Bitcoin Price Outlook 2025: Bullish Signals Emerge as Institutional Adoption Accelerates

- Current BTC Market Overview

- Technical Analysis: What the Indicators Show

- Institutional Adoption Heats Up Globally

- Corporate Bitcoin Adoption Accelerates

- Market Dynamics and Potential Risks

- Innovations in Bitcoin Infrastructure

- Is Bitcoin a Good Investment in August 2025?

- Bitcoin Price Prediction 2025: Your Questions Answered

Bitcoin (BTC) is showing strong bullish momentum in August 2025, trading at $114,664.35 with key technical indicators pointing to potential upside. Institutional adoption is accelerating globally, with nations like Indonesia and Brazil exploring bitcoin reserve strategies, while companies like Satsuma and Bakkt make significant Bitcoin-related moves. However, analysts caution about whale exits and declining leverage ratios that could signal short-term volatility.

Current BTC Market Overview

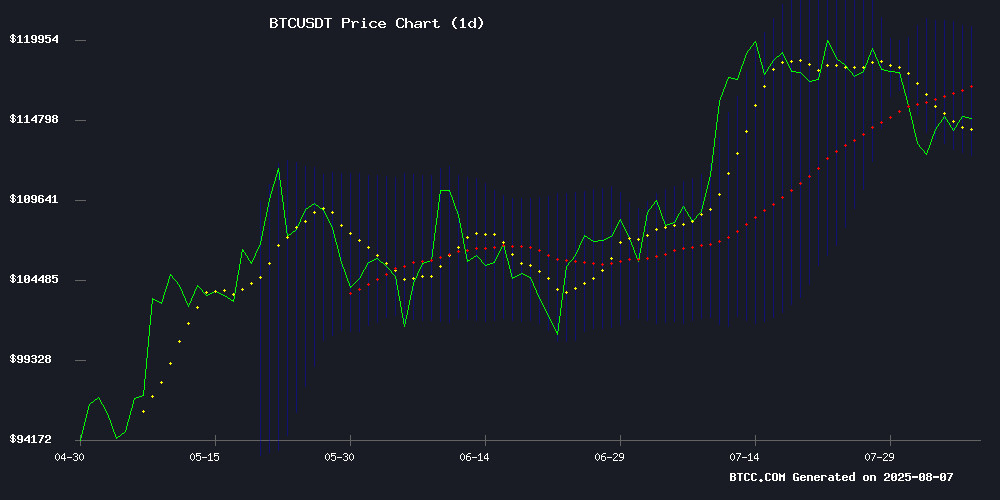

As of August 7, 2025, Bitcoin is trading at $114,664.35 on BTCC, slightly below its 20-day moving average of $116,649.93. The MACD indicator shows bullish momentum at 2,282.07, well above the signal line at 820.95. Bollinger Bands suggest consolidation between $112,496.78 (lower band) and $120,803.08 (upper band).

Source: BTCC

Technical Analysis: What the Indicators Show

The technical picture for Bitcoin remains constructive despite recent pullbacks. The MACD histogram has been positive for 12 consecutive days, suggesting sustained buying pressure. The Relative Strength Index (RSI) at 58 indicates Bitcoin isn't overbought yet, leaving room for further upside.

Key levels to watch:

- Immediate support: $112,000 (recent swing low)

- Major support: $110,000 (psychological level)

- Resistance: $116,250 (20-day MA)

- Strong resistance: $120,803 (upper Bollinger Band)

Institutional Adoption Heats Up Globally

Indonesia's Bitcoin Reserve Exploration

Indonesia is making waves with its potential Bitcoin reserve strategy. The Vice President's office has been in discussions with Bitcoin Indonesia about using surplus renewable energy for mining operations. While maintaining its ban on crypto payments, the government appears open to holding BTC as part of its $140 billion in foreign reserves.

"We're exploring bold ideas like Bitcoin mining as a national reserve strategy," said Adhit from the VP's office. With a $1.4 trillion GDP and 280 million population, Indonesia's MOVE could significantly impact regional adoption.

Brazil's $17 Billion Bitcoin Proposal

Brazil is moving even faster, with its Chamber of Deputies set to debate a bill on August 20 that WOULD allocate $17 billion to Bitcoin reserves. If passed, this would make Brazil the world's largest sovereign BTC holder. Lawmaker Eros Biondini, who introduced the bill in November 2024, calls it "strategic diversification."

Corporate Bitcoin Adoption Accelerates

Satsuma's $218M Bitcoin-Funded Round

London's Satsuma Technology just closed a $217.6 million funding round where $125 million came in Bitcoin subscriptions. The company accepted 1,097.29 BTC - a first for a London-listed firm. "This validates our Core thesis about Bitcoin-native treasuries," said CEO Henry Elder.

Bakkt's Strategic Move in Japan

Bakkt Holdings acquired 30% of Tokyo-listed Marusho Hotta, planning to rebrand it as "Bitcoin JP." Bakkt's Phillip Lord will become CEO, steering the company toward Bitcoin-centric operations. "Japan's regulatory climate is ideal for Bitcoin business models," noted Bakkt co-CEO Akshay Naheta.

Market Dynamics and Potential Risks

While fundamentals appear strong, some warning signs exist:

| Metric | Status | Implication |

|---|---|---|

| Leverage Ratios | Declining | Potential market stabilization |

| Whale Activity | 80,000 BTC moved from dormant wallets | Possible selling pressure |

| Retail Participation | Only emerged after $120k breakout | Typically late-cycle behavior |

Innovations in Bitcoin Infrastructure

The Bitcoin ecosystem continues evolving with new financial products:

This new DeFi product aims to unlock Bitcoin liquidity within Sui's ecosystem, already supporting over 1,000 BTC.

Helios Finance now uses Allora Network's AI-powered BTC price predictions to enhance trading strategies.

Is Bitcoin a Good Investment in August 2025?

Based on current technicals and fundamentals, Bitcoin presents an interesting opportunity. The growing institutional adoption provides strong fundamental support, while technical indicators suggest the consolidation may be nearing an end. However, investors should remain cautious about potential whale selling and monitor leverage ratios closely.

This article does not constitute investment advice.

Bitcoin Price Prediction 2025: Your Questions Answered

What is Bitcoin's current price?

As of August 7, 2025, Bitcoin is trading at $114,664.35 on BTCC.

What are the key support and resistance levels?

Key support sits at $112,000, with major support at $110,000. Resistance levels are $116,250 and $120,803.

Which countries are adopting Bitcoin as reserves?

Indonesia and Brazil are leading the charge, with Brazil considering a $17 billion BTC reserve allocation.

What are the risks to Bitcoin's price?

Potential whale selling and declining leverage ratios could create short-term volatility.

How is institutional adoption progressing?

Strongly, with companies like Satsuma raising $125 million in BTC and Bakkt expanding in Japan.