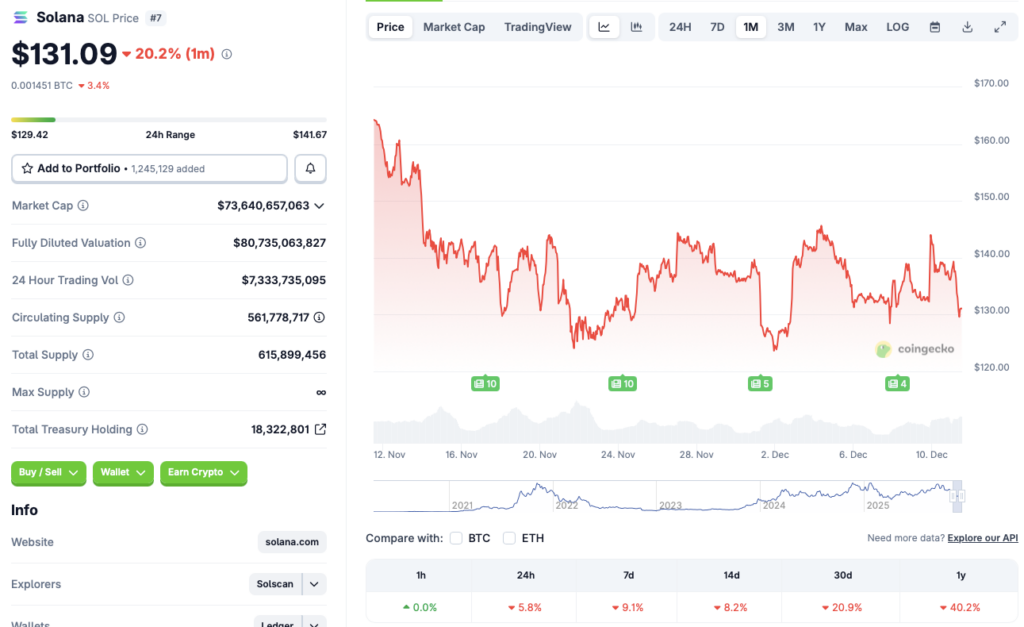

Solana Plunges 6% Post-Rate Cut: Is This the Start of a New Crypto Winter?

Solana just took a 6% nosedive. The trigger? A surprise rate cut from the Fed that's got the entire digital asset market asking one question: are we back in the freezer?

The Rate Cut Ripple

Forget "buy the rumor, sell the news." This was a classic case of "sell the reality." The central bank's move, intended to soothe traditional markets, sent a chill through crypto. It's a stark reminder that for all its decentralization talk, the sector still dances to the old masters' tune—usually with more volatility.

Winter Is Coming... Again?

Crypto winter isn't just a season; it's a state of mind. It's that gut-check moment when hype meets macroeconomics and hype usually loses. This 6% drop on Solana isn't just a blip—it's a potential canary in the coalmine for speculative assets. When liquidity gets questioned, the flashiest toys often get sold first.

The Solana Specifics

Why Solana? Speed and scalability come at a cost: sensitivity. As a high-throughput chain favored for everything from DeFi to NFTs, it acts as a leveraged bet on crypto adoption. Good news sends it soaring; bad macro news hits it harder. Today's move shows traders aren't sticking around to find out what's next.

The Silver Lining Playbook

Here's the bullish counter: smart money uses these shakes to build positions. Lower rates, theoretically, should eventually fuel risk appetite. The infrastructure built during the last boom—Solana's included—hasn't vanished. This isn't 2018. The ecosystem is real, even if the prices are schizophrenic.

One cynical take for the road: Wall Street spends millions on analysts to predict rate moves. Crypto traders get the same signal for free—they just often choose to ignore it until their portfolio does the talking.

The bottom line? Winter might be knocking, but it's not time to hibernate. It's time to watch who's building in the cold.

Source: CoinGecko

Source: CoinGecko

Why Did Solana Crash? Will It Recover?

Solana’s (SOL) dip comes amid a market-wide price correction. Bitcoin (BTC) briefly fell to the $89,000 level earlier today. According to CoinGlass, the crypto market registered more than $500 million in liquidations over the last 24 hours. The market correction is surprising, considering that the Federal Reserve rolled out an additional 25-basis-point interest rate cut.

Solana’s (SOL) price correction could be due to the larger macroeconomic uncertainties. The jobs data may have prompted investors to continue their risk-averse strategies. Moreover, the chances of another rate cut in the near future are substantially low. Slow economic growth and jobs data are likely pulling investors away from risky assets, such as Solana (SOL) and other cryptocurrencies.

There is a possibility that we are entering another crypto winter. However, the current lackluster market should not scare Solana (SOL) investors. SOL has proven to be one of the most resilient crypto assets in the market. SOL’s price fell to below $9 in 2022 after the collapse of FTX. However, since its 2022 lows, SOL has hit multiple all-time highs. The asset hit its most recent peak of $293 earlier this year, in January. While the current market predicament is concerning, there is a high chance that SOL will recover its price very soon.