Chainlink ETF Launch Imminent This Week: Will LINK Prices Skyrocket?

The crypto market holds its breath. A Chainlink ETF is reportedly crossing the finish line—set to launch within days. This isn't just another fund; it's a direct bridge between decentralized oracle data and traditional finance's trillions.

The Institutional Gateway Opens

An ETF transforms LINK from a speculative crypto asset into a regulated, accessible security. Pension funds, hedge funds, and your average retail investor can now gain exposure without touching a wallet or navigating a DEX. It bypasses the technical friction that has kept major capital on the sidelines.

Demand Shock on the Horizon?

The core question isn't about legitimacy—Chainlink's oracle networks already underpin billions in DeFi TVL. It's about a potential demand shock. The ETF issuer must hold the underlying LINK tokens to back its shares. That creates a new, massive, and constant buy-side pressure directly on the open market.

Will The Hype Translate?

History offers mixed signals. Past crypto ETF launches have triggered volatile rallies, often followed by a 'sell-the-news' slump as traders take profits. The real price driver won't be the launch day pop, but sustained institutional inflows. Will Wall Street's appetite match the hype? Or is this just another vehicle for financiers to collect fees on a trend they once mocked?

The tape doesn't lie. This week, we see if the market votes with its wallet.

Will Chainlink Rally After an ETF Launch?

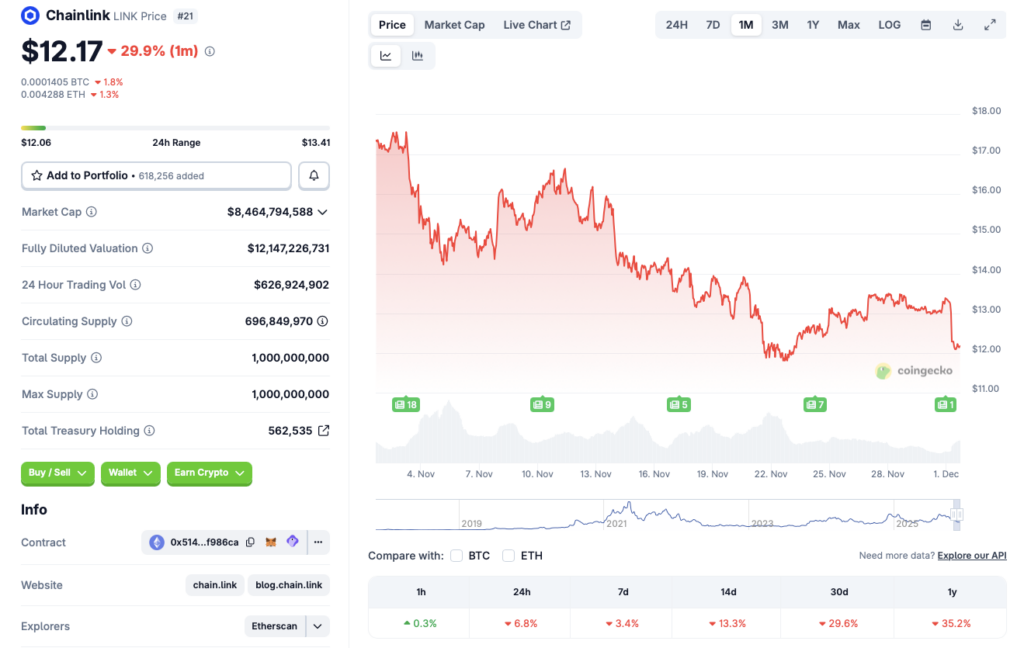

The crypto market has faced a massive price dip today, just days after the market showed signs of a recovery. Bitcoin (BTC) has fallen to the $86,000 price mark after hitting $92,000. Chainlink (LINK) also follows the market downtrend. According to CoinGecko data, LINK’s price is down 6.8% in the last 24 hours, 3.4% in the last week, 13.3% in the 14-day charts, 29.6% over the previous month, and 35.2% since December 2024.

There are two reasons why Chainlink (LINK) could rally over the coming weeks. Firstly, the ETF launch could lead to a surge in investor confidence in LINK as it brings more institutional interest in the asset. Increased ETF inflows could lead to a massive price rally for Chainlink (LINK).

Secondly, there is a high chance that the Federal Reserve will roll out another interest rate cut later this month. Rate cuts often lead to a spike in risky investments. Cryptocurrencies are among the riskiest of all financial assets. Chainlink (LINK) and the larger crypto market could see increased investments if borrowing becomes easier.

However, there is also a possibility that the ETF launch will not aid Chainlink’s (LINK) price. For example, when the SEC approved ethereum (ETH) ETFs in 2024, the asset did not see much price movement. It was only a year later that ETH hit a new all-time high. LINK could follow such a trajectory. How things unfold is yet to be seen.