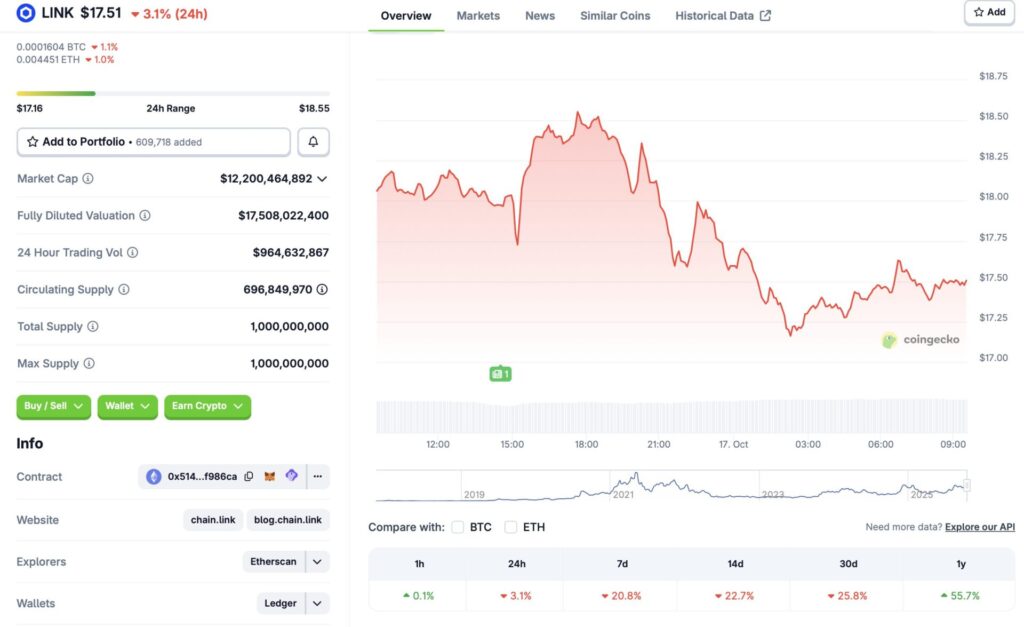

Chainlink Plunges 20%: Is This The Buying Opportunity You’ve Been Waiting For?

Chainlink's oracle network just took a brutal hit—crashing 20% in a single week as market volatility wreaks havoc across crypto.

The Great Crypto Shakeout

While traditional investors panic-sell, seasoned crypto veterans know these dips often create prime entry points. The fundamentals haven't changed—Chainlink still powers most of DeFi's critical price feeds.

Market Psychology at Play

Fear spreads faster than rational analysis in crypto markets. Remember when Bitcoin dropped 50% last quarter? Those who held—or bought—are now laughing all the way to the blockchain.

When Wall Street gets nervous about a 20% drop, crypto natives call it Tuesday. Maybe they should stick to their 2% annual returns and leave the real volatility to professionals.

Source: CoinGecko

Source: CoinGecko

Should You Be Worried About Chainlink’s Massive Price Crash?

The current market crash could be due to heightened investor worry. The market faced its most significant single-day liquidation ever earlier this month. The dip was triggered by a spat between the US and China, with both parties threatening trade blockages. The market recovered after positive developments at the negotiating table. However, investor sentiment is still low. Chainlink (LINK) and other assets continue to see big outflows. According to CoinGlass data, $717.76 million was liquidated from the crypto market in the last 24 hours.

Chainlink (LINK) is currently following Bitcoin’s (BTC) trajectory. LINK’s price could recover if BTC rebounds. BTC’s price path could pick up steam after a potential interest rate cut later this month. In a recent speech, Federal Reserve Chair Jerome Powell hinted that lowering rates may be inevitable. This would mark the second interest rate cut in 2025. Such a development could lead to a spike in risky investments, such as chainlink (LINK) and other altcoins.

However, there is also a possibility that Chainlink (LINK) will consolidate around current levels. The crypto market is still dipping, and recovery may take longer than expected. September’s interest rate cut led to a slight rally, but ended with a market crash. A similar pattern could emerge after the second rate cut as well. Market volatility is still high, and prices could move in either direction. How things unfold is yet to be seen.