Solana Dips 5% in 24 Hours: Why This Pullback Could Be Your Golden Entry

Solana takes a breather—and traders are circling.

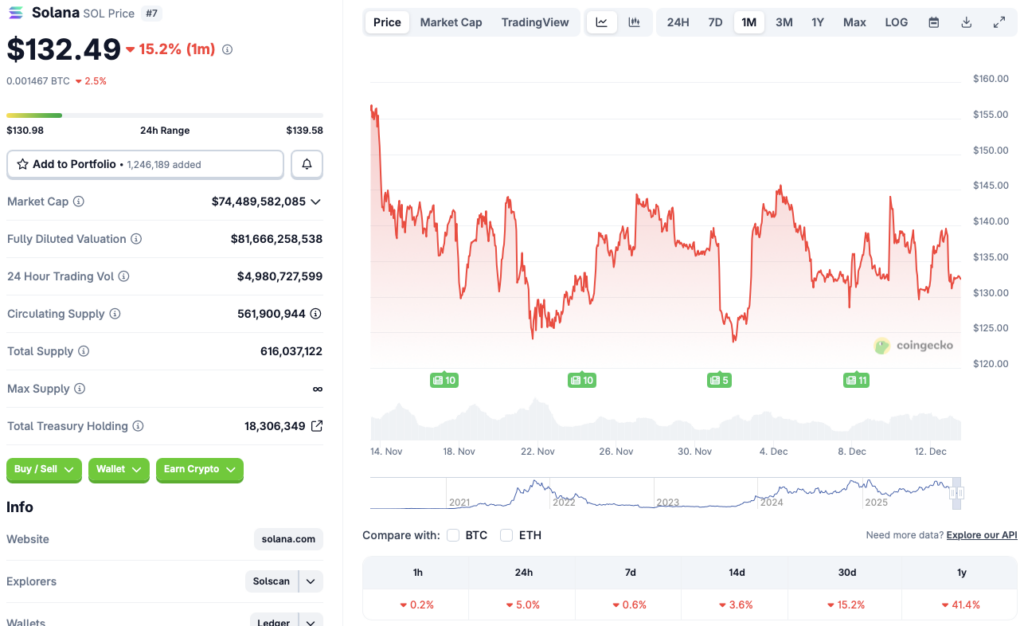

The high-speed blockchain's native token shed 5% of its value in a single day, creating the kind of short-term volatility that makes algorithmic traders salivate and long-term believers check their conviction. This isn't a collapse; it's a classic market recalibration.

The Dip Narrative

Every pullback tells a story. This one whispers about profit-taking after a strong run, a slight rotation out of risk assets, or just the market's natural ebb and flow. For networks built for scale, minor price corrections are often just noise against the signal of growing adoption and developer activity.

Beyond the Price Tick

Smart money looks past the daily chart. They're tracking transaction finality times, network uptime, and the pace of new projects deploying on-chain. Price is a lagging indicator; utility is the engine. When the tech keeps firing, temporary discounts tend to look very attractive in the rearview mirror.

The Contrarian Play

Fear sells newspapers, but it rarely builds wealth. While the herd panics over a few percentage points, seasoned players assess the fundamentals. Is the core technology still superior? Is the developer community still building? If the answer's yes, then a dip isn't a disaster—it's an opportunity dressed in red.

Remember, in traditional finance, they'd charge you a 2% management fee just to watch your money do nothing. Here, a 5% volatility swing is called a Tuesday—and your chance to act.

Source: CoinGecko

Source: CoinGecko

Why Solana’s Price Fall Could Be a Blessing

Solana’s (SOL) current situation is far from its worst. SOL’s price fell to below $9 after the collapse of FTX in 2022. Since its 2022 lows, SOL’s price has hit multiple all-time highs. The asset hit its most recent peak of $293.31 in January of this year. SOL’s price has fallen by more than 54% from its January peak.

Solana’s (SOL) incredible performance over the last few years has solidified its status as one of the most resilient cryptocurrencies in the market. Although the asset’s current lackluster trajectory is concerning to many, it could be a blessing in disguise.

Solana’s (SOL) price is expected to hit new heights over the coming years. The project saw the launch of a few spot ETFs over the last few months. ETF inflows have been low, but may pick up the pace once the bear market is over.

Moreover, Bitcoin (BTC) is expected to hit a new all-time high next year. Solana’s (SOL) price tends to follow BTC’s trajectory. BTC hitting a new peak will likely lead to SOL following suit. The current prices could be an excellent entry point for new investors or for investors looking to bring down their average cost.