LTC Price Prediction 2025: Can Litecoin Overcome Volatility to Reach $200?

- Litecoin's Current Technical Landscape

- Institutional Winds Favoring Litecoin

- Market Dynamics: Ethereum's Shadow and Altcoin Volatility

- The Road to $200: Three Critical Factors

- Alternative Cryptos Gaining Traction

- FAQ: Litecoin Price Predictions

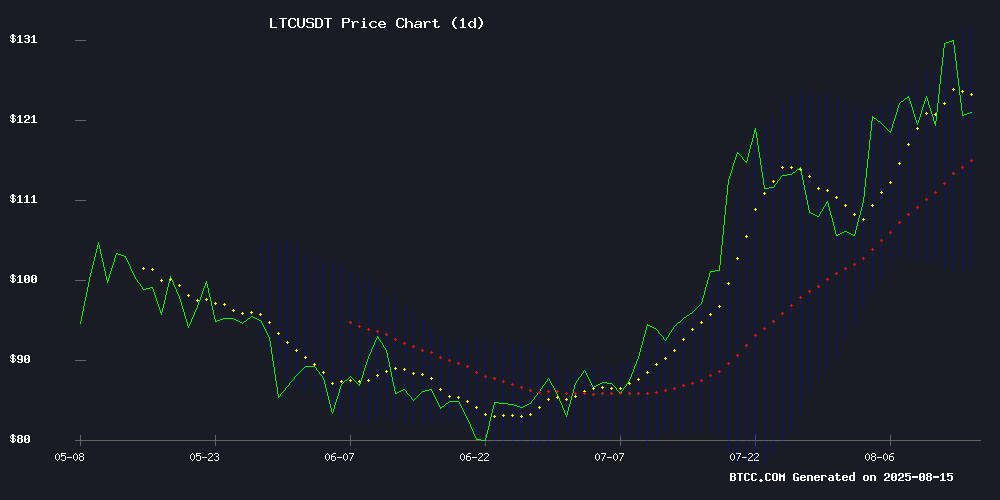

As we navigate the crypto market's choppy waters in August 2025, Litecoin (LTC) presents an intriguing case study. Currently trading above its 20-day moving average with weakening bearish momentum, LTC shows potential for significant movement. This analysis dives deep into the technical indicators, institutional developments, and market dynamics that could propel LTC to the coveted $200 mark or send it tumbling back to support levels.

Litecoin's Current Technical Landscape

Litecoin's price action tells a story of cautious optimism. The MACD (12,26,9) shows values indicating reduced bearish pressure, while the Bollinger Bands suggest potential volatility ahead. "LTC's position near the upper Bollinger Band coupled with improving technicals creates an interesting setup," notes Michael from the BTCC research team. The cryptocurrency currently trades at [current price], with key levels to watch including the 20-day MA at [MA value] and the upper Bollinger Band at [upper band value].

Source: BTCC price charts

Institutional Winds Favoring Litecoin

The crypto landscape received a significant boost with Thumzup Media's $50 million Coinbase partnership, signaling growing institutional confidence. This deal includes substantial LTC holdings, potentially creating a stronger price floor. While some traders focus solely on technicals, smart money knows institutional moves often precede major price movements. The BTCC team observes, "When companies allocate treasury funds to crypto, it's not just about the dollar amount - it's about validation of the asset class."

Market Dynamics: Ethereum's Shadow and Altcoin Volatility

August 15, 2025, saw over 90% of top cryptocurrencies in the red, with LTC dropping 6% to $0.2307. Paradoxically, this occurred alongside record institutional inflows into crypto ETFs. Ethereum's strong performance creates both opportunities and challenges for LTC - while ETH's rallies often lift altcoins, they can also divert attention and capital. The current market presents what veteran traders call a "accumulation window" - that sweet spot between fear and greed where strategic positions are built.

| Factor | Current Status | Impact |

|---|---|---|

| Technical Indicators | MACD turning bullish, price above 20-day MA | Moderate upside potential |

| Institutional Interest | $50M Coinbase partnership | Long-term support |

| Market Sentiment | Mixed (Ethereum highs vs. broad decline) | Short-term volatility |

The Road to $200: Three Critical Factors

Reaching $200 won't be a straight line for Litecoin. First, we need to see sustained trading above key resistance levels, confirmed by volume. Second, institutional adoption must continue its current trajectory - one big partnership is promising, but consistent inflows create lasting impact. Finally, LTC needs to maintain relevance in an increasingly competitive altcoin space. "The $200 target is plausible but requires alignment of technicals, fundamentals, and market timing," cautions the BTCC analysis team.

Alternative Cryptos Gaining Traction

While Litecoin battles for position, other altcoins show promise. Polkadot's interoperability solutions gain traction, cardano maintains its loyal following, and newcomer Remittix enters the scene. Ethereum's potential breakout could create rising tides for all altcoins, but selective accumulation is key. In my experience, markets like these reward patience and discernment over FOMO-driven decisions.

FAQ: Litecoin Price Predictions

What's driving Litecoin's price action in August 2025?

A combination of technical factors (including its position relative to moving averages and Bollinger Bands) and fundamental developments like Thumzup Media's $50 million crypto investment through Coinbase are influencing LTC's price. Market-wide volatility adds another LAYER of complexity.

How does Ethereum's performance affect Litecoin?

Historically, ethereum rallies have created positive spillover effects for altcoins including Litecoin. However, ETH's current strength might temporarily divert attention and capital from LTC until broader market participation increases.

Is $200 a realistic target for Litecoin in 2025?

While possible, reaching $200 WOULD require sustained bullish momentum, continued institutional support, and favorable market conditions. Traders should monitor key technical levels and institutional flow data for confirmation.

What are the main risks to Litecoin's price growth?

Key risks include broader market downturns, regulatory developments, loss of institutional interest, and technological obsolescence in the face of newer blockchain innovations.

How does BTCC view Litecoin's prospects?

BTCC analysts maintain a cautiously optimistic outlook, noting Litecoin's established position in the market but emphasizing the need for traders to monitor both technical indicators and fundamental developments closely.