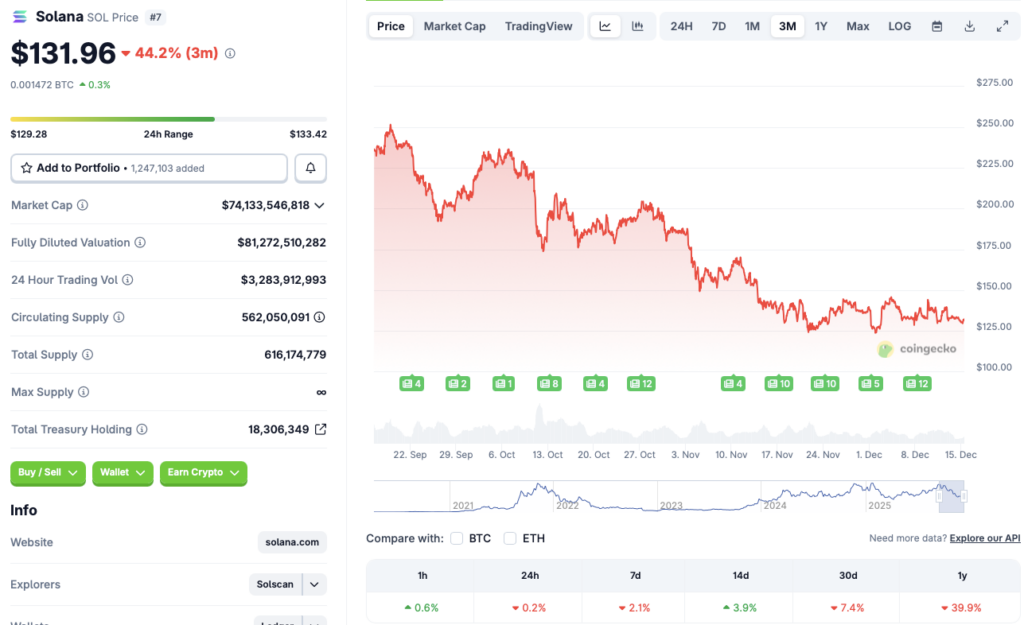

Solana Weekly Price Prediction: How Much Lower Will SOL Go?

Solana's price action this week has traders asking one question: where's the bottom?

Pressure Mounts on Key Support

The charts aren't painting a pretty picture. SOL is testing crucial support levels that, if broken, could trigger another leg down. The usual suspects are in play—broader market sentiment, network congestion narratives, and that relentless macro headwind. It's the classic crypto cocktail of fear and technical analysis.

The Bull Case Amid the Gloom

Don't write the obituary just yet. Solana's core throughput advantage hasn't vanished. Developer activity remains a bright spot, and the ecosystem continues to launch and iterate at a pace that leaves some legacy chains in the dust. This isn't a fundamentals breakdown; it's a sentiment washout. For the true believers, this is where you separate the diamond hands from the paper ones.

Looking Ahead: The Path to Recovery

A swift reclaim of lost ground seems unlikely without a major catalyst. The path forward hinges on stability first, then momentum. Watch for a consolidation pattern—a sign selling pressure is exhausting itself. Remember, in crypto, the most brutal corrections often set the stage for the most violent rallies. Just ask anyone who bought the last 'fat finger' or 'liquidity crisis'—or whatever the finance blogs are calling this week's panic.

Final Take: This is where conviction gets expensive. The easy money left the chat. Now it's about who's building and who's just watching charts flicker—another reminder that in digital asset markets, the only free lunch is the one promised by a shady token launch.

Source: CoinGecko

Source: CoinGecko

Solana Weekly Price Prediction: Is a Recovery In The Cards?

Solana (SOL) is most likely following Bitcoin’s (BTC) trajectory. Therefore, SOL’s price will most probably not recover unless BTC makes a positive move. BTC’s current lackluster performance could be due to macroeconomic uncertainties, pulling investors away from risky assets. Moreover, there is a very low chance of another interest rate cut in early 2026. Investors are likely moving to safe havens like gold and silver to escape the bear market. Silver recently hit a new all-time high last Friday, signaling a MOVE to safer assets.

According to CoinCodex analysts, solana (SOL) will continue to consolidate around current levels over the coming week. The platform expects SOL’s price to remain at the $131 level till Dec. 21, 2025.

Solana (SOL) is one of the most resilient crypto assets in the market. The current bearish trend should not scare investors away from SOL. SOL’s price fell below the $9 mark after the collapse of FTX in 2022. Since then, SOL has hit multiple all-time highs. There is a very high chance that Solana (SOL) will recover its lost lustre once the bear market is over.