Bitcoin’s Sleeping Giants Stir: 3–5 Year Dormant Coins Surge Back to Life

Long-dormant Bitcoin wallets are waking up—and the market's watching every move.

### The Ghosts of Bull Markets Past

Coins that haven't budged in three to five years are hitting the blockchain again. That's not just old dust shaking off—it's capital that survived the last cycle's euphoria and the subsequent crypto winter. These aren't rookie holdings; they're veteran stacks, and their sudden activity sends a signal that cuts through daily price noise.

### Reading the On-Chain Tea Leaves

When 'sleeping' Bitcoin moves, it bypasses speculative chatter and points directly to holder psychology. Are long-term believers taking profits, or are they simply reorganizing cold storage? The sheer age of these coins adds weight to each transaction, offering a clearer, if cryptic, pulse on market sentiment than any analyst's hot take.

### A Cynical Nod to Tradition

Let's be real—in traditional finance, this much scrutiny over inactive assets would likely trigger a compliance review. In crypto, it's just another Tuesday. The movement of old coins remains one of the few metrics that hasn't been gamified into oblivion by yield farmers and algorithmic traders—for now.

The revival of these ancient satoshis doesn't guarantee a price direction, but it never happens in a vacuum. It's a stark reminder that in Bitcoin's ecosystem, even silence can be a form of market commentary.

Old Coins Start Moving as Macro Fear Collides With Policy Shifts

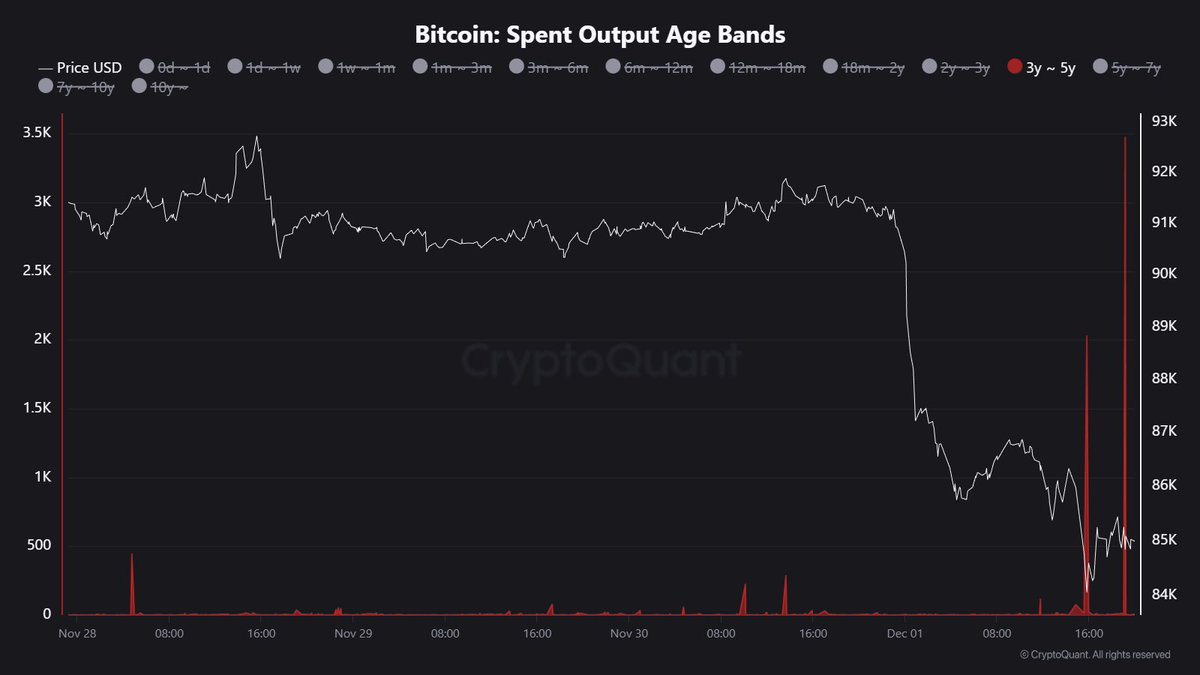

Maartunn highlights a notable rise in activity from 3–5 year-old Bitcoin, a cohort that typically remains dormant unless underlying conditions begin to shift. The Spent Output Age Bands show a sharp increase, jumping from 2,030 BTC earlier today to 3,475 BTC now. These spikes rarely happen randomly. Maartunn believes that “something’s stirring beneath the surface,” suggesting that long-term holders may be reacting to mounting market stress—or positioning ahead of a potential macro inflection.

This awakening of older coins comes at a moment filled with conflicting signals. Fear around Tether’s reserves has resurfaced, sparking concerns over liquidity stability across exchanges. At the same time, renewed headlines about a supposed China bitcoin ban have circulated again, despite offering no new policy information. These narratives have added yet another layer of anxiety to an already fragile market.

Yet the macro backdrop also contains reasons for cautious optimism. The Federal Reserve is expected to bring its quantitative tightening (QT) program to an end, and markets are increasingly pricing in a potential interest rate cut this December. Such shifts historically improve liquidity conditions and support risk assets.

As long-term coins begin to move and macro forces pull in opposite directions, Bitcoin enters a complex environment—one that could precede either deeper volatility or the early stages of a larger transition.

Bitcoin Struggles to Recover as Daily Trend Remains Firmly Bearish

Bitcoin’s 1-day chart continues to reveal a market trapped in a strong downtrend, with price failing to reclaim the key moving averages that define higher-timeframe momentum. After breaking down from the $115,000 region, BTC plunged directly through the 50 SMA, 100 SMA, and 200 SMA, creating a steep momentum shift that sellers still control.

The current price action around $86,000–$88,000 shows hesitation and a lack of follow-through from bulls, even after several attempts to rebound.

The 50 and 100 SMAs both slope sharply downward, confirming a bearish trend structure. Meanwhile, the 200 SMA has flattened and now sits far above price, highlighting just how aggressive and extended the selloff has been. BTC continues to print lower highs and lower lows, a clear signal that the market has not yet found a stable bottom.

Volume spikes on major red candles suggest a mix of forced liquidations and panic-driven exits, while green candles remain smaller and less convincing. The lack of strong buy volume shows that investors remain cautious despite the magnitude of the correction.

If Bitcoin fails to break back above $92,000–$95,000, the market risks another leg lower. The next major supports sit between $80,000 and $78,000, levels that align with previous consolidation zones. For now, the bears still control the daily trend.

Featured image from ChatGPT, chart from TradingView.com