The Rupee Rout: How the Mighty US Dollar Bulldozed India’s Local Currency in 2025

The greenback just delivered another knockout punch to emerging markets—and India's rupee took the full force.

The Dollar's Unstoppable March

Forget subtle shifts—this was a full-scale currency bulldozing. The US dollar, turbocharged by Federal Reserve policies and global safe-haven flows, has been crushing competitors worldwide. India's rupee, caught in the crossfire, buckled under the pressure. No complex trade theories needed—just raw dollar strength meeting vulnerable emerging market defenses.

India's Defensive Playbook

Reserve Bank interventions? Check. Policy rate adjustments? Check. Market stabilization measures? Double-check. The traditional central bank toolkit got a full workout, but sometimes even the best defenses can't stop a tidal wave. It's the financial equivalent of bringing a shield to a drone strike.

The Global Currency War Heats Up

India isn't fighting alone—this is part of a broader emerging market currency crisis. When the dollar flexes, everyone feels the squeeze. Import costs spike, inflation pressures mount, and economic planning gets tossed like confetti in a hurricane. The real question isn't why the rupee fell, but why anyone expected different given the dollar's current reign.

Digital Assets: The Uninvited Guest

While traditional currencies duke it out, cryptocurrency markets watch from the sidelines—not as mere spectators, but as an alternative financial universe gaining real traction. When fiat currencies show their fragility, digital assets start looking less like speculative toys and more like legitimate hedges. It's almost enough to make you believe in decentralized finance. Almost.

The rupee's rout exposes a harsh truth: in today's financial arena, you're either holding dollars or you're getting held hostage by them. And somewhere in the background, Satoshi Nakamoto's creation keeps ticking along, completely unconcerned with which government-backed currency is winning this week's race to the bottom.

Source: Google

Source: Google

On the heels of the rupee rout, the Sensex dipped nearly 450 points while the Nifty is down 150 points. The stock market is already feeling the pinch with leading equities trading in the red. HDFC Bank stock, the leading banking giant, is below the 1,000 mark and is trading at 994. The US dollar is pulling the steam out of the rupee, making it the least performing currency in the Asian markets.

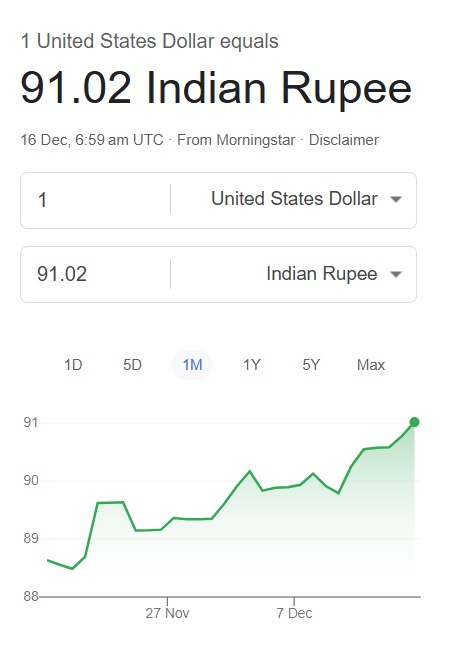

At this speed of decimation in the currency markets, it wouldn’t take long for the Indian rupee to fall to the 100 level against the US dollar. The INR is down 6.80% against the USD year-to-date, which is its biggest fall in years. In the last five years alone, it has dipped by 20% and shows no signs of a recovery.

The Rupee’s Worst Performance Against the US Dollar

Watcher Guru wrote an article in January predicting that the rupee WOULD fall to the 90-92 level against the US dollar. Its price was around the 85.93 range back then, and has fallen by another 6% since January. The downturn is affecting the import and export sector as goods are becoming costlier. Importers are the hardest hit as they need to shell out extra money to procure.

The entities put the burden on the consumers by raising prices to meet profits. The end user on the streets is the one who bears the brunt of the rupee’s decline vs the US dollar. Businesses and governments have their way of protecting themselves with various methods. The common man has only two options: either pay more or stop buying.