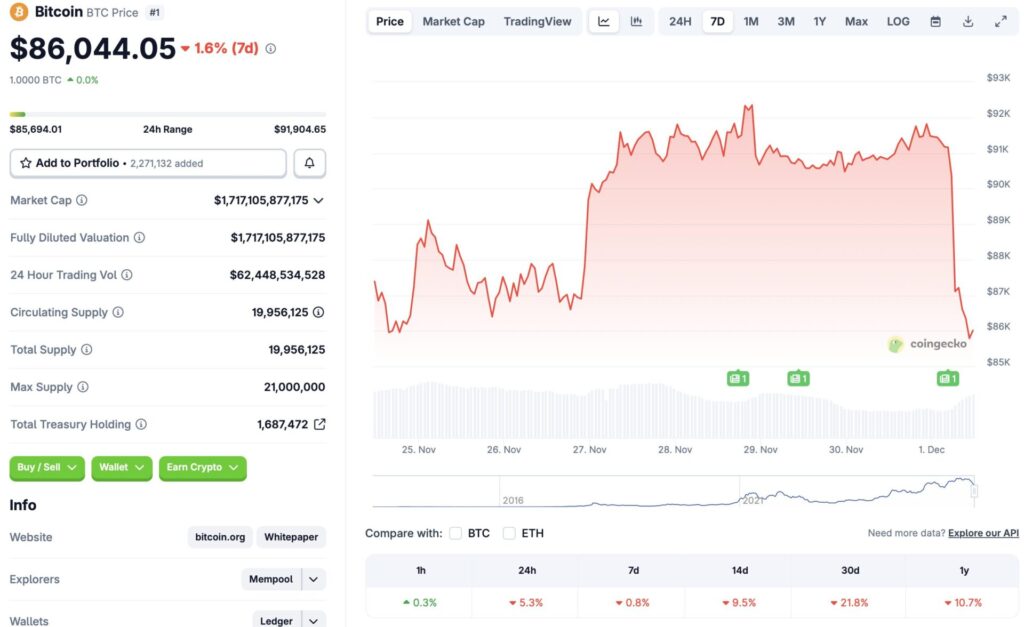

Bitcoin Plunges Again: Decoding the Latest Crypto Market Earthquake

Bitcoin just took another gut-wrenching dive. The digital asset's price chart looks like a cliff edge—again. So what's rattling the cage this time?

The Liquidity Squeeze

Major exchanges are reporting massive sell orders hitting the books. It's not just retail panic; institutional wallets are on the move. The usual suspects—leveraged long positions—are getting liquidated in cascading waves. Remember that 'wall' of support at the last key level? Gone in minutes.

Macro Meets Crypto

Traditional finance isn't helping. Bond yields are doing their usual dance, and suddenly 'risk-off' means 'dump everything digital.' Some hedge funds are rebalancing portfolios ahead of quarter-end, treating Bitcoin like just another tech stock—which, of course, it isn't. But try telling that to a fund manager chasing his bonus.

The Narrative Shift

Headlines have flipped from 'digital gold' to 'speculative bubble' overnight. Regulatory murmurs from a few key jurisdictions aren't helping sentiment. Never mind that the underlying network is humming along, processing transactions as it always does. The market trades on fear and greed, not hash rates.

What Comes Next?

History suggests this is where the strong hands separate from the weak. Volatility is the price of admission for an asset class rewriting the rules. Corrections shake out excess, even if they feel like a punch to the gut. The cynical take? Wall Street probably loves this—creates a nice, juicy buying opportunity for the big players who just told their clients to be cautious. The crypto market never sleeps, but it does take the occasional brutal nap. Buckle up.

Source: CoinGecko

Source: CoinGecko

What’s Behind Bitcoin’s Price Crash? Can It Recover Soon?

The market correction is likely due to fresh volatility after the Thanksgiving holiday weekend. According to CoinGlass data, the crypto market saw $638.58 million worth of liquidations in the last 24 hours.

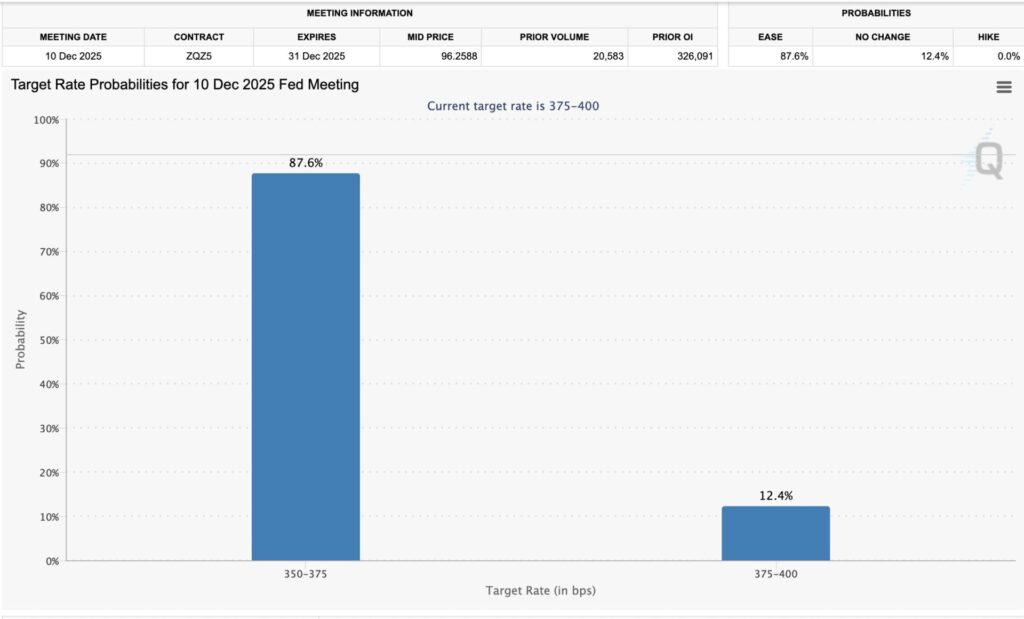

Bitcoin’s (BTC) price crash is surprising, given that the chances of an interest rate cut have increased from 84% to more than 87%, according to CME FedWatch. The market took a hit in October-November due to macroeconomic uncertainties and low interest rate cut chances. Bitcoin (BTC) and the larger crypto market saw a trend reversal after the chances of another rate cut went up.

The market correction could be due to investor sentiment still being down. Moreover, the market is still quite weak. Slow economic growth and the fears of rising inflation have led to a substantial dip in investor confidence. bitcoin (BTC) and other risky assets have been particularly hit.

Given the high chances of another interest rate cut in December, there is a possibility that Bitcoin (BTC) will rebound from its current predicament. Rate cuts usually lead to investors taking on more risks. Crypto, being the riskiest sector in finance, may see a surge in inflows if rates are cut further.

However, there is also a possibility that the market will enter a prolonged consolidation phase. If the Federal Reserve does not cut rates, we may see another correction, or prices may plateau.