Hyperliquid Project Sparks $3.6 Million Firestorm as Rug Pull Suspicions Mount

Another day, another crypto controversy—this time a Hyperliquid-based project finds itself at the center of a $3.6 million storm.

Investors are hitting the panic button as funds vanish and developers go radio silent. The classic rug pull playbook unfolds once more.

Warning Signs Ignored

Liquidity pools drained overnight while Telegram channels fill with desperate questions. The project's token charts look like a cliff dive—straight down with no parachute.

Community Backlash Intensifies

Angry investors are organizing across social media, demanding answers that aren't coming. Screenshots of disappearing transactions flood crypto Twitter as the digital trail grows cold.

Just when you thought the crypto space was maturing, a $3.6 million reminder surfaces that some things never change—especially when anonymous developers control the purse strings. The only thing more predictable than these exits? The regulatory shrug that follows.

HyperVault Social Channels Wiped Amid Rug Pull Suspicions

According to PeckShield, the suspicious activity began with a large withdrawal from HyperVault, a yield optimization protocol built on Hyperliquid.

The assets were bridged out of the network to Ethereum, converted into ETH, and eventually funneled into Tornado Cash, a popular coin mixer often used to obscure fund flows.

In total, 752 ETHwere deposited into Tornado Cash, raising strong suspicion of a deliberate exit scam.

#PeckShieldAlert #Rugpull? We have detected an abnormal withdrawal of ~$3.6M worth of cryptos from @hypervaultfi.

The funds were bridged from #Hyperliquid to #Ethereum, swapped into $ETH, and then 752 $ETH was deposited into #TornadoCash. pic.twitter.com/mHQLPYXvzS

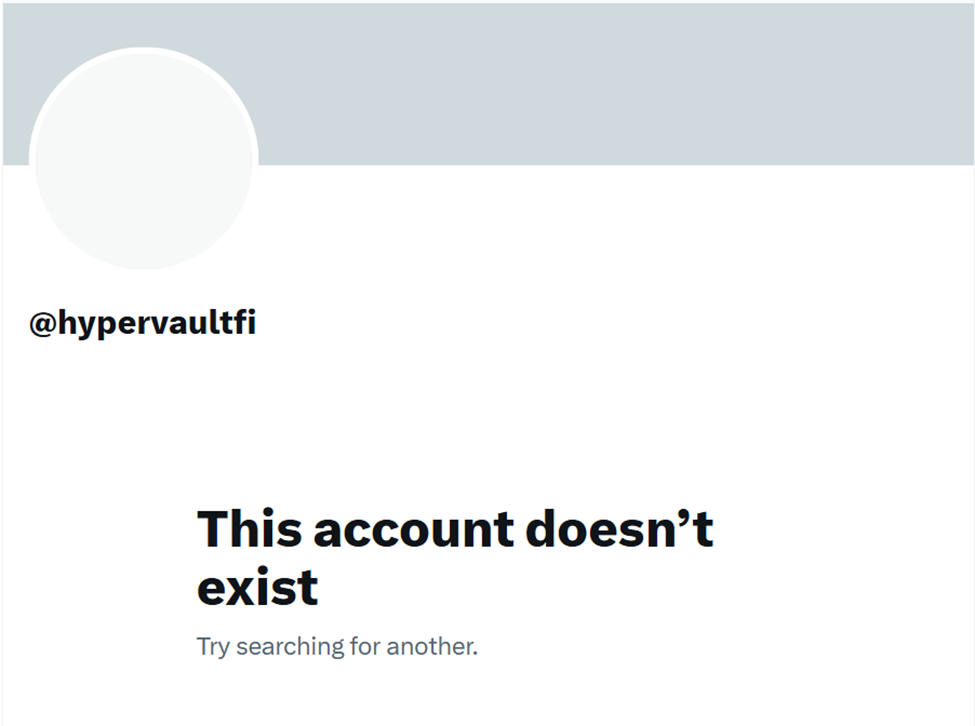

The fallout escalated quickly when HyperVault’s social media accounts were deactivated, including its X (Twitter) profile and Discord server.

HypingBull, a Hyperliquid community member, views this as confirmation after warning about the protocol weeks earlier.

On September 4, they highlighted irregularities in the project’s audit claims, noting that while developers said audits were underway, at least two firms denied any involvement.

MAX REPOST 🚨: HYPERVAULT PROJECT IS DOING SHADY STUFF

Friends, withdraw your funds from the protocol ASAP until further updates! When I asked Hypervault developers about audits, they answered that: "Audits are pending via Spearbit, Pashov, and Code4rena; expected turnaround for… https://t.co/SMKLP9S1tR pic.twitter.com/NBwrsbwRT6

Despite these warnings, HyperVault continued to attract users, leveraging its branding as a password manager and digital vault for businesses.

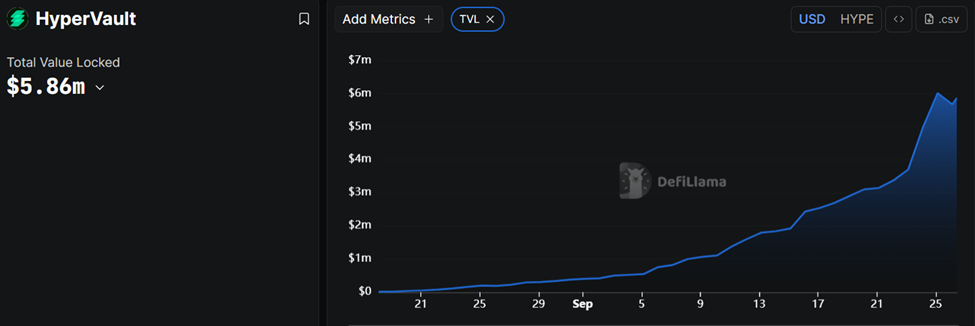

The platform also promoted itself as a multichain yield optimization hub. With roughly $5.8 million in total value locked (TVL), the project had positioned itself as a key DeFi player within Hyperliquid’s ecosystem.

Sentiment is that HyperVault TVL (total value locked) may have been inflated. If this is not the case, crypto markets may have just witnessed the largest rug pull on HyperEVM.

What HyperVault Users Should Do

Following the latest development, the Hyperliquid proponent urged HyperVault users to revoke all the permissions on the wallet used to connect to the website.

“That’s the only thing you can do if you were affected. Can the lost funds be recovered? No, it’s blockchain. Nothing can be done. That’s what may happen when you interact with unaudited contracts,” they articulated.

While Hyperliquid itself, a high-performance Layer-1 blockchain focused on perpetual futures and spot trading, remains unaffected, the HyperVault scandal risks denting trust in its broader ecosystem.

Critics argue that unaudited third-party protocols can undermine confidence in otherwise strong infrastructure.

As of this publication, neither Hyperliquid nor HYPEconomist had commented on the incident.