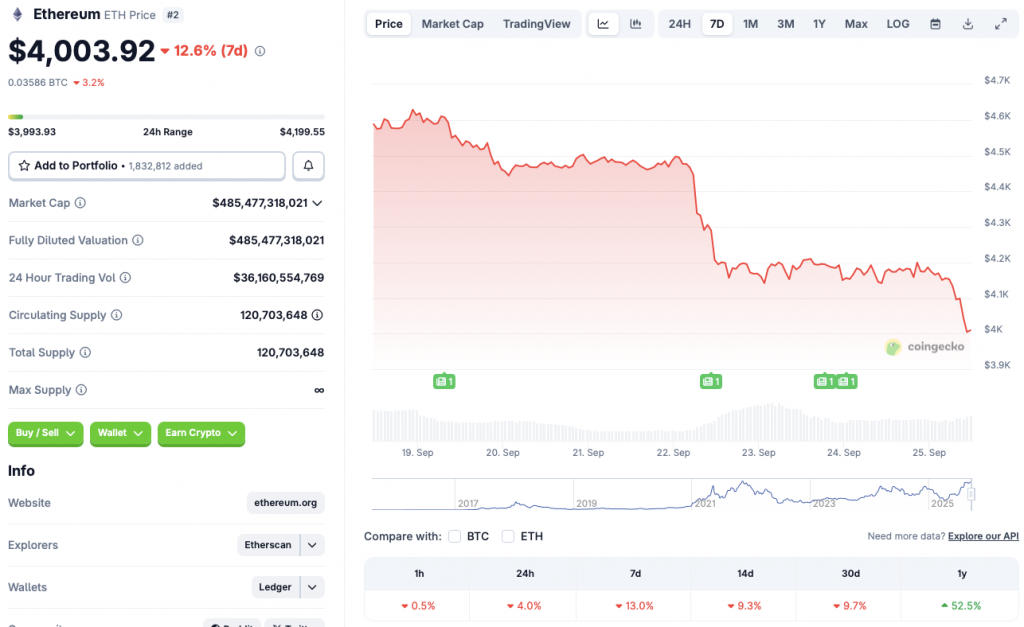

Ethereum Teeters at $4k Brink - Most Fragile Position Since August Market Shakeout

Digital asset investors grip armrests as ETH tests critical support level.

The Gravity-Defying Act

Ethereum's valuation dances precariously above the psychological $4,000 threshold - a floor not challenged since summer's regulatory tremors. Market momentum indicators flash amber as trading volume contracts.

Whale Movements Signal Nervousness

Blockchain analytics reveal institutional wallets redistributing holdings while retail traders increase leveraged positions. This divergence typically precedes volatile price action.

Technical Breakdown Looms

Chart analysts note weakening resistance clusters between $4,200-$4,500. A sustained breach below $3,950 could trigger automated sell orders totaling nine figures across major exchanges.

Meanwhile traditional finance pundits - who still think blockchain is something you buy at Home Depot - continue predicting crypto's imminent demise between golf rounds.

The smart money's watching whether Ethereum's infrastructure upgrades can offset macro pressures. This isn't just a price test - it's a stress test for the entire altcoin ecosystem.

Source: CoinGecko

Source: CoinGecko

What’s Behind Ethereum’s Price Dip?

Ethereum (ETH) climbed to a new all-time high of $4,946.05 on Aug. 24, after nearly four years. The asset has since fallen by 18.6%.

Ethereum’s (ETH) price correction follows a market-wide dip. Bitcoin (BTC) has fallen to the $111,000 price level, and the global crypto market cap has dipped to $3.92 trillion. According to CoinGlass, the crypto market has seen $401 million in liquidations in the last 24 hours.

Ethereum’s (ETH) latest price correction could be due to uncertainties around the Federal Reserve’s policies, despite the central bank rolling out a 25 basis point interest rate cut earlier this month. Investors are likely moving their funds to Gold and stocks. Gold recently hit a new all-time high, and the stock market is also following a similar trajectory.

Another factor could be the slowing down of ETF inflows. ETFs have played a major role in Ethereum’s (ETH) rise to a new all-time high in August. Slow ETF inflows may have led to a price dip.

Token unlocks could be another reason for the market dip. According to Tokenomist data, around $517 million worth of tokens are to be pushed into the market from Sept. 22 to Sept. 29. The development may have led investors to take a cautious approach.

Will The Asset Recover?

There is a very high chance that Ethereum (ETH) will rebound over the coming weeks. The Federal Reserve is expected to roll out another interest rate cut in October. Another rate cut could boost investor sentiment, leading to more inflows into the crypto space.

Moreover, October has usually been a bullish month for the crypto market. How Ethereum (ETH) behaves over the coming weeks is yet to be seen.