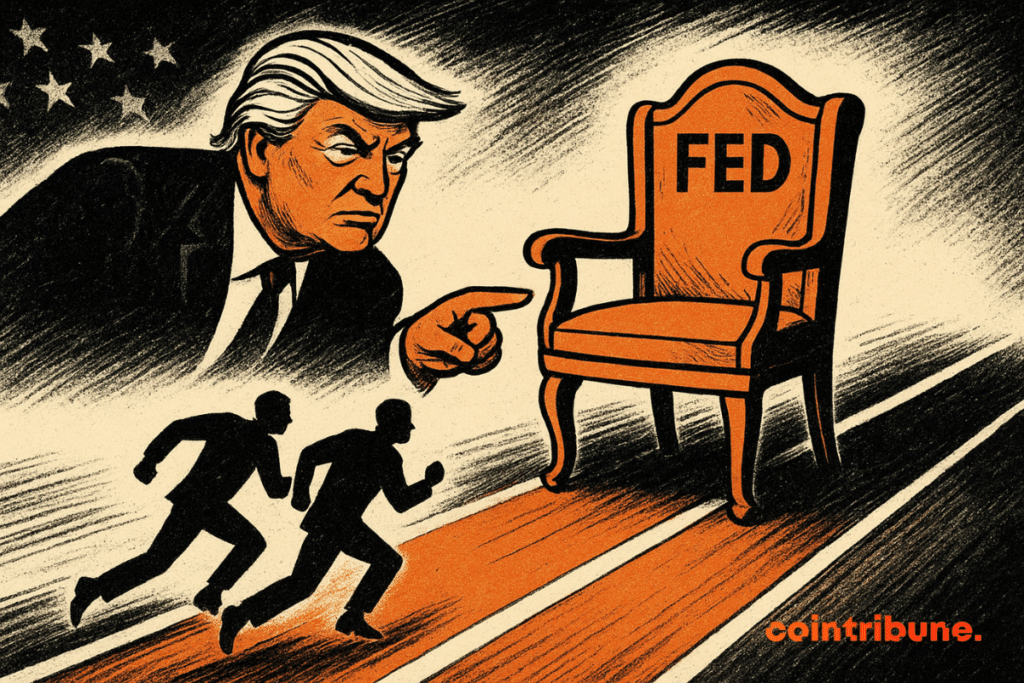

Fed Chair Race Keeps Markets Guessing: Dimon Backs Warsh as Trump Eyes Rate Cuts

The Federal Reserve's leadership carousel is spinning again—and Wall Street is placing its bets.

Jamie Dimon just threw his weight behind Kevin Warsh, a former Fed governor known for his hawkish leanings. Meanwhile, whispers from the White House suggest the administration is hungry for rate cuts—yesterday.

The Contenders and Their Baggage

Warsh brings establishment credibility but a track record that makes doves nervous. His potential nomination signals a preference for traditional, inflation-focused policy—a stark contrast to the growth-at-all-costs mantra echoing from Pennsylvania Avenue.

Trump's Rate Cut Obsession

The administration's public and private push for lower rates isn't subtle. It's a classic political play: juice the economy now, let the next guy handle the hangover. Markets are left to decode whether this is mere jawboning or a serious directive for the next Fed chief.

Why Crypto Watchers Should Care

Forget bonds and stocks for a second. This uncertainty is pure rocket fuel for digital assets. A dovish, politically-influenced Fed could weaken the dollar and turbocharge inflation hedges—like Bitcoin. A hawkish surprise could trigger short-term volatility but ultimately validate crypto's narrative as an alternative to a politicized monetary system.

The entire spectacle underscores a cynical truth in modern finance: the most important price in the world—the cost of money—is often set by committee, consensus, and political pressure. The market isn't just guessing who'll get the job; it's betting on which master the new chair will truly serve.

Read us on Google News

Read us on Google News

In brief

- Jamie Dimon supports Kevin Warsh for Fed chair, citing alignment with his views on central bank independence and policy discipline.

- Kevin Hassett remains a top contender, seen as more willing to cut rates quickly in line with Trump’s economic priorities.

- Trump says the decision is not final, with more interviews planned before a Fed chair pick is announced.

- Recent Fed rate cuts and Powell’s cautious stance keep crypto and risk markets focused on the next policy shift.

Leadership Race Keeps Rate Outlook Unclear for Crypto Markets

JPMorgan CEO Jamie Dimon has expressed support for former Federal Reserve governor Kevin Warsh as a possible next chair of the US central bank. He also noted that Kevin Hassett may be more inclined to support near-term rate cuts.

The CEO shared his views during JPMorgan’s private asset management CEO conference in New York on Thursday evening, according to people familiar with the discussion.

Dimon admitted his agreement with Warsh’s past views on the Federal Reserve and its responsibilities. And as expected, this support further strengthened the former Fed governor’s position among senior Wall Street figures. Dimon also told executives that Hassett, who currently leads the WHITE House National Economic Council, would likely be quicker to cut interest rates if appointed.

President Donald Trump added to the uncertainty in a Friday interview with The Wall Street Journal, saying Warsh has moved higher on the shortlist of candidates competing with Hassett. While Hassett has been widely seen as the frontrunner, Trump said both men remain strong options, along with other unnamed candidates.

I think the two Kevins are great. I think there are a couple of other people that are great.

Donald TrumpEarlier this week, Trump suggested he had already reached a decision, saying he had a “pretty good idea” who he WOULD nominate. His latest remarks indicate the process is still ongoing, with interviews continuing and no final choice yet announced.

Trump Signals Urgency on Rate Cuts as Fed Chair Race Evolves

Market expectations around the Fed chair decision are shaped by several factors:

- Jamie Dimon supports Warsh’s views on Fed independence and policy discipline.

- Hassett is viewed as more aligned with Trump’s push for faster rate cuts.

- White House officials interviewed Warsh earlier this week.

- Trump wants a chair willing to move quickly on borrowing costs.

- Betting markets continue to favor Hassett.

Trump, Treasury Secretary Scott Bessent, and other senior officials interviewed Warsh at the White House on Wednesday, according to reports. At least one additional candidate is expected to be interviewed next week, with an announcement possible in the coming weeks.

Pressure on the Federal Reserve remains strong. Trump has repeatedly criticized current chair Jay Powell for resisting aggressive rate cuts, blaming him for slower growth and higher debt costs. Dimon, however, has warned that Fed independence is important and that political interference can produce negative outcomes.

Federal Reserve policymakers cut rates to a three-year low on Wednesday, marking the third quarter-point reduction in a row. Powell signaled caution, saying officials are prepared to pause and assess economic conditions. Several regional Fed presidents supported keeping rates unchanged.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.