Historically, whenever the proportion of profitable supply falls this quickly, it signals one of two things: capitulation or the formation of an accumulation zone.

Current readings are now approaching levels seen during major resets in 2018, 2020, and 2022—each of which preceded substantial rebounds in the months that followed. This metric is crucial because it tells us that XRP’s corrective MOVE is flushing out weak hands and resetting expectations, rather than ushering in a prolonged downtrend.

A Market That’s Weak Short-Term, But Strengthening Underneath

When all three signals are aligned, the conclusion becomes clearer: Whales are driving the immediate sell-off, and ETFs are absorbing a meaningful portion of that pressure, reflecting institutional conviction. Meanwhile, on-chain profitability metrics show XRP entering a historical reset zone.

Despite short-term weakness, XRP’s underlying market structure is quietly strengthening. Together, these trends suggest the current correction may be setting the stage for a broader recovery once selling pressure eases. If institutional demand holds and on-chain metrics continue to stabilize, xrp price could realistically work its way back toward the $2 level before the end of 2025.