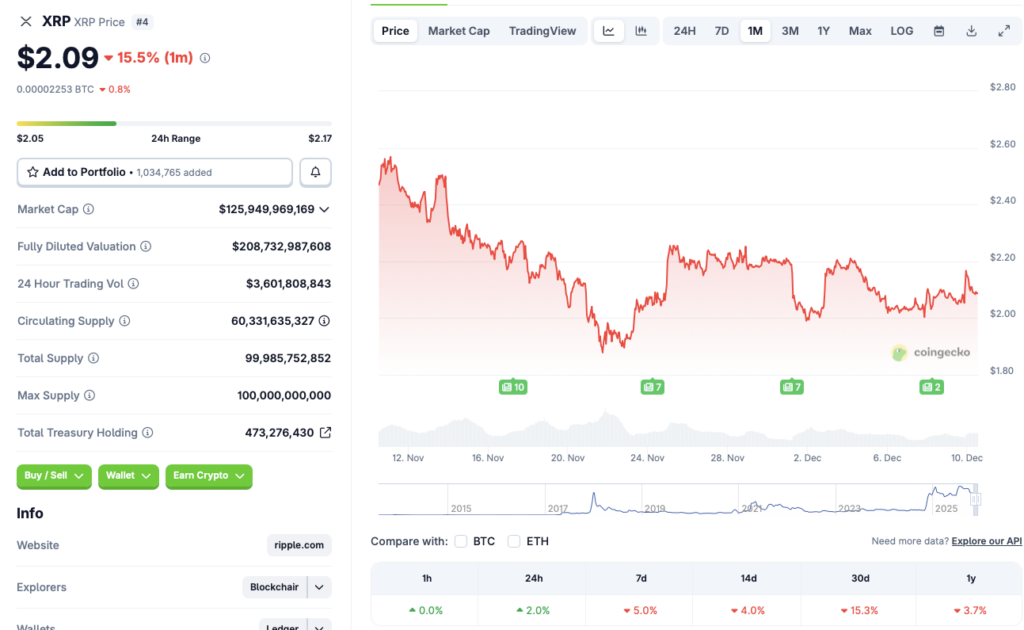

XRP Hits Turbulence at $2.10 - Why a Breakout to $3 Could Be Imminent

XRP faces stiff resistance at the $2.10 mark—but analysts whisper of a bigger prize just over the horizon.

The Consolidation Zone

It's a classic crypto story: a digital asset grinds against a psychological barrier. For XRP, that wall sits firmly at $2.10. The price action here isn't a crash; it's a coiled spring. Trading volume hints at accumulation, not distribution, suggesting smart money might be positioning for the next leg up.

Reading the Technical Tea Leaves

Charts don't lie, they just tell inconvenient truths. The current struggle paints a clear picture of a market testing its resolve. Each rejection at the $2.10 level doesn't signal weakness—it's building a stronger foundation. The key metrics, from moving averages to on-chain activity, suggest this isn't a dead end, but a pause. Remember, in traditional finance, they'd call this 'prudent risk management.' In crypto, we call it Tuesday.

The $3 Horizon: More Than Just a Number

Breaking past $2.10 isn't the endgame; it's the gateway. The real target, the one flashing on every trader's screen, is the $3 threshold. This isn't mere speculation. The path is technically visible, carved by previous support and resistance levels. Reaching it would represent a significant psychological victory and validate the current consolidation as strategic, not stagnant.

The Bull Case in a Bearish World

While skeptics point to the struggle, the architecture for a rally is being built in plain sight. The move from current levels to $3 represents a defined, calculable jump. It's a trajectory supported by market structure, not just hype. In a sector where legacy finance still scratches its head, XRP's potential surge would be a masterclass in digital asset momentum—proving once again that sometimes, the best investments are the ones that make Wall Street's old guard visibly uncomfortable.

Source: CoinGecko

Source: CoinGecko

Is XRP Gearing Up For A Big Rally?

XRP and the larger cryptocurrency market could experience a big rally over the coming weeks if the Federal Reserve rolls out an interstate rate cut after today’s Federal Open Market Committee (FOMC) meeting. According to CME FedWatch, there is an 87.6% chance of a 25 basis point interest rate cut. Another rate cut could lead to a massive boost in investor sentiment. Market participants may begin to redirect funds into risky assets as borrowing becomes easier. However, XRP’s price could consolidate or face a correction if an interest rate cut is not announced.

Apart from the possible interest rate cut, XRP saw the launch of a few spot ETFs earlier this year. The bearish market tone may have kept ETF inflows at bay. However, ETF inflows may kick off over the coming weeks. ETFs have played a major role in Bitcoin (BTC) and ethereum (ETH) hitting new all-time highs. A similar pattern may emerge for XRP as well.

Additionally, many anticipate Bitcoin (BTC) to enter another bullish phase over the coming months. Grayscale and Bernstein both anticipate BTC to hit new peaks in 2026. BTC hitting a new all-time high could propel XRP to a new peak as well.