Amazon Stock Targets $250-$300 by End of 2025: Analysts Reveal Bullish Case

Wall Street's crystal ball is flashing green for the e-commerce giant. Analysts are painting a picture of aggressive growth, with price targets clustering between $250 and $300 by the end of 2025. That's not just optimism—it's a calculated bet on the company's next phase.

The Engine Behind the Numbers

Forget the hype. The projections hinge on core business drivers: relentless cloud adoption, a retail machine that keeps finding new gears, and advertising revenue that's becoming a powerhouse of its own. It's a trifecta that has analysts reaching for their upgrade buttons.

Risks on the Radar

No forecast is a sure thing. Regulatory scrutiny is intensifying, competition is a constant shadow, and the macroeconomic winds can shift without warning. The path to those lofty targets is paved with 'ifs' and 'buts' that every investor needs to weigh. After all, on Wall Street, a price target is often just a sophisticated guess dressed up in a spreadsheet.

The final verdict? The consensus is bullish, but the smart money is watching the execution. Hitting that range means Amazon needs to deliver quarter after quarter—no easy feat, even for a titan.

Amazon Stock End of 2025 Forecast Highlights Price Target and Earnings

Strong Buy Consensus Among Analysts

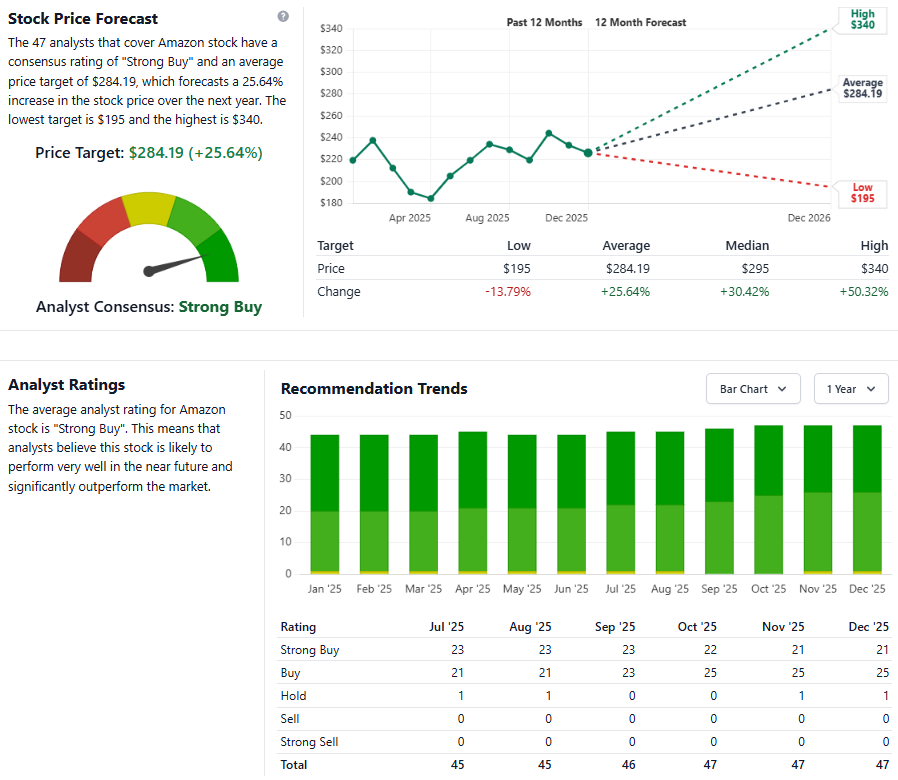

The consensus around Amazon stock end of 2025 performance has accelerated remarkably across various major investment research platforms, actually. Based on 61 analysts tracked by MarketBeat, the stock carries a “” rating, and the Amazon price target averaging $295.43 represents a 30.61% upside from current levels right now.

Through several key analytical frameworks, Stock Analysis reports similar sentiment from 47 analysts, assigning a “” consensus rating and an Amazon price target of $284.19. This alignment across multiple essential research institutions is pretty close to what MarketBeat is seeing, and it validates the broader market perspective.

CEO Andy Jassy had this to say about AWS growth:

The Amazon stock end of year prediction encompasses numerous significant price points ranging from a low of $218 to a high of $360, and most analysts are clustering their estimates around the $280-$300 range. Across various major macroeconomic scenarios and also the Amazon earnings forecast for cloud computing, this spread reflects varying assumptions about future conditions. Through several key profitability drivers, the Amazon strong buy rating is actually supported by AWS reaching an annualized revenue run rate of $110 billion. The cloud division has established control of roughly 33% of the cloud infrastructure market, which is quite impressive and also demonstrates market leadership.

AWS Drives Growth Projections

Amazon Web Services has spearheaded the optimistic Amazon stock end of 2025 outlook across multiple strategic business lines. The division was reported to have grown 19% year-over-year in Q3 2025, and the Amazon earnings forecast engineered by leading analysts projects continued acceleration as AI workloads expand. Through various major technological implementations, AWS accounted for 66% of Amazon’s operating income despite representing just 18% of total revenue right now. This profitability dynamic really highlights its importance to the bottom line and also the company’s overall financial health.

Jassy emphasized the AI opportunity, stating:

The advertising business has Leveraged several key market advantages to bolster the Amazon price target, with Q3 revenue growing 24% to $17.7 billion. Across numerous significant advertising segments, this high-margin division continues outperforming expectations and supports the Amazon strong buy rating. Analysts who see the company positioned for sustained profitability heading into year-end have actually integrated multiple essential data points, and even though some investors worry about spending, the advertising division has been a bright spot.

Risks and Market Challenges

The path to the Amazon stock end of year prediction involves navigating certain critical obstacles across various major economic scenarios, though. Capital expenditures have accelerated from $75 billion in 2024 to a projected $90 billion in 2025, and some analysts view this as a concern. Through several key competitive dynamics, Microsoft Azure and Google Cloud also pose challenges to AWS market share right now, and analysts are monitoring this competitive pressure closely across multiple essential industry benchmarks.

Macroeconomic headwinds have impacted certain critical consumer spending patterns across Amazon’s retail segments, while regulatory scrutiny continues to loom over the tech giant. The Amazon earnings forecast accounts for these variables through various major risk assessment frameworks, but analysts remain confident the Amazon price target of $250-$300 is achievable. At the time of writing, the Amazon stock end of 2025 trajectory looks solid despite these challenges, and the Amazon stock end of year prediction maintains its bullish stance across numerous significant analytical models even with risks considered and also accounted for in projections.