Bitcoin Whales Go All-In: ’Uptober’ Poised for Historic $4B Crypto Surge

Digital asset giants are placing massive bets as Bitcoin enters its most bullish seasonal pattern.

The Whale Watching Report

Crypto's deep-pocketed investors are accumulating positions at levels not seen since previous market cycles. Trading volumes suggest institutional money flowing back into digital assets despite regulatory uncertainty.

Seasonal Patterns Don't Lie

Historical data reveals October consistently delivers above-average returns for cryptocurrency markets. This 'Uptober' phenomenon has traders anticipating another breakout month.

The $4 Billion Question

Recent whale movements indicate sophisticated investors are positioning for what could be the sector's biggest monthly gain yet. The smart money seems to know something retail traders don't—or maybe they just have better Bloomberg terminals.

When whales move, markets follow. The only question remaining is whether this October surge will make or break another generation of crypto millionaires.

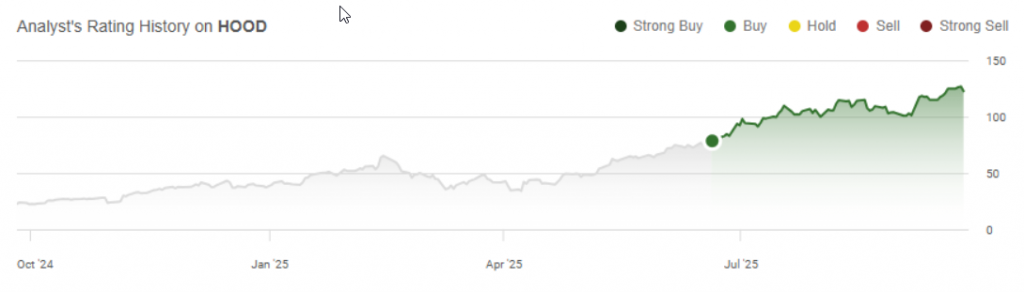

HOOD Stock Jumps 12% Amid $4B Prediction Trades and Market Growth

This milestone was announced by CEO Vladimir Tenev in a post on X, and he pointed out the fast growth of the company. The observed viral nature of the platform with over two billion dollars of Robinhood prediction trade occurring in the third quarter of 2025 alone.

Tenev also said that:

Robinhood customers have now transacted more than 4 billion of such event contracts, 2 billion of which were in the third quarter alone.

Prediction Markets Drive Performance

The HOOD stock advance was triggered by Robinhood’s partnership with Kalshi, which is a CFTC-regulated platform. The company rolled out football contracts in August, tapping into the space between financial markets and wagering. This Robinhood market growth strategy’s proven successful at this point.

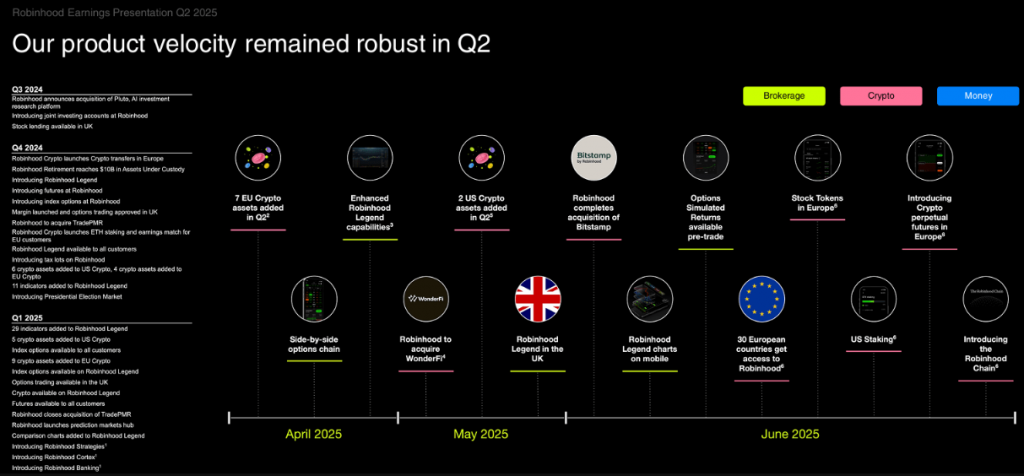

Q2 results showed customers hit 26.5 million, while Gold subscribers reached 3.48 million. Platform assets climbed to $279 billion. These numbers highlight Robinhood fintech expansion beyond traditional trading.

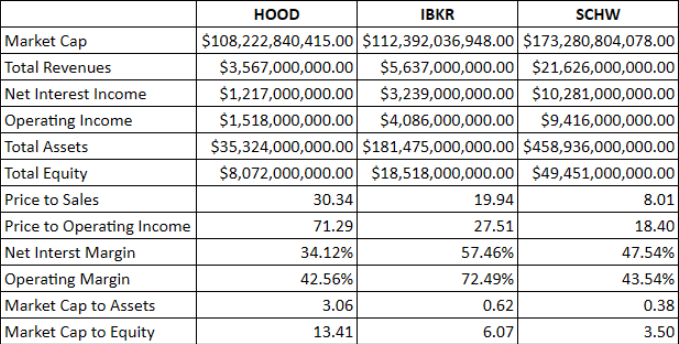

HOOD stock joined the S&P 500 in September 2025. Having deposits of up to $13.8 billion and operating income of $1.518 billion, Robinhood has demonstrated good performance and its market growth, Robinhood market.

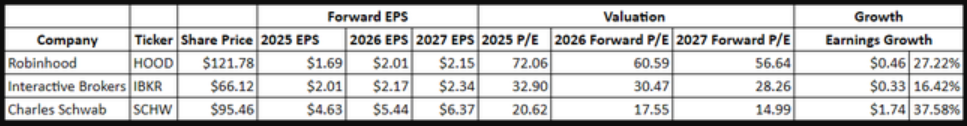

It has a market capitalization of about $108.2 billion. HOOD stock is climbing as Robinhood rolls out new features. According to some analysts, the net interest margin of 34.12 is a good sign.

The momentum behind HOOD stock appears backed by fundamentals. Robinhood prediction trades generate substantial volumes even now. The Robinhood fintech expansion positions the company well for growth in the competitive space.