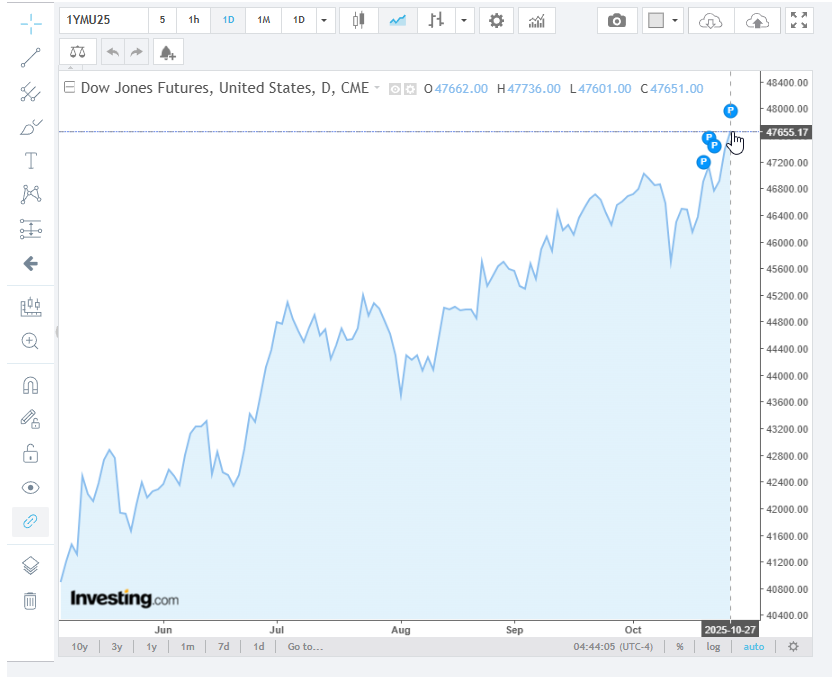

Fed Rate Cut, China Trade Deal, Big Tech Propel Dow Futures Higher

Markets surge as three powerful catalysts converge—creating the perfect storm for risk assets.

The Triple Threat Driving Markets

Federal Reserve signals dovish pivot with unexpected rate cut, China trade tensions finally show signs of resolution after years of uncertainty, and Big Tech giants post earnings that smash expectations—sending shockwaves through pre-market trading.

Wall Street's cocktail of positive news has traders scrambling to reposition portfolios, with Dow futures climbing steadily in overnight sessions. The synchronized bullish momentum across monetary policy, geopolitical relations, and corporate earnings represents the kind of alignment that market veterans describe as 'once-in-a-cycle.'

Meanwhile, crypto markets watch with interest as traditional finance gets its temporary sugar rush—proving once again that when the Fed opens the liquidity taps, everyone gets invited to the party. Even the suits.

Trade Deal Framework Boosts Dow Futures

Treasury Secretary, confirmed that there had been significant advances in US China trade negotiations, a factor that has been propelling the Dow futures up as the times of writing. Speaking on, Bessent had this to say:

“President TRUMP gave me a great deal of negotiating leverage with the threat of the 100% tariffs, and I believe we’ve reached a very substantial framework that will avoid that and allow us to discuss many other things with the Chinese.”

China’s top trade negotiatoralso confirmed progress, stating that the two sides reached a preliminary consensus after some weekend discussions in Kuala Lumpur.

Fed Rate Cut Expectations Drive Dow Futures

Markets are pricing in what looks like a near-certain Fed rate cut this week, which is supporting Dow futures momentum right now. President Trump expressed Optimism about the China trade deal, stating:

“I have a great relationship with President Xi. I expect to be able to make a good deal with him. I want him to make a good deal for China — but it’s got to be fair.”

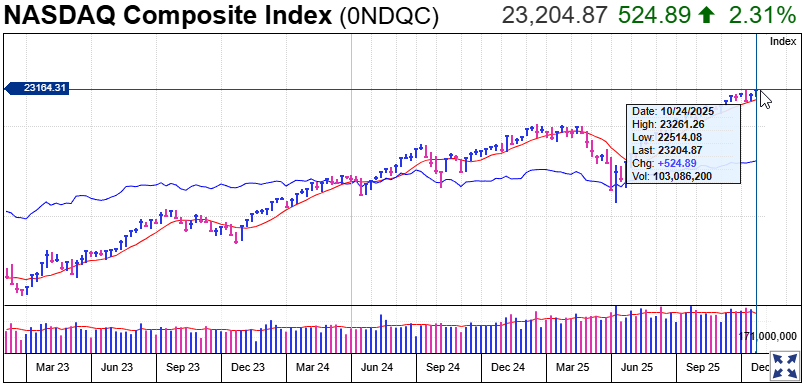

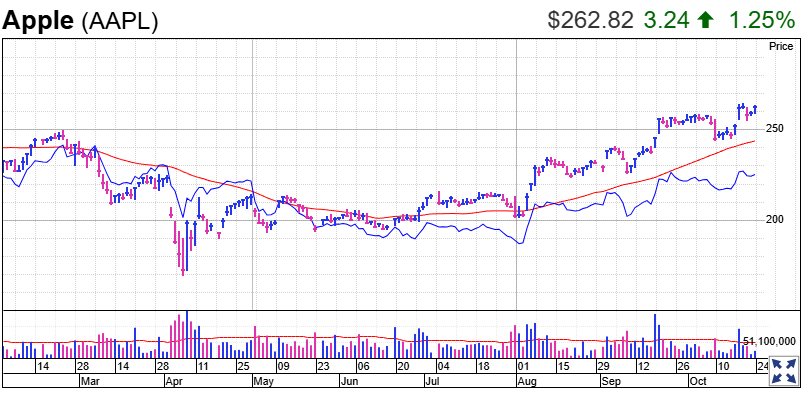

Big Tech Earnings Power Nasdaq and Dow Futures

shares gained 1.25% to reach $262.82 in premarket trading, whileand other Big Tech companies were preparing to report quarterly results. The tech-heavys 2.31% surge has been boosting overallsentiment as investors anticipated strong earnings that are driven by AI investments along with cloud computing growth.

The combination of Fed rate cut expectations, the China trade deal framework, and Big Tech earnings actually created a powerful catalyst for Dow futures, with the S&P 500 futures even reflecting broad-based strength across multiple sectors.