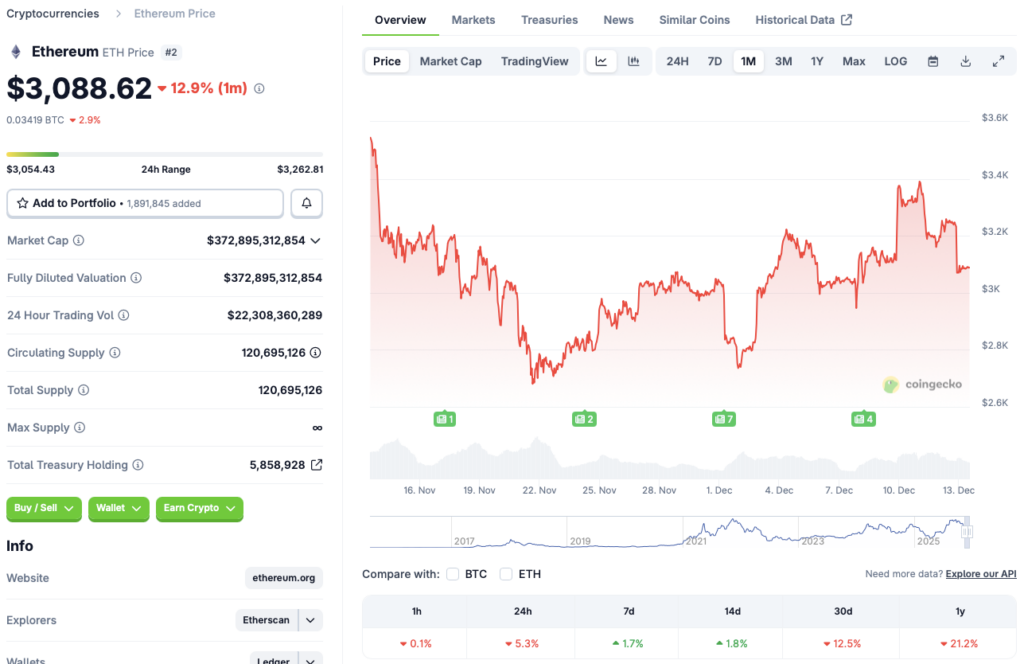

Ethereum Teeters on the Brink: Could $3000 Be the Next Stop?

Ethereum faces a critical test as selling pressure mounts, threatening to push its price below a key psychological level.

The Pressure Builds

A confluence of factors is squeezing the world's second-largest cryptocurrency. Market-wide jitters, shifting regulatory winds, and a classic case of profit-taking after recent gains have all contributed to the downdraft. The $3000 mark isn't just a number—it's a major support zone that traders are watching like hawks. A decisive break below could trigger another wave of automated selling.

Beyond the Price Chart

While the spot price action grabs headlines, the real story often unfolds in the derivatives markets. Watch for shifts in funding rates and open interest—they're the canaries in the crypto coal mine, signaling whether the smart money is doubling down or heading for the exits. It's the same old dance: leverage giveth, and leverage taketh away, often with the subtlety of a sledgehammer.

The Bull Case in Hibernation?

Long-term believers aren't hitting the panic button—yet. They point to Ethereum's entrenched developer ecosystem and its upcoming roadmap milestones as fundamental reasons for resilience. But in the short term, sentiment is a fickle beast, easily spooked by whispers from central bankers or the latest celebrity meme-coin dump—because nothing says 'sound investment' like digital assets endorsed by someone famous for being famous.

The next few days are crucial. Either Ethereum finds its footing above $3000, or it prepares for a deeper correction. Buckle up.

Source: CoinGecko

Source: CoinGecko

Why Is Ethereum Falling?

Ethereum’s (ETH) current predicament comes amid a market-wide bearish tone. Bitcoin (BTC), the market leader, is showing signs of consolidation around the $90,000 mark. The current lackluster market is surprising, considering the fact that the Federal Reserve rolled out a 25 basis point cut earlier this week.

Ethereum (ETH) may be facing the consequences of investors taking a risk-averse approach. Silver hit an all-time high on Friday, signaling increased inflows. Market participants are likely worried about slow economic growth amid macroeconomic uncertainties. Investors are also worried that the Federal Reserve will not announce another interest rate cut over the coming months. The bearish signals could pull ethereum (ETH) below the $3000 mark.

Despite its current lackluster trajectory, Ethereum (ETH) may pick up the pace over the coming months. Tom Lee’s Bitmine recently bought 14,959 ETH worth around $46 million. The move could be a signal of a bullish reversal coming ahead.

![]() UPDATE: Tom Lee's #Bitmine just bought 14,959 $ETH ($46M).

UPDATE: Tom Lee's #Bitmine just bought 14,959 $ETH ($46M).

Bitmine now holds over 3.86M $ETH with an average entry price of $3,008 per ETH. pic.twitter.com/B7aly1nXgX

Moreover, several analysts have predicted that Bitcoin (BTC) will hit a new all-time high in 2026. Grayscale and Bernstein anticipate the original cryptocurrency to follow a 5-year cycle, instead of a 4-year cycle. BTC hitting a new all-time high could trigger a rally for Ethereum (ETH) as well.