Brace for Turbulence: A Heavy Week of Economic Data Could Jolt Market

Markets are bracing for impact. A deluge of economic data hits this week, threatening to upend fragile sentiment and rewrite trading scripts across asset classes.

From inflation prints to employment figures, every release carries the potential to shift monetary policy expectations. Central bank watchers are on high alert, parsing each decimal point for clues about future rate moves.

The traditional finance playbook looks shaky. Analysts scramble to adjust models, while algorithms stand ready to amplify every surprise. It's a reminder that in conventional markets, 'efficiency' often just means faster ways to lose money.

For digital asset investors, this volatility isn't noise—it's signal. It underscores the fragility of legacy systems and the growing appetite for uncorrelated, decentralized alternatives. When traditional anchors drag, crypto's narrative as a hedge against systemic risk gets another hearing.

Buckle up. The data storm is coming, and its aftershocks will ripple far beyond Wall Street's trading floors.

The Global Market Braces For Further Volatility

According to a new update shared by CryptosRUs, the upcoming week is full of macroeconomic announcements, the ones that could end up shaping the new market momentum in real time. Per the details shared by the portal, this week comprises some leading macro announcements and developments to roll out, starting with Powell speaking on Monday. Alongside that, the QT is officially ending today, which may again uniquely impact the markets. Moreover, on Tuesday, the markets may brace for JOLTS job opening data for September, followed by PMI and ISM data, plus ADP nonfarm data being released on Wednesday.

The government will release initial jobless claims on Thursday and PCE inflation data on Friday. All these data rollouts may impact the markets in their own way, bringing in more volatility than usual.

.”

A MASSIVE WEEK FOR MARKETS IS HERE

Here’s what’s coming — and why this week could set the tone for Bitcoin, stocks, and rates heading into year-end:![]() Monday: Powell speaks, QT officially ends, plus PMI + ISM Manufacturing

Monday: Powell speaks, QT officially ends, plus PMI + ISM Manufacturing![]() Tuesday: JOLTS Job Openings (Sep)

Tuesday: JOLTS Job Openings (Sep)![]() Wednesday:… pic.twitter.com/H5mmyHfLZ6

Wednesday:… pic.twitter.com/H5mmyHfLZ6

Bitcoin Future Price Stance: Can It Redeem Its Losses Fast?

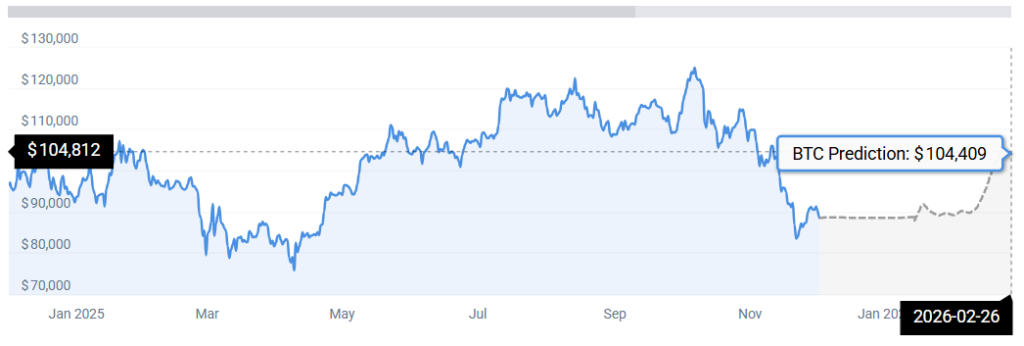

Bitcoin is now at a crashing point, plunging below to sit at $86K at press time. As markets brace for more volatility, BTC technical stats suggest Bitcoin eventually hitting $88K by December’s end, followed by ascending to hit $104K by February 2025.