3 Shocking Consequences of a US Dollar Collapse (And Why Crypto Wins)

The dollar's reign looks shakier than a Jenga tower in an earthquake. Here's what happens when it falls—and how digital assets become the life raft.

1. Hyperinflation Hits Main Street

Groceries cost more than your rent. Savings evaporate faster than meme coins in a bear market. Bitcoin's fixed supply starts looking like genius.

2. Global Trade Goes Rogue

Petrodollar? More like petro-BTC. Nations ditch USD settlements faster than Wall Street dumps toxic assets. DeFi bridges the gap.

3. The Great Asset Reset

Gold bugs cheer until they realize transporting bullion sucks. Enter crypto: borderless, censorship-resistant, and ironically more stable than the Fed's balance sheet.

Bonus jab: Your bank's 'risk management' team will still be blaming millennials.

What May Happen If the USD Collapses?

1. Trade Chaos

Global trade is mostly priced in US dollars. Major markets such as oil and commodities often trade in USD. If the US dollar shows signs of weakness and instability, then it could propel global trade chaos, resulting in markets showing DEEP signs of erosion. Without the US dollar, the pricing systems sustaining these orders may collapse, resulting in a global trade halt and intense chaos.

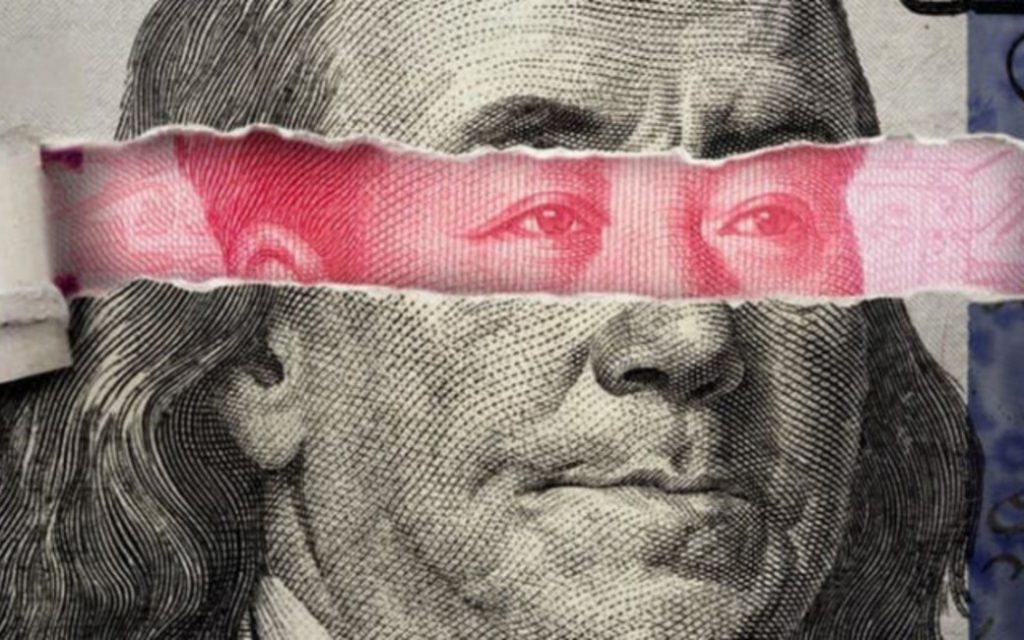

2. New Currency Blocs Emerging

With the fall of the US dollar, the investors or markets may be more likely to try to find a new alternative to find momentum in the rising chaos. This could give birth to new currency blocs supporting each demographic, such as the euro sustaining Europe and the yuan supporting Asia. That being said, the rise of safe-haven assets and their trading may also find a solid footing in such circumstances.

3. Extreme Market Volatility

The major stock market indexes and indices may also feel the heat as the US dollar helms these markets. With the USD collapse, these stock and bond valuations may fall, with investors scurrying towards Gold and silver to safeguard their assets.

But Is The USD Truly Falling?

The US dollar is encountering fluctuations. But to deem it as a weak currency will be an exaggeration. The dollar is currently at its weakest, its price decline fueled by frequent rate cuts and TRUMP tariffs. However, per Robin Brooks, the USD is far from collapsing and is still going strong despite occasional disruptions.

The Dollar has recovered from its lows earlier this year. That's not a sign how great the US is, but – above all – a sign how weak the rest of the world is. In currency space, you only have to be better than the next guy and the Dollar remains far superior to all alternatives… pic.twitter.com/hv7ljxqY6M

— Robin Brooks (@robin_j_brooks) November 11, 2025