Cardano (ADA) Gets Its First Bullish Price Prediction After Major Slump

Cardano's ADA finally catches a break—analysts spot green shoots after the brutal downturn.

The Technical Turnaround

Forget the doom-scrolling. On-chain metrics and chart patterns are whispering what the price hasn't shouted yet: a potential reversal is brewing. The network's core activity—staking, development velocity, smart contract deployments—didn't vanish during the slump. It just got cheaper to accumulate.

The Prediction Engine

Where's this newfound optimism coming from? Not from hopium, but from cold, hard Fibonacci retracements and liquidity pool analysis. Key resistance levels are now in sight, and the order book shows a thinning of sell-side pressure. It's the classic setup—weak hands are out, patient capital is moving in.

The Road Ahead

This isn't a call for irrational exuberance. It's a signal that the bearish narrative has been fully priced in. The next moves will hinge on broader market sentiment and Cardano's own delivery on its roadmap. A cynical take? In crypto, a 'bullish prediction' often just means someone ran out of bearish things to say.

Watch the key levels. If they hold, this could be more than a dead-cat bounce.

Cardano ADA Bullish Price Prediction: New Target

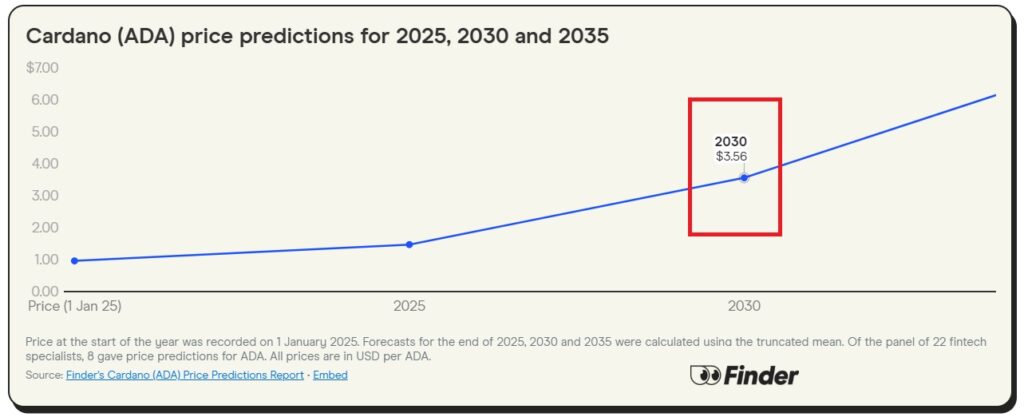

The Finder’s panel of experts revised their price prediction for Cardano’s ADA in December. According to the price estimates, the leading altcoin is projected to reach a high of $3.56 by the end of the decade in 2030. That’s another five years from now and is considered a long-term holding.

That’s an uptick and return on investment (ROI) of approximately 825% from its current price of $0.38. Therefore, an investment of $1,000 could turn into $9,250 if the price prediction turns out to be accurate. This gives present-day investors ample returns with the badge of buying low and selling high.

The last time Cardano’s ADA was above the $3 mark was in September 2021. It had reached an all-time high of $3.09 but never reclaimed its lost ground. It is now down close to 88% from its ATH, adding nothing to investors’ wallets.