Bitmine-Linked Wallet Snags $106M Ethereum Haul From FalconX – Here’s What Went Down

A cryptocurrency wallet with ties to Bitmine just executed one of the largest Ethereum movements we've seen this quarter – grabbing a cool $106 million from institutional trading platform FalconX.

The Whale Move That's Turning Heads

While the crypto markets continue their usual volatility dance, this massive transfer cuts through the noise like a laser beam. We're talking about serious institutional-level movement here, not your average retail trader shuffling coins between wallets.

FalconX, known for catering to the big players in digital assets, just facilitated this nine-figure Ethereum transfer to a wallet that blockchain sleuths have connected to Bitmine operations. The timing? Absolutely perfect – right as ETH shows renewed strength against traditional finance assets.

What This Means for the Ecosystem

Movements like this typically signal either major institutional positioning or substantial capital redeployment. Given Bitmine's mining heritage and FalconX's institutional client base, this smells more like strategic accumulation than routine portfolio management.

The cynical take? Another day, another nine-figure crypto transaction that would make traditional finance bankers sweat about their 2% annual returns. While Wall Street fights over basis points, crypto's big players are moving entire fortunes between digital wallets before most traders finish their morning coffee.

Whale Activity Signals Confidence in Ethereum

Ethereum’s recent price action has left traders uncertain, but whale behavior tells a different story. According to on-chain data from Lookonchain, large holders continue to accumulate ETH despite the recent market drop. In just the past few hours, two major transactions highlighted this ongoing trend.

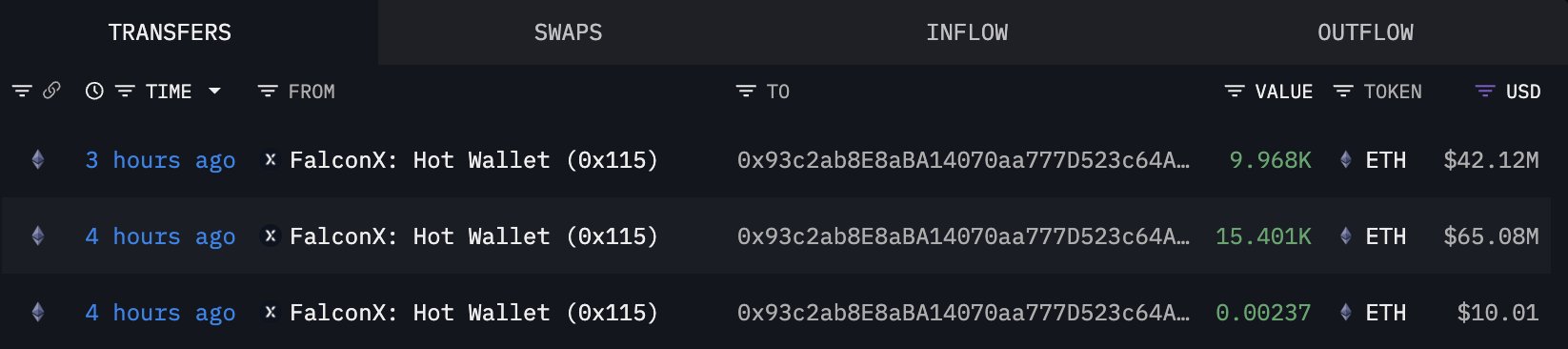

A newly created wallet, 0x93c2 — which analysts suggest may belong to Bitmine — received 25,369 ETH, worth approximately $106.74 million, from FalconX only three hours ago. Such a large inflow into a fresh wallet suggests strategic accumulation, likely intended for long-term holding or staking rather than short-term trading. In parallel, another new wallet, 0x6F9b, withdrew 4,985 ETH (about $21 million) from OKX just an hour later. These moves reduce supply on exchanges, often considered a bullish sign since it limits the immediate selling pressure.

This pattern highlights a broader market dynamic: while retail traders and smaller participants react to short-term volatility, whales appear to view the correction as an opportunity. Their accumulation not only demonstrates confidence in Ethereum’s resilience but also signals preparation for future price appreciation. Historically, consistent whale inflows into fresh wallets have coincided with periods of structural support and eventual recovery.

ETH Struggles To Reclaim $4,200

Ethereum is trading NEAR $4,138 after a volatile week that saw the price tumble below $4,000 before bouncing back. The 8-hour chart highlights a recovery attempt, but ETH now faces significant resistance around the $4,200 level, where both the 100-period (green) and 200-period (red) moving averages converge. This confluence creates a heavy supply zone that bulls must overcome to confirm further upside momentum.

The recent decline from the $4,600–$4,800 range left ethereum in a fragile state, with selling pressure intensifying during the drop. The rebound shows resilience, but price action remains capped by overhead resistance, keeping sentiment cautious. The failure to reclaim the 50-period moving average (blue) earlier underscores the challenge of reversing short-term bearish momentum.

On the downside, the $4,000 mark acts as the first critical support. A breakdown below that level could re-expose ETH to $3,800 or even $3,600, where stronger demand may appear. For now, Ethereum trades in a consolidation phase, and the next decisive move will likely depend on whether bulls can force a breakout above $4,200. A clean move higher would open the door toward $4,400, while rejection risks renewed downside pressure.

Featured image from Dall-E, chart from TradingView