Amazon Stock Surge: $305 Price Target Signals 35% AMZN Profit Potential

Amazon's stock is poised for a major breakout as analysts project significant upside momentum.

The Bullish Case for AMZN

With a clear $305 price target on the horizon, Amazon investors could see returns hitting that sweet 35% profit mark—almost makes traditional investment strategies look like they're moving in slow motion.

Market Positioning

AMZN continues to demonstrate why it remains a cornerstone of growth portfolios, defying broader market hesitations while legacy financial advisors still debate whether tech stocks are 'overvalued.'

The e-commerce giant's relentless innovation across cloud computing, AI integration, and global logistics creates multiple revenue streams that traditional retailers can only dream of matching.

Investment Outlook

While Wall Street analysts crunch numbers and revise spreadsheets, Amazon keeps executing—proving once again that sometimes the best investment strategy is simply betting on companies that actually understand the future.

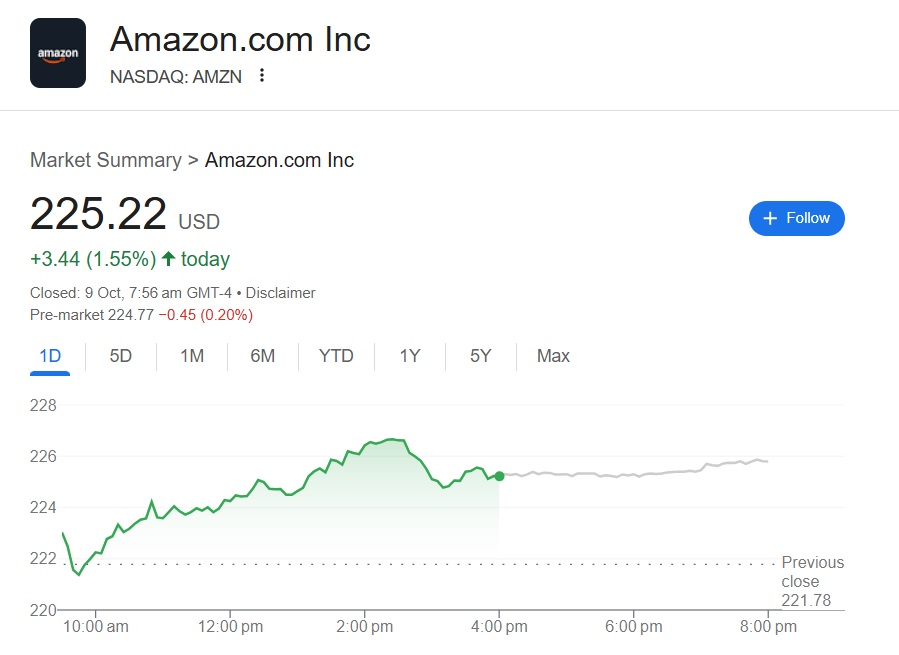

Source: Google

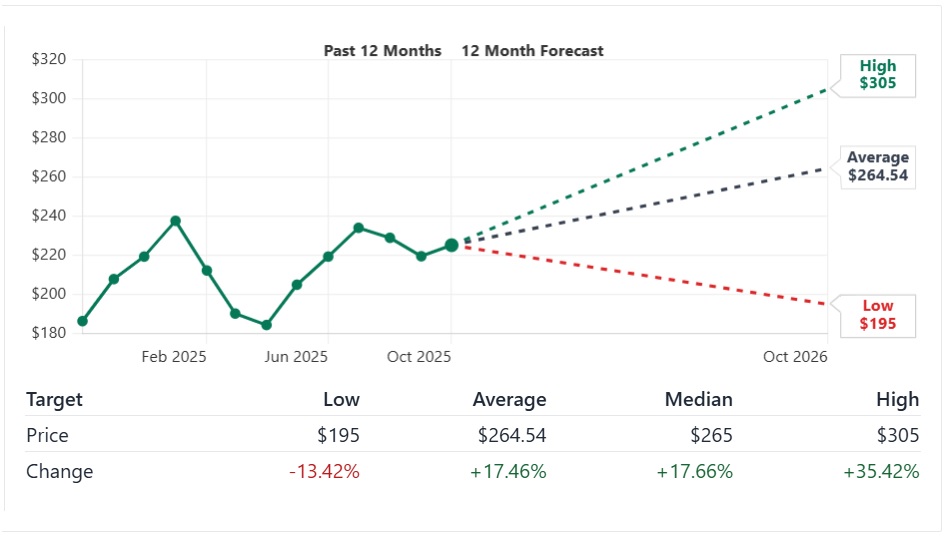

Source: Google

Amazon Stock Gets Buy Call: Target for AMZN $305, Profit 35%

Stock Analysis, the leading price prediction firm, has given a buy call for Amazon. According to the price forecast, the target for AMZN is $305 with an estimated timeline of 12 months. That’s an uptick and return on investment (ROI) of approximately 35% from its current price of $225.

Therefore, an investment of $1,000 could turn into $1,350 in the next 12 months if the forecast turns out to be accurate. 46 financial strategists from the analytical firm gave a ‘strong buy’ rating for AMZN. The overall consensus is bullish, and an entry now could prove beneficial.

In addition, the analysts have given a downside for AMZN if the market falters. The lowest Amazon stock could trade on the flipside is $195. That’s a significant dip of 13% and could be used to accumulate if it falls below $200.

However, considering the ‘strong buy’ bullish thesis, Amazon stock could likely outperform the market. The e-commerce giant has seen a revenue growth of 13.35% during the first two quarters. The estimates for FY 2026 also remain positive with a prediction of double-digit growth. The firm has called for an 11% revenue growth for the first quarter of 2026. All of these add to the positive price trend for AMZN’s performance.