XRP Price Prediction 2025: Bullish Patterns and Institutional Catalysts Point to Major Breakout

- Technical Analysis: Is XRP Building Momentum for a Major Breakout?

- Institutional Adoption: Why Big Money Is Flocking to XRP

- Market Psychology: The Whale vs Retail Divide

- XRP vs Traditional Finance: The Changing of the Guard

- Price Predictions: Where Could XRP Go From Here?

- Risks and Considerations

- XRP Price Prediction 2025: Your Questions Answered

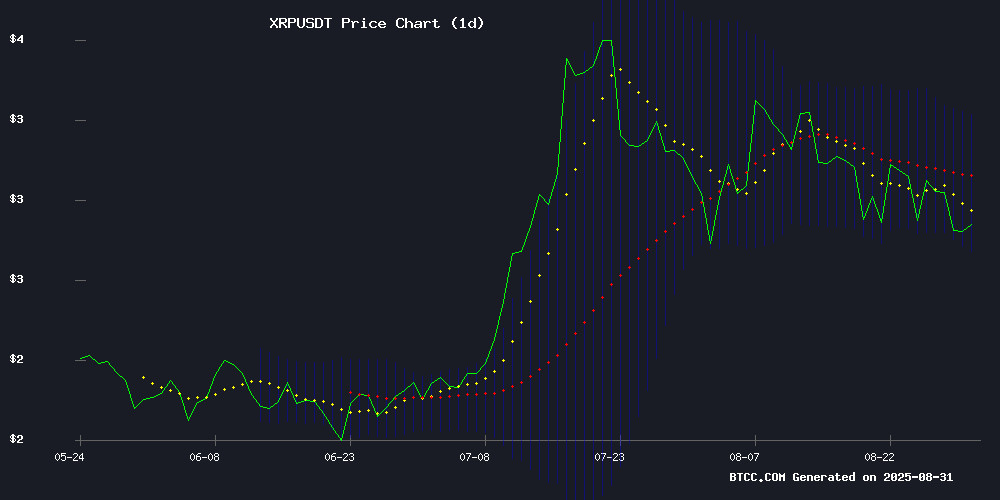

XRP is showing all the signs of a cryptocurrency poised for significant movement as we approach Q4 2025. Currently trading at $2.8153, the digital asset presents a compelling case for investors with its technical consolidation pattern, strong institutional tailwinds, and growing adoption in cross-border payments. The resolution of Ripple's SEC lawsuit, multiple ETF filings, and its recent market cap surpassing traditional finance giant BlackRock ($178.4 billion vs $172.3 billion) all contribute to what could be XRP's most bullish setup in years.

Technical Analysis: Is XRP Building Momentum for a Major Breakout?

XRP's current technical picture reveals an asset in accumulation phase, with several bullish indicators emerging. The price sits just below the 20-day moving average ($3.0013), a key level that often acts as both support and resistance. What's particularly interesting is the MACD reading of 0.1520 sitting above its signal line (0.1191) - this momentum indicator suggests building bullish pressure despite the modest histogram reading of 0.0329.

Bollinger Bands paint an equally intriguing picture, with the price comfortably between the upper band ($3.2682) and lower band ($2.7344). "We're seeing classic consolidation behavior here," notes the BTCC research team. "The alignment with the 20-day MA and Bollinger middle band suggests XRP is gathering strength before its next major move."

Institutional Adoption: Why Big Money Is Flocking to XRP

The institutional story for XRP has never been stronger. With 15 ETF filings now on the SEC's desk (including Amplify's innovative Option Income ETF targeting November launch), regulatory clarity following the $125 million SEC settlement, and real-world adoption in cross-border payments, XRP is shedding its "retail coin" reputation.

Some standout institutional developments:

- Thumzup Media's $50 million XRP allocation (with plans to expand to $250 million)

- JP Morgan's projection of $4.3-$8.4 billion in potential ETF inflows

- Gemini's XRP credit card offering 4% cashback (10% at select merchants)

- Ripple's interactive demo showcasing XRP's payment rail efficiency

Market Psychology: The Whale vs Retail Divide

An interesting tension has emerged in XRP markets - while CryptoQuant data shows whales have been distributing holdings throughout 2025, retail traders remain fervently bullish. Coinalyze data reveals funding rates at 0.0114 (projected to rise to 0.0159) with $2.87B in open interest favoring long positions.

This divergence creates what veteran trader Peter Brandt calls a "standoff scenario" - where institutional profit-taking meets retail FOMO. The resolution of this tension will likely determine XRP's next major move.

XRP vs Traditional Finance: The Changing of the Guard

XRP's market cap surpassing BlackRock's ($178.4B vs $172.3B) isn't just a vanity metric - it signals a fundamental shift in how value is being allocated in global markets. What's particularly noteworthy is that this occurred during a period when XRP was 20% off its July 2025 highs.

The cryptocurrency now sits comfortably among the world's top 100 assets by market cap, a position that brings both increased scrutiny and institutional interest. As regulatory clarity improves, this trend appears likely to accelerate.

Price Predictions: Where Could XRP Go From Here?

Analysts are divided on short-term movements but increasingly bullish on XRP's 12-18 month outlook. Key levels to watch:

| Level | Price | Significance |

|---|---|---|

| Immediate Support | $2.76 | July 2025 low, must hold for bullish structure |

| 20-day MA | $3.0013 | Short-term momentum indicator |

| Upper Bollinger | $3.2682 | Near-term resistance |

| All-Time High | $3.65 | July 2025 peak |

| 2025 Bull Target | $5.00+ | 200% from current levels |

Risks and Considerations

While the outlook appears bright, investors should remain aware of potential headwinds:

- SEC delays on ETF approvals (next key deadline October 2025)

- Macroeconomic conditions impacting crypto markets broadly

- Competition in payment solutions (Circle, Stripe entering space)

- Whale selling pressure continuing

This article does not constitute investment advice. Always conduct your own research before making investment decisions.

XRP Price Prediction 2025: Your Questions Answered

Is XRP a good investment for 2025?

Based on current technicals and fundamentals, XRP presents a compelling case for 2025. The combination of regulatory clarity, institutional adoption, and strong technical setup suggests potential upside. However, cryptocurrency investments carry substantial risk and investors should only allocate what they can afford to lose.

What price could XRP reach by end of 2025?

Analysts see potential for XRP to reach $5 by year-end 2025, representing about 200% upside from current levels around $2.81. This WOULD require breaking through key resistance at $3.65 (the July 2025 all-time high) and maintaining bullish momentum.

Why did XRP's price drop recently?

XRP's 20% pullback from July highs reflects both broader crypto market weakness and profit-taking after its 481% surge earlier in 2025. The $2.76 level has emerged as critical support that could determine whether this is a healthy correction or start of deeper pullback.

How does XRP's technology compare to competitors?

Ripple's payment rail technology, demonstrated in their recent interactive demo, shows distinct advantages over traditional systems like SWIFT in speed and cost efficiency. However, competitors like Circle and Stripe are developing alternative solutions, making this a space to watch closely.

What are the biggest risks for XRP investors?

Key risks include regulatory setbacks, failure to gain expected ETF approvals, macroeconomic conditions reducing risk appetite, and technological competition. The recent whale selling activity also suggests some large holders may believe XRP is NEAR peak valuation.