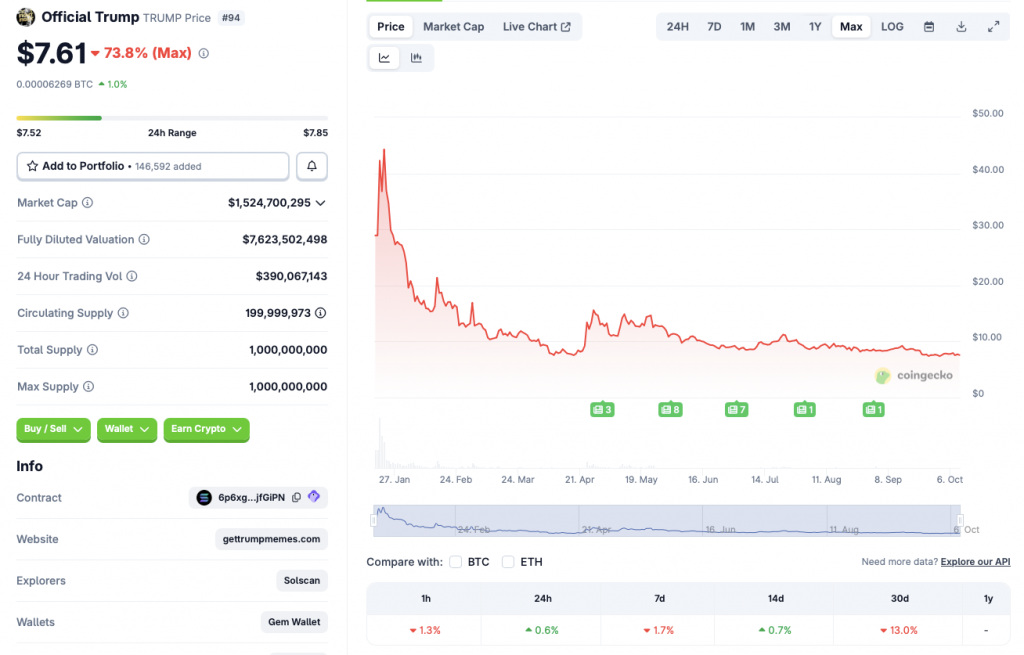

Trump Coin Plunges 90% Since January: Is TRUMP Primed for Epic Comeback?

TRUMP token collapses 90% from January highs—memecoin massacre or buying opportunity?

The Brutal Reality Check

Nine months of relentless selling pressure vaporized nearly all gains from the token's previous rally. Retail investors who bought the hype now face devastating portfolio damage—another classic crypto cautionary tale.

Technical Breakdown

Chart patterns show consistent lower highs and lower lows since February. Trading volume dried up 75% from peak levels, signaling fading interest as newer meme tokens capture speculative capital.

The Political Wildcard

Unlike traditional assets, TRUMP's fate ties directly to political developments and social media sentiment. Any major announcement could trigger violent price swings in either direction—because nothing says stable investment like combining politics and meme economics.

Bottom Line: High-risk punters might see this as discounted entry, while sane investors remember the oldest rule in finance—if something drops 90%, it can always drop another 90%. Welcome to cryptocurrency, where fundamentals are optional and hopium is the real currency.

Source: CoinGecko

Source: CoinGecko

Trump Coin Price Prediction: Is A Recovery Possible Anytime Soon?

TRUMP’s price dip comes amid a decrease in popularity for President Trump’s trade policies. Many have blamed President Trump’s economic policies for the dwindling value of the US dollar. Poor dollar values have led investors to exit risky markets, such as cryptocurrencies, and instead put their money in safer options, such as gold.

The crypto market has also taken a hit over the last few days. The dip could be due to increased profit-taking or low investor sentiment. TRUMP and other memecoins have been severely affected by the macroeconomic conditions.

Despite the lackluster performance over the last few months, there is a chance that TRUMP coin will recover its losses over the coming months. There is a very high chance that the Federal Reserve will roll out another round of interest rate cuts after its next meeting. Another rate cut could inspire market participants to take heavier risks. Such a development could lead to TRUMP and other risky assets surging.

Despite the bullish possibilities, CoinCodex analysts do not anticipate TRUMP to recover anytime soon. Instead, the platform expects TRUMP’s price to go even lower. CoinCodex predicts TRUMP to trade at $5.47 on Oct. 19. Hitting $5.47 from current price levels will entail a dip of about 28.12%.