From $9 to $263: How Solana Defied the Crash and Rewrote the Crypto Playbook

Forget the bear market noise. One blockchain didn't just survive—it staged a financial heist on conventional wisdom.

The Anatomy of a Rocket Ship

While traditional portfolios bled, Solana executed a silent ascent. The network didn't wait for permission; it built through the downturn. Developers flocked to its high-throughput engine, deploying applications that actually worked at scale. Users followed, trading and transacting at speeds that made legacy chains look like dial-up. The market took notice—not with a slow nod, but with a violent re-rating of what was possible.

Liquidity Finds Its Home

Capital is a coward—until it smells a sure thing. Solana became that magnet. Its technical thesis—raw speed and low cost—translated into a user experience so seamless it felt like cheating. This wasn't just speculation; it was utility attracting real volume. The chain became a self-fulfilling prophecy: more activity bred more developers, which bred more activity. A virtuous cycle spun up while others sputtered.

The New Performance Benchmark

The climb from single digits reshuffled the entire sector's leaderboard. It proved that during chaos, foundational technology wins. While pundits debated 'crypto winters,' builders were laying the groundwork for the next spring. The surge established a brutal new benchmark: in the digital asset arena, either you innovate at light speed or you become a relic.

Let the traditional finance crowd clutch their pearls over volatility. In the meantime, the protocols that actually work are quietly building the next financial system—and collecting the rewards that come with it.

Source: CoinGecko

Source: CoinGecko

Why You Should Not Fear Solana’s Price Crash

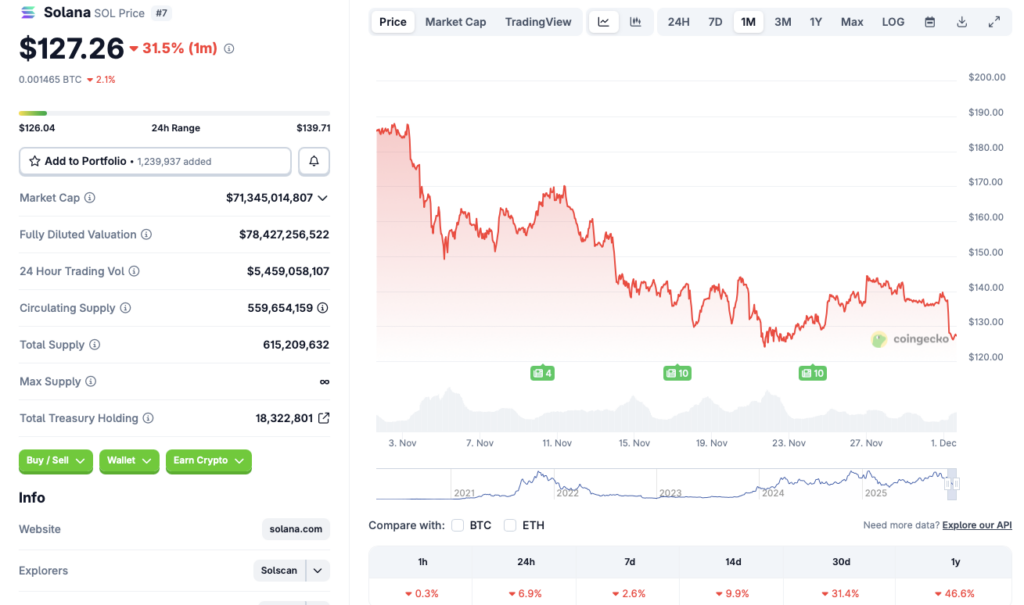

Solana (SOL) has proven to be one of the most resilient cryptocurrencies in the market. The asset’s price fell to the $9 mark in 2022 after the collapse of FTX. Since its 2022 lows, SOL’s price has hit multiple all-time highs. Looking at SOL’s historical data, it could be SAFE to assume that you should not fear the asset’s current predicament.

The latest market crash could be due to fresh volatility after the Thanksgiving holiday. Moreover, China reaffirming its crypto ban position may have further increased price volatility. However, Solana (SOL) and the larger crypto market may recover over the coming weeks. The chances of another interest rate cut this month have significantly increased over the last week. If the Federal Reserve rolls out another 25 basis point rate cut, risky assets such as cryptocurrencies could see a surge in inflows.

Solana (SOL) also saw the launch of several ETFs over the past few weeks. ETF inflows could pick up over the coming days. Both developments could lead to SOL reclaiming the $200 mark.