Jiuzi’s $1B Crypto Treasury Bet: Banking on BTC, ETH, and BNB for Massive Returns

Jiuzi just dropped a billion-dollar bombshell on traditional finance.

STRATEGIC ALLOCATION BREAKDOWN

The company's treasury committee greenlit a $1 billion crypto portfolio targeting Bitcoin, Ethereum, and Binance's BNB token. This isn't some cautious dip-toe-in-water approach—it's a full-scale strategic deployment that positions digital assets alongside traditional reserves.

MARKET SIGNAL AMPLIFICATION

Corporate treasuries shifting nine figures into crypto used to make headlines. Now we're talking ten figures. Jiuzi's move signals institutional adoption isn't just accelerating—it's leapfrogging traditional investment timelines. The allocation spreads across three major blockchain ecosystems, hedging against single-platform risk while capturing upside from decentralized finance, smart contracts, and exchange token economics.

TRADITIONAL FINANCE SIDESTEP

While legacy institutions debate crypto exposure percentages, forward-thinking corporations are building actual positions. Treasury managers used to spend months debating bond durations—now they're executing eight-figure blockchain transactions before lunch. The move bypasses traditional custody bottlenecks through direct exchange relationships and cold storage solutions.

REGULATORY FRONTRUNNING

Jiuzi's timing suggests confidence in regulatory clarity—or at least enough legal framework to justify billion-dollar bets. They're not waiting for perfect conditions; they're building positions ahead of broader institutional movement. Because nothing says 'we believe in this asset class' like committing capital that would make most hedge funds blush.

Of course, Wall Street analysts will call this reckless—right before quietly upgrading their own crypto research departments.

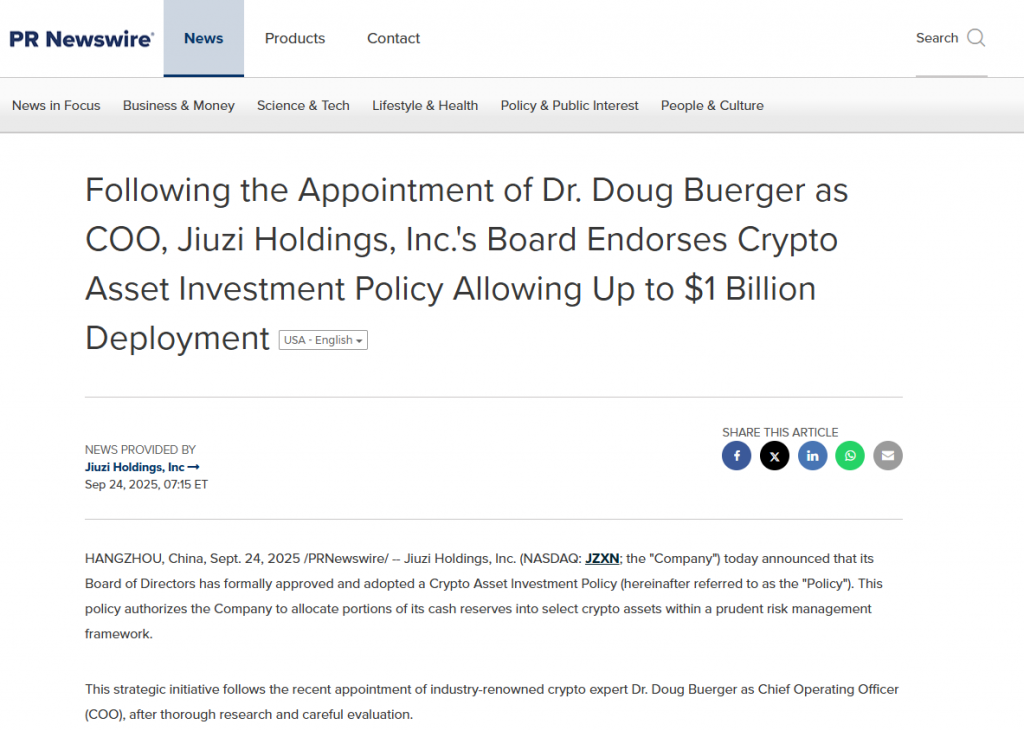

The Jiuzi Holdings $1 billion crypto asset investment policy announcement – Source: PR Newswire

The Jiuzi Holdings $1 billion crypto asset investment policy announcement – Source: PR Newswire

Jiuzi Crypto Treasury Strategy Secures Bitcoin, Ethereum, and BNB

Board Endorses Major Crypto Investment Policy

Following Dr. Doug Buerger‘s appointment as COO, Jiuzi’s board formally approved the crypto asset investment policy. The Jiuzi crypto treasury initiative authorizes allocation of cash reserves into select cryptocurrencies within what they described as a prudent risk management framework. This strategic MOVE came after thorough research and careful evaluation by company leadership.

The policy specifically targets Bitcoin, Ethereum, and even BNB for the company’s crypto reserves. Bitcoin serves as the foundation due to its institutional acceptance, while ethereum provides exposure to smart contract technology. BNB rounds out the portfolio with exchange token benefits along with ecosystem advantages.

$1 Billion Deployment Builds on Previous Bitcoin Strategy

The comprehensive Jiuzi crypto treasury policy builds upon earlier cryptocurrency investments that the company made. Previously, funds were raised through convertible notes specifically to acquire Bitcoin, establishing what was described as a

This expansion to a $1 billion crypto reserves allocation demonstrates the company’s growing commitment to digital assets. The policy encompasses Bitcoin, Ethereum, and also BNB investments, providing diversified exposure across major cryptocurrency categories right now.

Strategic Risk Management Framework

The Jiuzi crypto treasury policy approved underlines the need to handle risks wisely whereas accruing as much as possible out of such investments. The framework assuages market volatility issues since it provides clear guidelines on the manner in which the company will utilize crypto reserves. The company has chosen Bitcoin, Ethereum and BNB due to their market presence and potential in the long-term.

The experience that Dr. Buerger has in the crypto industry will be a direct boon to this venture and the company will be well placed to execute its strategy of having crypto reserves. The diversification strategy on Bitcoin, Ethereum, and BNB will reduce risks associated with the single asset but grab a wider market opportunity that is there.