Bernstein’s Bold Call: Bitcoin’s Bull Run Is Just Getting Started, New Peak Incoming

Bitcoin's not done yet. According to analysts at Bernstein, the flagship cryptocurrency is gearing up for another leg higher—potentially smashing through previous records on its way to a fresh all-time high.

The Fuel Behind the Fire

Forget the doom-and-gloom headlines. The underlying drivers for this digital asset haven't vanished; they've just taken a breather. Institutional adoption continues its slow, steady march, while the core narrative of digital scarcity grows stronger with each passing cycle. It's a classic setup that has veteran traders leaning in, not running for the exits.

Timing the Next Surge

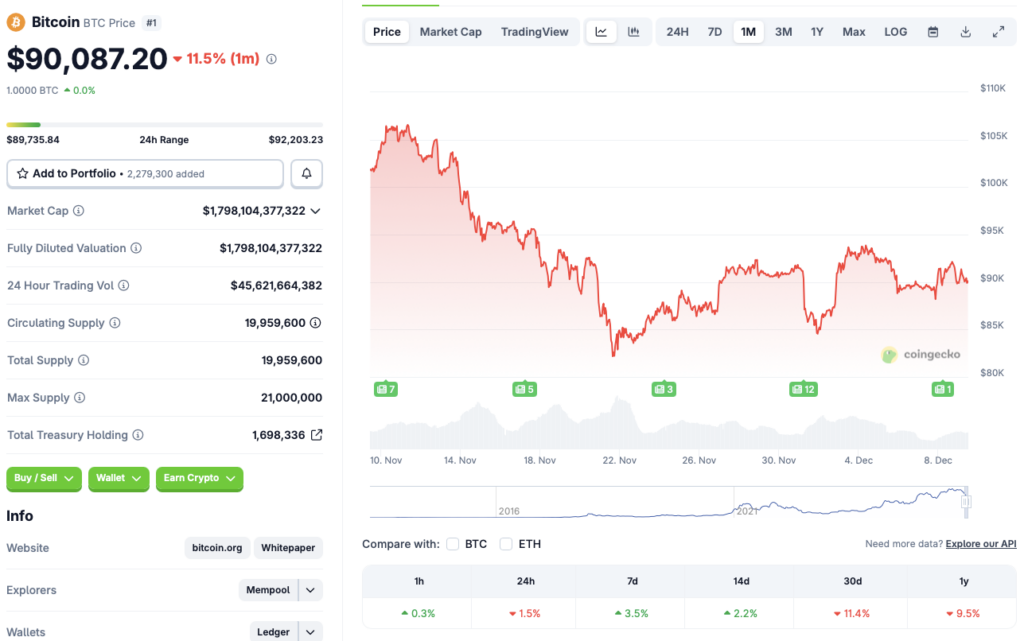

Markets move in waves, and the smart money is positioning for the next crest. The current consolidation phase, often mistaken for fatigue, is more accurately a reloading period. History doesn't repeat, but it often rhymes—and the chart patterns suggest a familiar tune is about to play. The question isn't 'if,' but 'when' the momentum shifts back into overdrive.

A Reality Check for the Skeptics

Sure, traditional finance veterans might scoff, calling it a speculative bubble fueled by hype and memes—after all, what's a bull market without a few Wall Street graybeards dismissing it as a fad before quietly allocating a fraction of their fund to it later? But dismissing the structural shift towards digital assets is a riskier bet than participating. The train is leaving the station, and Bernstein's analysis suggests it's picking up speed.

The bottom line? This isn't a victory lap. It's the starting gun for what could be the most consequential phase of Bitcoin's journey yet. Strap in.

Source: CoinGecko

Source: CoinGecko

Bernstein Predicts New All-Time High For Bitcoin

According to an X post by VanEck’s head of digital asset research, Matthew Sigel, Bernstein believes that bitcoin (BTC) has broken its 4-year cycle. The asset is ““

Bernstein: "In view of recent market correction, we believe, the Bitcoin cycle has broken the 4-year pattern (cycle peaking every 4 years) and is now in an elongated bull-cycle with more sticky institutional buying offsetting any retail panic selling.

Despite a ~30% Bitcoin…

Berntstein highlights that although Bitcoin’s (BTC) price has faced a 30% correction, BTC ETFs saw less than 5% outflows. The financial institution predicts Bitcoin (BTC) will climb to a new all-time high of $150,000 in 2026. The firm does not anticipate BTC to stop at just $150,000, predicting the asset to hit a peak of $200,000 in 2027. Hitting $200,000 from current price levels will entail a rally of about 122%.

Bernstein is not the only firm that believes Bitcoin (BTC) has broken its 4-year cycle. Grayscale also released a report with a thesis that claims that BTC is currently following a 5-year cycle. This means that the original crypto will climb to a new peak in 2026, five years after its 2021 peak.