Silver & Copper Shatter Records: 90% and 27% Surges Signal Commodity Frenzy

Metals go berserk as inflation hedges turn into momentum plays.

Silver’s moonshot: The poor man’s gold rockets 90%—outperforming half the crypto top 10.

Copper’s quiet dominance: Up 27% while Wall Street was busy chasing AI stocks.

Traders pile in as fiat currencies sweat—because nothing says ‘store of value’ like volatile industrial metals. (Bonus jab: Hedge funds will spin this as ‘strategic allocation’ after 3 margaritas.)

Commodity Market: Silver & Copper Rule the Roost

The prices of silver have soared by 90% in 2025, outperforming gold. The XAU/USD index, which tracks the performance of gold, shows the glittery metal up 62% YTD. Silver prices are up by another 28% during the same timeframe, making it the king of the commodity market. Silver entered the year at $29.50 and is now trading at $56.9. An investment of $1,000 has turned into $1,900. The XAG/USD index shows that silver has sustainably scaled up in the charts along with copper this year.

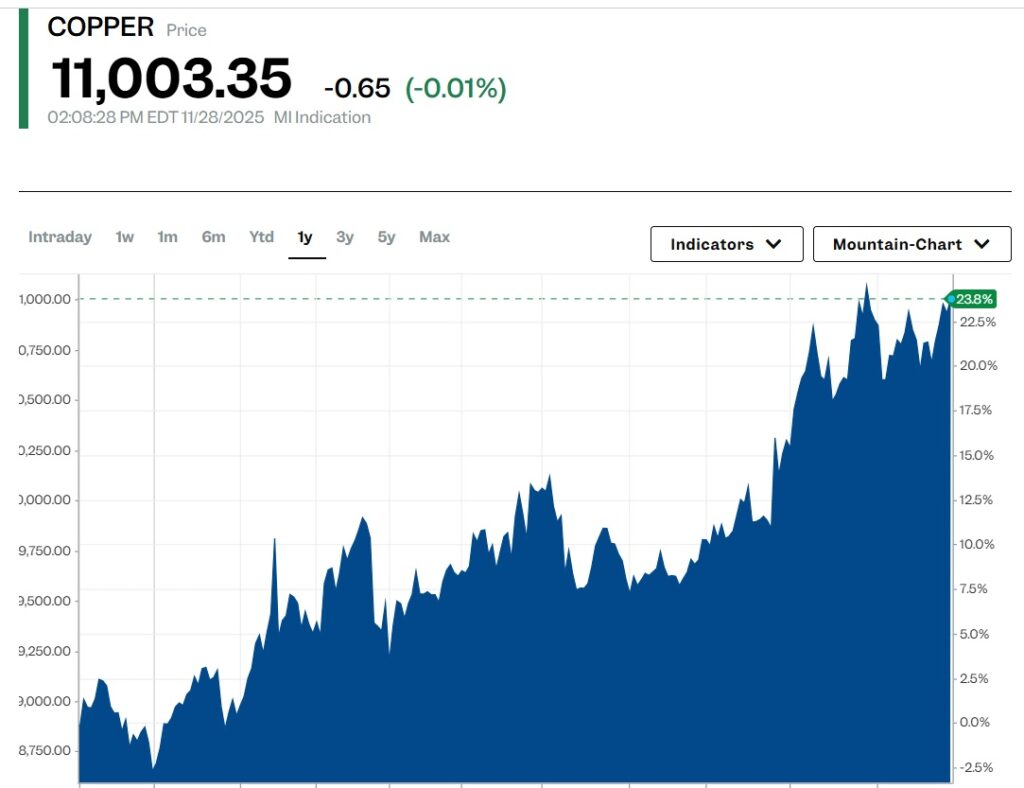

On the other hand, copper prices have crossed the $11,000 mark, reaching a high of $11,067. Copper entered 2025 at $8,691 and has only soared in the indices. It has risen close to 27% year-to-date due to its high demand for industrial purposes. Unlike silver, copper comes with major industrial use-cases. It powers modern technology as copper is found in all cables, wires, circuits, EVs, wind turbines, and motors, among others.

Morgan Stanley has also predicted that the world will be in a copper deficit in the next two decades. When the demand is high and the supply is low, it leads to scarcity, making prices surge. Therefore, copper could head north hereon along with silver and gold. The commodity market is primely positioned for a take-off that could reward investors in the next decade. Taking an entry position in silver, copper, and Gold could be rewarding for traders.