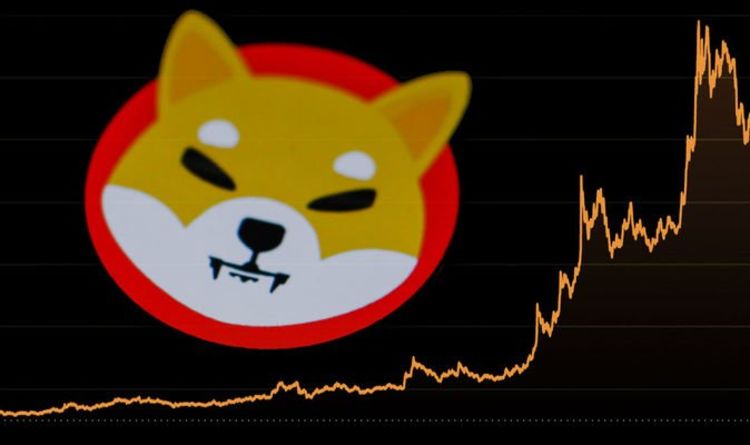

Shiba Inu Primed for Meteoric Rise as Bulls Smash Through EMA Barrier

Shiba Inu’s price is coiled like a spring—ready to launch once bulls overpower the EMA resistance. Here’s why traders are betting big on the meme coin’s breakout.

The EMA Wall: Last Stand Before Liftoff

A stubborn cluster of exponential moving averages has kept SHIB’s price in check. But with Bitcoin ETF inflows juicing the broader market, retail FOMO is building. One analyst calls it 'a powder keg with a lit fuse.'

Meme Coin Mechanics in Play

Unlike its 2021 hype cycle, Shiba Inu now has actual utility—Shibarium transactions hit record highs last quarter. Still, let’s be real: this trade is 90% speculative frenzy, 10% blockchain fundamentals. (Wall Street would charge 2-and-20 for that ratio.)

The Trigger Watch

Traders eye two key levels: a clean break above $0.000012 could trigger algorithmic buying, while losing $0.000009 might spark panic sells. Either way—volatility incoming.

Whether this pumps or dumps, one truth remains: in crypto, the 'buy the rumor' phase always ends. The question is when—not if—retail bags get heavy.

Will Shiba Inu Explode Again? Bulls Eye Breakout Amid Resistance Levels

EMA Wall Is Blocking the Recovery Path

The daily chart shows why traders struggle to overcome these resistance levels at the time of writing. A descending trendline stretching from the early-year highs has capped every rally attempt since August, creating a pattern that repeatedly rejects bulls. Four major moving averages stack directly overhead, forming what analysts describe as a thick ceiling above current price action.

The 20-day EMA sits at $0.00001068, the 50-day EMA at $0.00001146, the 100-day EMA at $0.00001200, and the 200-day EMA at $0.00001257. All four EMAs stack above where price trades right now, and the Supertrend indicator stays red, signaling that sellers still control the market trend. This dense cluster blocks multiple breakout attempts over the past several weeks.

Crypto analyst Javon Marks has been tracking this setup closely. In his analysis, he pointed out some interesting technical patterns forming.

Javon Marks stated:

Analyst Is Projecting a 200% Rally Target

Will Shiba Inu explode again after these months of consolidation? According to Marks, the answer might actually lie in breaking above the current resistance. The analyst has projected that SHIB could be preparing for around a 200% surge as it exits what he’s calling a key accumulation zone. He highlighted some bullish divergences on the MACD indicator and expects a move toward the $0.000032 level, which would represent a significant rally from where we’re trading.

Javon Marks had this to say:

From the current price levels of around $0.00001003, reaching that target WOULD mark what many are calling a major breakout. Marks has also suggested that if SHIB successfully breaks above the $0.000032 mark, it could even advance toward $0.000081, which would bring it near its previous all-time high. That’s the kind of move that would definitely answer the question of whether Shiba Inu will explode again.

Support Is Holding But Volume Stays Light

Spot flow data is showing an $84.25K inflow that was recorded today, and this marks a shift after there were sessions of consistent outflows. Buyers have been defending support at the $0.00000980 level multiple times, preventing what could have been a breakdown into lower zones. On the 30-minute chart, SHIB actually broke out of a short-term descending channel and reclaimed the VWAP line, which is seen as an early sign of momentum shifting.

The RSI sits NEAR 52 right now, and the first resistance is standing at around $0.00001020. A close above the 20-day EMA at $0.00001068 would confirm that bullish momentum is shifting from sellers to buyers, which is what traders have been waiting to see.

Lucie, who is a key team member in the Shiba Inu ecosystem, shared her perspective on market cycles and opportunities during volatile periods.

Lucie emphasized:

Breaking above the 200-day EMA at $0.00001257 would confirm a full trend reversal and open up a path toward $0.00001400. On the other hand, failure to break through these levels sends the price back to the $0.00000980 support, with even deeper downside risk toward $0.00000900 if selling pressure returns. The coming sessions will determine whether Shiba Inu explodes again and becomes reality, or if sellers reassert control and push the market trend back into consolidation, leaving these resistance levels intact and the breakout delayed once more.